Yesterday(15th) evening, the International Monetary Fund (IMF) released the latest World Economic Outlook report. If the market expects to be lowered again this year, the global economic growth rate is estimated to fall to 3%, which is lower than the 3.2% predicted in July. The lowest point since the recession, and the fifth consecutive revision, the main reason is that the damage under the global trade friction continues to expand, leading to a general slowdown in the main real economy, and the growth forecast for next year 2020 is reduced from 3.5% to 3.4%. . The IMF report issued a warning detailing the economic difficulties caused by the punitive tariffs imposed by both Sino-US trade parties, including the increase in direct costs, market turmoil, a decline in willingness to invest, and a decline in productivity caused by the destruction of the supply chain. If the global trade conflict remains unresolved, it may be more affected in the future.

Gita Gopinath, chief economist at the International Monetary Fund (IMF), said that due to the slowdown in the global economy and the increase in uncertainties, the global outlook remains unstable and there is no room for policy to make mistakes. And all parties in the decision-makers need to cooperate with each other in order to prevent the tension between trade and geopolitics, and thus avoid the crisis of economic recession.

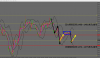

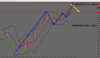

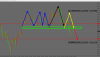

Forex(外汇) - Technical Analysis (Gold XAUUSD):

Today's foreign(外汇) exchange trend gold (October 16) early in the morning at 1480.9 US dollars / ounce, from the technical analysis, the 1 hour level observation trend is in line with yesterday's (15th) forecast high pressure and pull back, the top has formed short-term chip pressure, plus The news of the Brexit news from the UK was so that the demand for gold safe-haven fell sharply, so there was a chance to rebound after the market fell.

At present, the pressure range above the short-term line is located at 1490~1491 US dollars/ounce. In the downward direction, the initial support range is 1474~1475 US dollars/ounce. The operation mentality is mainly short. The investors who want to enter the market for a short time can consider the price of 1481 US dollars. To buy a light warehouse in the $1483/oz range, the MT4 set stop loss can be set below $1479/oz.

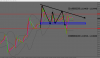

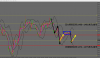

Forex(外汇) - Technical Analysis (EUR/USD EURUSD):

Today's foreign(外汇) exchange trend EUR/USD (October 16th) Early in the morning near 1.10306, cut in from the technical analysis, the 1-hour level observation trend yesterday (15th), immediately after the high, immediately pulled back, but the British Brexes came out in the evening The agreement has a solution, which makes the euro soaring, so there is a chance to pull back and correct the trend after the skyrocketing.

At present, the pressure range above the short-term line is located at 1.10400~1.10440, the downward direction, the initial support interval is 1.10050~1.10080, and the operational mentality is short-term. The investors who want to enter the short-term market may consider buying in the 1.10275 to 1.10325 range. MT4 sets the stop loss point to consider setting above 1.10399.

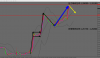

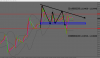

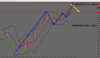

Forex(外汇) - Technical Analysis (GBP/USD GBPUSD):

Today's foreign(外汇) exchange trend GBP/USD (October 16) Early in the vicinity of 1.27559, from the technical analysis, the 1-hour line level observation trend is in line with yesterday's (15th) forecast correction and then re-raised, has formed a wave theory uptrend structure Therefore, there is a chance to pull back the correction trend first.

At present, the pressure range above the short-term line is located at 1.28000~1.28100, the downward direction, the initial support range is 1.26750~1.26800, and the operational mentality is mainly short-term. Investors who want to enter the short-term market may consider buying in the 1.27500 to 1.27550 range. MT4 sets the stop loss point to consider setting above 1.27700.

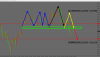

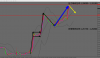

Forex(外汇) - Technical Analysis (NZD/USD NZDUSD):

Today's foreign(外汇) exchange trend NZD/USD (October 16th) Early in the vicinity of 0.63112, cut from the technical analysis, 1 hour line level observation trend can clearly see the chip range shock, fell below the key support neckline so that the selling pressure market Therefore, there is a chance to continue to fall.

At present, the pressure range above the short-term line is located at 0.62950~0.62990, the downward direction, the initial support range is 0.62500~0.62550, and the operation mentality is short-term. The investors who want to enter the short-term market may consider buying in the 0.62750 to 0.62800 range. MT4 sets the stop loss point to consider setting below 0.6285.

Forex(外汇) - Technical Analysis (Nasdaq Index Nas100):

Today's foreign(外汇) exchange trend Nasdaq (October 16) Early in the morning near 7946.9, from the technical analysis, the 1 hour line level observation trend is in line with yesterday's (15th) forecast after a small correction and then rise again, receiving Sino-US trade news, inspiring global stock market Therefore, there is a chance to pull back and make a correction structure.

At present, the pressure range above the short-term line is located at 7970~7980 points, the downward direction, the initial support range is 7900~7910 points, and the operation mentality is short-term. The investors who want to enter the short-term market can consider buying in the 7935 to 7945 range. In, MT4 set stop loss point can be considered to set above 7960.

