Last week, Sino-US trade frictions will restart news of negotiations. Market risk aversion has cooled down immediately, and risk-averse debts have fallen. From the perspective of capital flows, we have observed investment-grade bonds that have been the leader of the bond market in the past few weeks. Last week, the total net inflow was 3.95 billion U.S. dollars, which was significantly lower than the previous week. The high-yield bond funds flowed out slightly, and the emerging market bonds were net inflows of 0.2 billion U.S. dollars. Therefore, the overall amount of funds from the bond market clearly felt the Sino-US trade.

The news of restarting the negotiations has made the bond market weaker.

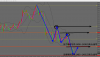

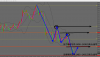

forex - Technical Analysis (Gold XAUUSD):

Today's foreign exchange gold (September 10) early in the morning at 1498.8 US dollars / ounce, from the technical analysis, the 1 hour level observation trend fell below 1,500 US dollars / ounce, lost support, the road pulled back sharply, according to the gold return line clear When you see pressure, it falls, so after the high point moves down, there is a chance to rebound and then there is a high point.

At present, the pressure range above the short-term is located at 1498~1498.5 US dollars/ounce. In the downward direction, the initial support range is 1485~1485.5 US dollars/ounce. The operation mentality is mainly short. The investors who want to enter the market for a short time can consider the price of 1487.5 US dollars. To the 1489.5 US dollars / ounce range of light warehouse buy, MT4 set stop loss can be considered to set below 1485.5 US dollars / ounce.

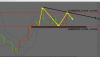

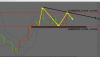

forex - Technical Analysis (EUR/USD EURUSD):

Today's foreign exchange EUR/USD (September 10th) Early in the morning near 1.10478, from the technical analysis, the 1 hour level observation trend stabilized the bottom support showed a small rebound, after the pre-pressed pull back again, so there is a chance to correct the narrow Rebound.

At present, the pressure range above the short-term line is located at 1.10670~1.10700, the downward direction, the initial support interval is 1.10200~1.10250, and the operating mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the 1.10390 to 1.10430 range. MT4 sets the stop loss point to consider setting below 1.10320.

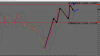

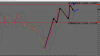

forex - Technical Analysis (GBP/USD GBPUSD):

Today's foreign exchange sterling / US dollar (September 10) Early in the vicinity of 1.23451, cut from the technical analysis, 1 hour line level observation trend yesterday (9th) pull back correction, there is a big rise pattern to form a complete wave theory, so cooperate The opening of the Bollinger Channel opening will have a chance to continue to rise.

At present, the pressure range above the short-term line is located at 1.23850~1.23900, the downward direction, the initial support range is 1.22300~1.22350, and the operating mentality is mainly short. Investors who want to enter the market to be shorter and short may consider buying in the 1.23280 to 1.23320 range. MT4 sets the stop loss point to consider setting below 1.23100.

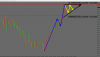

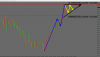

forex - Technical Analysis (NZD/USD NZDUSD):

Today's foreign exchange NZD/USD (September 10) Early in the vicinity of 0.64263, from the technical analysis, the 1-hour line level observation trend is in line with yesterday's (9th) forecast to go out of the rising pattern, but pay attention to the current flag-shaped structure However, the previous high has the possibility of pulling back, so a break below the uptrend line will bring back the correction.

At present, the pressure range above the short-term line is located at 0.64450~0.64500, in the downward direction, the initial support range is 0.64050~0.64100, and the operating mentality is mainly short-term. Investors who want to enter the short-term market may consider buying in the range of 0.64290 to 0.64330. MT4 sets the stop loss point to consider setting above 0.64400.

Today's key data:

1.China August CPI annual rate

2.French industrial output monthly rate in July

3.China August M2 Money Supply Annual Rate

4.UK unemployment rate in August

5.Number of UK jobless claims in August (10,000)

6.UK ILO unemployment rate for three months in July

7.US August NFIB Small Business Confidence Index

Please watch for more information forex or MT4

The news of restarting the negotiations has made the bond market weaker.

forex - Technical Analysis (Gold XAUUSD):

Today's foreign exchange gold (September 10) early in the morning at 1498.8 US dollars / ounce, from the technical analysis, the 1 hour level observation trend fell below 1,500 US dollars / ounce, lost support, the road pulled back sharply, according to the gold return line clear When you see pressure, it falls, so after the high point moves down, there is a chance to rebound and then there is a high point.

At present, the pressure range above the short-term is located at 1498~1498.5 US dollars/ounce. In the downward direction, the initial support range is 1485~1485.5 US dollars/ounce. The operation mentality is mainly short. The investors who want to enter the market for a short time can consider the price of 1487.5 US dollars. To the 1489.5 US dollars / ounce range of light warehouse buy, MT4 set stop loss can be considered to set below 1485.5 US dollars / ounce.

forex - Technical Analysis (EUR/USD EURUSD):

Today's foreign exchange EUR/USD (September 10th) Early in the morning near 1.10478, from the technical analysis, the 1 hour level observation trend stabilized the bottom support showed a small rebound, after the pre-pressed pull back again, so there is a chance to correct the narrow Rebound.

At present, the pressure range above the short-term line is located at 1.10670~1.10700, the downward direction, the initial support interval is 1.10200~1.10250, and the operating mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the 1.10390 to 1.10430 range. MT4 sets the stop loss point to consider setting below 1.10320.

forex - Technical Analysis (GBP/USD GBPUSD):

Today's foreign exchange sterling / US dollar (September 10) Early in the vicinity of 1.23451, cut from the technical analysis, 1 hour line level observation trend yesterday (9th) pull back correction, there is a big rise pattern to form a complete wave theory, so cooperate The opening of the Bollinger Channel opening will have a chance to continue to rise.

At present, the pressure range above the short-term line is located at 1.23850~1.23900, the downward direction, the initial support range is 1.22300~1.22350, and the operating mentality is mainly short. Investors who want to enter the market to be shorter and short may consider buying in the 1.23280 to 1.23320 range. MT4 sets the stop loss point to consider setting below 1.23100.

forex - Technical Analysis (NZD/USD NZDUSD):

Today's foreign exchange NZD/USD (September 10) Early in the vicinity of 0.64263, from the technical analysis, the 1-hour line level observation trend is in line with yesterday's (9th) forecast to go out of the rising pattern, but pay attention to the current flag-shaped structure However, the previous high has the possibility of pulling back, so a break below the uptrend line will bring back the correction.

At present, the pressure range above the short-term line is located at 0.64450~0.64500, in the downward direction, the initial support range is 0.64050~0.64100, and the operating mentality is mainly short-term. Investors who want to enter the short-term market may consider buying in the range of 0.64290 to 0.64330. MT4 sets the stop loss point to consider setting above 0.64400.

Today's key data:

1.China August CPI annual rate

2.French industrial output monthly rate in July

3.China August M2 Money Supply Annual Rate

4.UK unemployment rate in August

5.Number of UK jobless claims in August (10,000)

6.UK ILO unemployment rate for three months in July

7.US August NFIB Small Business Confidence Index

Please watch for more information forex or MT4