The National Bureau of Statistics announced yesterday (11th) that the gross domestic product (GDP) grew by 0.3% in the previous quarter, escaping the two consecutive quarters of shrinking and falling into recession, but still below the market expectations of 0.4%. It shows that the economic growth momentum of the fourth quarter is likely to be weak. Compared with the same period of last year, the GDP growth rate slowed from 1.3% to 1.0%, which is the slowest growth rate since the first quarter of 2010, and not as much as the economist predicted growth of 1.1%, although the UK economy temporarily breathed away from the recession. The crisis, but the slowdown in investment and the almost lost growth momentum of the economy, the prospects for the fourth quarter of the future and the first quarter of next year are quite pessimistic.

At present, the Bank of England (BOE) predicts that economic growth will slow down to 1.3% next year. The central bank raised its economic growth rate from 1.3% to 1.4% last week, mainly because it expects the GDP growth rate in the previous quarter to be better than expected. The UK's economic focus next year in 2020 will depend on the final outcome of the election and Brexit.

Fixed Spread Forex Platform(固定点差外汇平台) - Technical Analysis (Gold XAUUSD):

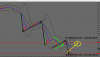

Today's gold (November 12) early in the morning at 1454.8 US dollars / ounce, from the technical analysis, the 1 hour level observation trend yesterday (11th) again broke down at the end of the sharp decline, followed by a rebound red K stick stopped falling back So there is a chance to start entering the rally.

At present, the pressure range above the short-term is located at 1465~1466 USD/oz. In the downward direction, the initial support range is 1450~1451 USD/oz. The operation mentality is mainly short. The investors who want to enter the market for a short time can consider the 1455 USD ounce. To buy a light warehouse at $1,457 per ounce, the stop loss can be set below $1,452 per ounce.

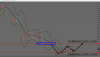

Fixed Spread Forex Platform(固定点差外汇平台) - Technical Analysis of Fixed Spreading Forex Platform (EUR/USD EURUSD):

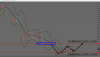

Today's EUR/USD (November 12) Early in the morning at around 1.10308, cut from the technical analysis, the bottom of the 1-hour level observation trend gradually formed, and now the dollar is pulled back to make the euro stop falling, so there is a chance to rebound. Quotes.

At present, the pressure range above the short-term line is located at 1.10510~1.10560, the downward direction, the initial support range is 1.10200~1.10240, and the operational mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the 1.10300 to 1.10340 range. The stop loss point can be considered to be set below 1.10240.

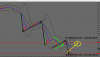

Fixed Spread Forex Platform(固定点差外汇平台) - Technical Analysis (GBP/USD GBPUSD):

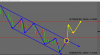

Today's GBP/USD (November 12) In the early trading session near 1.28509, we cut in from the technical analysis. The 1-hour line level observation trend is in line with yesterday's (11th) forecast, and the current market is not bad, and the US dollar is not falling. Weakening, so that the pound made an effective breakthrough in the rise, so there is a chance to pull back and continue to rise.

At present, the pressure range above the short-term line is located at 1.29000~1.29080, the downward direction, the initial support range is 1.28300~1.28360, and the operating mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the 1.28510 to 1.28580 range. The stop loss position can be considered to be set below 1.28470.

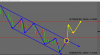

Fixed Spread Forex Platform(固定点差外汇平台) - Technical Analysis (NZD/USD NZDUSD):

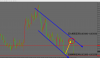

Today's New Zealand Dollar / US Dollar (November 12) Early in the vicinity of 0.63592, cut from the technical analysis, the 1-hour line level observation trend is in full compliance with yesterday's (11th) forecast rebound market to the red circle in the picture, the current K-bar is again pressured The upper rail has fallen sharply, so there is a chance to rebound after the collapse.

At present, the pressure range above the short-term line is located at 0.63500~0.63550, the downward direction, the initial support interval is 0.63200~0.63250, and the operation mentality is mainly short. The investors who want to enter the market for a short time can consider buying in the 0.63300 to 0.63340 range. The stop loss position can be considered to be set below 0.63250.

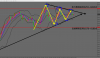

Fixed Spread Forex Platform(固定点差外汇平台) - Technical Analysis (Nasdaq Index Nas100):

Today's Nasdaq (November 12) early in the vicinity of 8246.9, from the technical analysis, the 1 hour line level observation trend appears standard convergence triangle shock consolidation, the current shock amplitude is smaller and smaller, must wait for a clear direction, so there is a chance After the pressure, make a break and pull back the market.

At present, the pressure range above the short-term line is located at 8255~8265 points, the downward direction, the initial support range is 8170~8180 points, and the operation mentality is short-term. The investors who want to enter the short-term market can consider buying in the 8235 to 8245 range. In, the stop loss point can be considered to be set above 8260.