Today's foreign(外汇) exchange key data (data name / importance / previous value / expected):

1. UK September CPI monthly rate / three stars / 0.4% / 0.2%

2. UK retail price index monthly rate / three stars / 0.8% / -0.1%

3. Eurozone August quarter adjusted trade account (100 million euros) / three stars / 190/180

4. Eurozone September CPI monthly rate / three stars / 0.1% / 0.2%

5. Eurozone September CPI annual rate final value / three stars / 0.9% / 0.9%

6. Canada's September CPI monthly rate / three stars / -0.1% / -0.a2%

7. US September retail sales monthly rate / four stars / 0.4% / 0.3%

8. US August commercial inventory monthly rate / three stars / 0.4% / 0.2%

9. US October NAHB Housing Market Index / Three Stars / 68/68

For more information on Forex(外汇) and MT4, please click here to watch.

Gita Gopinath, chief economist at the International Monetary Fund (IMF), said that due to the slowdown in the global economy and the increase in uncertainties, the global outlook remains unstable and there is no room for policy to make mistakes. And all parties in the decision-makers need to cooperate with each other in order to prevent the tension between trade and geopolitics, and thus avoid the crisis of economic recession.

Forex(外汇) - Technical Analysis (Gold XAUUSD):

Today's foreign(外汇) exchange trend gold (October 16) early in the morning at 1480.9 US dollars / ounce, from the technical analysis, the 1 hour level observation trend is in line with yesterday's (15th) forecast high pressure and pull back, the top has formed short-term chip pressure, plus The news of the Brexit news from the UK was so that the demand for gold safe-haven fell sharply, so there was a chance to rebound after the market fell.

At present, the pressure range above the short-term line is located at 1490~1491 US dollars/ounce. In the downward direction, the initial support range is 1474~1475 US dollars/ounce. The operation mentality is mainly short. The investors who want to enter the market for a short time can consider the price of 1481 US dollars. To buy a light warehouse in the $1483/oz range, the MT4 set stop loss can be set below $1479/oz.

Forex(外汇) - Technical Analysis (EUR/USD EURUSD):

Today's foreign(外汇) exchange trend EUR/USD (October 16th) Early in the morning near 1.10306, cut in from the technical analysis, the 1-hour level observation trend yesterday (15th), immediately after the high, immediately pulled back, but the British Brexes came out in the evening The agreement has a solution, which makes the euro soaring, so there is a chance to pull back and correct the trend after the skyrocketing.

At present, the pressure range above the short-term line is located at 1.10400~1.10440, the downward direction, the initial support interval is 1.10050~1.10080, and the operational mentality is short-term. The investors who want to enter the short-term market may consider buying in the 1.10275 to 1.10325 range. MT4 sets the stop loss point to consider setting above 1.10399.

Forex(外汇) - Technical Analysis (GBP/USD GBPUSD):

Today's foreign(外汇) exchange trend GBP/USD (October 16) Early in the vicinity of 1.27559, from the technical analysis, the 1-hour line level observation trend is in line with yesterday's (15th) forecast correction and then re-raised, has formed a wave theory uptrend structure Therefore, there is a chance to pull back the correction trend first.

At present, the pressure range above the short-term line is located at 1.28000~1.28100, the downward direction, the initial support range is 1.26750~1.26800, and the operational mentality is mainly short-term. Investors who want to enter the short-term market may consider buying in the 1.27500 to 1.27550 range. MT4 sets the stop loss point to consider setting above 1.27700.

Forex(外汇) - Technical Analysis (NZD/USD NZDUSD):

Today's foreign(外汇) exchange trend NZD/USD (October 16th) Early in the vicinity of 0.63112, cut from the technical analysis, 1 hour line level observation trend can clearly see the chip range shock, fell below the key support neckline so that the selling pressure market Therefore, there is a chance to continue to fall.

At present, the pressure range above the short-term line is located at 0.62950~0.62990, the downward direction, the initial support range is 0.62500~0.62550, and the operation mentality is short-term. The investors who want to enter the short-term market may consider buying in the 0.62750 to 0.62800 range. MT4 sets the stop loss point to consider setting below 0.6285.

Forex(外汇) - Technical Analysis (Nasdaq Index Nas100):

Today's foreign(外汇) exchange trend Nasdaq (October 16) Early in the morning near 7946.9, from the technical analysis, the 1 hour line level observation trend is in line with yesterday's (15th) forecast after a small correction and then rise again, receiving Sino-US trade news, inspiring global stock market Therefore, there is a chance to pull back and make a correction structure.

At present, the pressure range above the short-term line is located at 7970~7980 points, the downward direction, the initial support range is 7900~7910 points, and the operation mentality is short-term. The investors who want to enter the short-term market can consider buying in the 7935 to 7945 range. In, MT4 set stop loss point can be considered to set above 7960.

Today's foreign(外汇) exchange key data (data name / importance / previous value / expected):

1. UK September CPI monthly rate / three stars / 0.4% / 0.2%

2. UK retail price index monthly rate / three stars / 0.8% / -0.1%

3. Eurozone August quarter adjusted trade account (100 million euros) / three stars / 190/180

4. Eurozone September CPI monthly rate / three stars / 0.1% / 0.2%

5. Eurozone September CPI annual rate final value / three stars / 0.9% / 0.9%

6. Canada's September CPI monthly rate / three stars / -0.1% / -0.a2%

7. US September retail sales monthly rate / four stars / 0.4% / 0.3%

8. US August commercial inventory monthly rate / three stars / 0.4% / 0.2%

9. US October NAHB Housing Market Index / Three Stars / 68/68

For more information on Forex(外汇) and MT4, please click here to watch.