Last Friday (1st), the non-agricultural employment data was unexpectedly better than expected, and the Sino-US trade agreement was expected to be signed, which made the three major indexes of the US stock market rise. It is worth noting that the Dow Jones Industrial Index is approaching an all-time high. To continue the bullish gains, we must pay attention to the follow-up development of Sino-US trade negotiations. Under the influence of non-agricultural employment data, the world's largest gold ETF wealthy gold index fund announced on Friday (1st) that gold holdings decreased by 0.88 metric tons to 914.67 metric tons, showing a slight reduction in multi-party holdings.

On the other hand, on October 30, the Federal Reserve lowered the benchmark interest rate by 0.25 percentage points, which is in line with market expectations and the third rate cut this year. However, after the meeting, the Federal Reserve (Fed) Chairman Powell said that unless the market subsequently has a major impact Change, otherwise this may be the last rate cut in a period of time, which is relatively bad news for the gold short-term, because the interest rate is an important factor in the trend of gold, so we must pay attention to the short-term correction trend.

Forex Technical Analysis(外汇) (Gold XAUUSD):

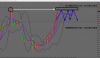

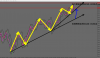

Today's foreign exchange gold (November 4) early in the vicinity of 1513.9 US dollars / ounce, from the technical analysis, the 1 hour level observation trend is consistent with last Friday (November 1) forecast first pull back and then rise, mainly due to the US non-agricultural The employment data unexpectedly outperformed expectations, causing the gold to pull back sharply. However, the US PMI index remained weak in the evening, and gold once again surged, so there was a chance to rise, but the high point in the chart pulled back the correction again.

At present, the pressure range above the short-term line is located at 1516~1517 US dollars/ounce, the downward direction, the initial support range is 1506~1507 US dollars/ounce, and the operation mentality is short-term. The investors who want to enter the short-term market can consider the price of 1512 US dollars. To buy a light warehouse at $1514/oz, the stop loss level can be set above $1516.5/oz.

Forex technical analysis(外汇) (EUR/USD EURUSD):

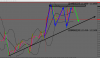

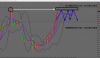

Today's foreign exchange EUR/USD (November 4th) Early in the morning at around 1.11641, from the technical analysis, the 1-hour level observation trend is in line with the forecast of the trend of last Friday (November 1), and is currently a high point to make a shock to try to break through. However, it should be noted that multiple breakthrough failures will pull back the correction, so there is a chance to wait for the opportunity to pull back the correction.

At present, the pressure range above the short-term is located at 1.11800~1.11830, the downward direction, the initial support range is from 1.11450~1.11500, and the operational mentality is mainly short-term. Investors who want to enter the short-term market may consider buying in the 1.17.140 to 1.11780 range. The stop loss point can be considered to be set above 1.11810.

Forex technical analysis(外汇) (GBP/USD GBPUSD):

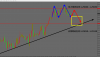

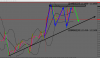

Today's foreign exchange sterling / US dollar (November 4) Early in the vicinity of 1.29332, cut from the technical analysis, 1 hour line level observation trend in line with last Friday (November 1) forecast after the high pull back to correct the formation of a small head The chip pressure range, so there is a chance to rebound after a small rebound.

At present, the pressure range above the short-term line is located at 1.29600~1.29650, in the downward direction. The initial support range is 1.29050~1.29150. The operating mentality is mainly short-lived. Investors who want to enter the short-term market may consider buying in the 1.28950 to 1.29450 range. The stop loss point can be considered to be set above 1.29560.

Forex Technical Analysis(外汇) (NZD/USD NZDUSD):

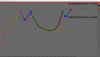

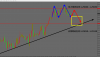

Today's foreign exchange NZD/USD (November 4th) Early in the vicinity of 0.64314, from the technical analysis, the 1-hour line level observation trend is consistent with last Friday (November 1) forecast continued to rise, it is now possible to clearly see the bottom of the chip is smooth Locked, the high point is stable, so there is a chance to continue to go long.

At present, the pressure range above the short-term is located at 0.64700~0.64760, in the downward direction, the initial support range is 0.64400~0.64480, and the operating mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the range of 0.64490 to 0.64530. The stop loss position can be considered to be set below 0.64420.

Forex Technical Analysis(外汇) (Nasdaq Nas100):

Today's foreign exchange Nasdaq (November 4th) early in the vicinity of 8160.9, from the technical analysis, the 1 hour line level observation trend broke through 8135 points to form a standard long position trend, multi-way homeopathic can not rush to do contrarian operations, plus global trade friction The problem is gradually optimistic, so there is a chance to continue to rise slowly.

At present, the pressure range above the short-term line is located at 8210~8220 points, the downward direction, the initial support interval is 8140~8150 points, and the operation mentality is mainly short. The investors who want to enter the market for a short time can consider buying in the 8165 to 8175 range. In, the stop loss point can be considered to be set below 8150.