Today's key data (data name / importance / previous value / expected):

1. France October BOF Business Confidence Index / three stars / 96/97

2. UK unemployment rate in October / three stars / 3.3% / --- / /

3. Number of UK jobless claims in October (10,000 people) / three stars / 2.11/2

4. UK ILO unemployment rate for three months in September / three stars / 3.9% / 3.9%

5. Germany November ZEW economic prosperity index / three stars / -22.8 / -13

6. Eurozone November ZEW Economic Prosperity Index / Three Stars / -23.5 / ---

7. US October NFIB Small Business Confidence Index / three stars / 101.8 / 102

For more information on the fixed spread forex platform(固定点差外汇平台), please click here to watch.

At present, the Bank of England (BOE) predicts that economic growth will slow down to 1.3% next year. The central bank raised its economic growth rate from 1.3% to 1.4% last week, mainly because it expects the GDP growth rate in the previous quarter to be better than expected. The UK's economic focus next year in 2020 will depend on the final outcome of the election and Brexit.

Fixed Spread Forex Platform(固定点差外汇平台) - Technical Analysis (Gold XAUUSD):

Today's gold (November 12) early in the morning at 1454.8 US dollars / ounce, from the technical analysis, the 1 hour level observation trend yesterday (11th) again broke down at the end of the sharp decline, followed by a rebound red K stick stopped falling back So there is a chance to start entering the rally.

At present, the pressure range above the short-term is located at 1465~1466 USD/oz. In the downward direction, the initial support range is 1450~1451 USD/oz. The operation mentality is mainly short. The investors who want to enter the market for a short time can consider the 1455 USD ounce. To buy a light warehouse at $1,457 per ounce, the stop loss can be set below $1,452 per ounce.

Fixed Spread Forex Platform(固定点差外汇平台) - Technical Analysis of Fixed Spreading Forex Platform (EUR/USD EURUSD):

Today's EUR/USD (November 12) Early in the morning at around 1.10308, cut from the technical analysis, the bottom of the 1-hour level observation trend gradually formed, and now the dollar is pulled back to make the euro stop falling, so there is a chance to rebound. Quotes.

At present, the pressure range above the short-term line is located at 1.10510~1.10560, the downward direction, the initial support range is 1.10200~1.10240, and the operational mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the 1.10300 to 1.10340 range. The stop loss point can be considered to be set below 1.10240.

Fixed Spread Forex Platform(固定点差外汇平台) - Technical Analysis (GBP/USD GBPUSD):

Today's GBP/USD (November 12) In the early trading session near 1.28509, we cut in from the technical analysis. The 1-hour line level observation trend is in line with yesterday's (11th) forecast, and the current market is not bad, and the US dollar is not falling. Weakening, so that the pound made an effective breakthrough in the rise, so there is a chance to pull back and continue to rise.

At present, the pressure range above the short-term line is located at 1.29000~1.29080, the downward direction, the initial support range is 1.28300~1.28360, and the operating mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the 1.28510 to 1.28580 range. The stop loss position can be considered to be set below 1.28470.

Fixed Spread Forex Platform(固定点差外汇平台) - Technical Analysis (NZD/USD NZDUSD):

Today's New Zealand Dollar / US Dollar (November 12) Early in the vicinity of 0.63592, cut from the technical analysis, the 1-hour line level observation trend is in full compliance with yesterday's (11th) forecast rebound market to the red circle in the picture, the current K-bar is again pressured The upper rail has fallen sharply, so there is a chance to rebound after the collapse.

At present, the pressure range above the short-term line is located at 0.63500~0.63550, the downward direction, the initial support interval is 0.63200~0.63250, and the operation mentality is mainly short. The investors who want to enter the market for a short time can consider buying in the 0.63300 to 0.63340 range. The stop loss position can be considered to be set below 0.63250.

Fixed Spread Forex Platform(固定点差外汇平台) - Technical Analysis (Nasdaq Index Nas100):

Today's Nasdaq (November 12) early in the vicinity of 8246.9, from the technical analysis, the 1 hour line level observation trend appears standard convergence triangle shock consolidation, the current shock amplitude is smaller and smaller, must wait for a clear direction, so there is a chance After the pressure, make a break and pull back the market.

At present, the pressure range above the short-term line is located at 8255~8265 points, the downward direction, the initial support range is 8170~8180 points, and the operation mentality is short-term. The investors who want to enter the short-term market can consider buying in the 8235 to 8245 range. In, the stop loss point can be considered to be set above 8260.

Today's key data (data name / importance / previous value / expected):

1. France October BOF Business Confidence Index / three stars / 96/97

2. UK unemployment rate in October / three stars / 3.3% / --- / /

3. Number of UK jobless claims in October (10,000 people) / three stars / 2.11/2

4. UK ILO unemployment rate for three months in September / three stars / 3.9% / 3.9%

5. Germany November ZEW economic prosperity index / three stars / -22.8 / -13

6. Eurozone November ZEW Economic Prosperity Index / Three Stars / -23.5 / ---

7. US October NFIB Small Business Confidence Index / three stars / 101.8 / 102

For more information on the fixed spread forex platform(固定点差外汇平台), please click here to watch.