Today's foreign(外汇) exchange key data (time/data name/importance/previous value/expected):

1. Switzerland consumer confidence index in October / three stars / -8 / ---

2. France's October manufacturing PMI final value / three stars / 50.5 / 50.5

3. Germany's October manufacturing PMI final value / three stars / 41.9 / 41.9

4. Eurozone October manufacturing PMI final value / three stars / 45.7 / 45.7

5. Eurozone November Sentix Investor Confidence Index / three stars / -16.8 / -13.8

6. US September factory order monthly rate / three stars / -0.1% / -0.5%

For more information on Forex(外汇), please click here to watch.

On the other hand, on October 30, the Federal Reserve lowered the benchmark interest rate by 0.25 percentage points, which is in line with market expectations and the third rate cut this year. However, after the meeting, the Federal Reserve (Fed) Chairman Powell said that unless the market subsequently has a major impact Change, otherwise this may be the last rate cut in a period of time, which is relatively bad news for the gold short-term, because the interest rate is an important factor in the trend of gold, so we must pay attention to the short-term correction trend.

Forex Technical Analysis(外汇) (Gold XAUUSD):

Today's foreign exchange gold (November 4) early in the vicinity of 1513.9 US dollars / ounce, from the technical analysis, the 1 hour level observation trend is consistent with last Friday (November 1) forecast first pull back and then rise, mainly due to the US non-agricultural The employment data unexpectedly outperformed expectations, causing the gold to pull back sharply. However, the US PMI index remained weak in the evening, and gold once again surged, so there was a chance to rise, but the high point in the chart pulled back the correction again.

At present, the pressure range above the short-term line is located at 1516~1517 US dollars/ounce, the downward direction, the initial support range is 1506~1507 US dollars/ounce, and the operation mentality is short-term. The investors who want to enter the short-term market can consider the price of 1512 US dollars. To buy a light warehouse at $1514/oz, the stop loss level can be set above $1516.5/oz.

Forex technical analysis(外汇) (EUR/USD EURUSD):

Today's foreign exchange EUR/USD (November 4th) Early in the morning at around 1.11641, from the technical analysis, the 1-hour level observation trend is in line with the forecast of the trend of last Friday (November 1), and is currently a high point to make a shock to try to break through. However, it should be noted that multiple breakthrough failures will pull back the correction, so there is a chance to wait for the opportunity to pull back the correction.

At present, the pressure range above the short-term is located at 1.11800~1.11830, the downward direction, the initial support range is from 1.11450~1.11500, and the operational mentality is mainly short-term. Investors who want to enter the short-term market may consider buying in the 1.17.140 to 1.11780 range. The stop loss point can be considered to be set above 1.11810.

Forex technical analysis(外汇) (GBP/USD GBPUSD):

Today's foreign exchange sterling / US dollar (November 4) Early in the vicinity of 1.29332, cut from the technical analysis, 1 hour line level observation trend in line with last Friday (November 1) forecast after the high pull back to correct the formation of a small head The chip pressure range, so there is a chance to rebound after a small rebound.

At present, the pressure range above the short-term line is located at 1.29600~1.29650, in the downward direction. The initial support range is 1.29050~1.29150. The operating mentality is mainly short-lived. Investors who want to enter the short-term market may consider buying in the 1.28950 to 1.29450 range. The stop loss point can be considered to be set above 1.29560.

Forex Technical Analysis(外汇) (NZD/USD NZDUSD):

Today's foreign exchange NZD/USD (November 4th) Early in the vicinity of 0.64314, from the technical analysis, the 1-hour line level observation trend is consistent with last Friday (November 1) forecast continued to rise, it is now possible to clearly see the bottom of the chip is smooth Locked, the high point is stable, so there is a chance to continue to go long.

At present, the pressure range above the short-term is located at 0.64700~0.64760, in the downward direction, the initial support range is 0.64400~0.64480, and the operating mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the range of 0.64490 to 0.64530. The stop loss position can be considered to be set below 0.64420.

Forex Technical Analysis(外汇) (Nasdaq Nas100):

Today's foreign exchange Nasdaq (November 4th) early in the vicinity of 8160.9, from the technical analysis, the 1 hour line level observation trend broke through 8135 points to form a standard long position trend, multi-way homeopathic can not rush to do contrarian operations, plus global trade friction The problem is gradually optimistic, so there is a chance to continue to rise slowly.

At present, the pressure range above the short-term line is located at 8210~8220 points, the downward direction, the initial support interval is 8140~8150 points, and the operation mentality is mainly short. The investors who want to enter the market for a short time can consider buying in the 8165 to 8175 range. In, the stop loss point can be considered to be set below 8150.

Today's foreign(外汇) exchange key data (time/data name/importance/previous value/expected):

1. Switzerland consumer confidence index in October / three stars / -8 / ---

2. France's October manufacturing PMI final value / three stars / 50.5 / 50.5

3. Germany's October manufacturing PMI final value / three stars / 41.9 / 41.9

4. Eurozone October manufacturing PMI final value / three stars / 45.7 / 45.7

5. Eurozone November Sentix Investor Confidence Index / three stars / -16.8 / -13.8

6. US September factory order monthly rate / three stars / -0.1% / -0.5%

For more information on Forex(外汇), please click here to watch.