robert7774

New Member

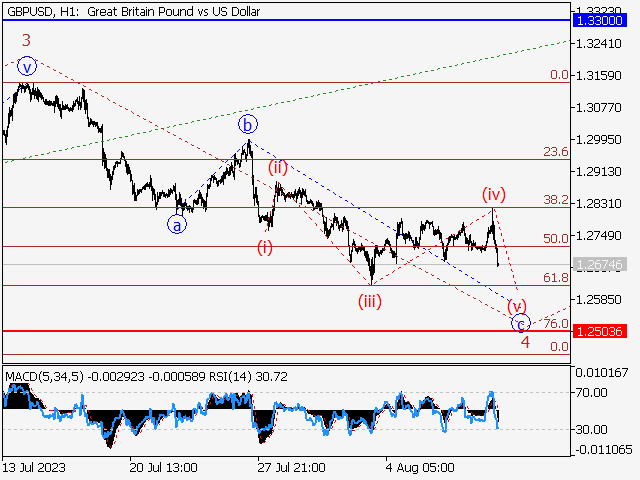

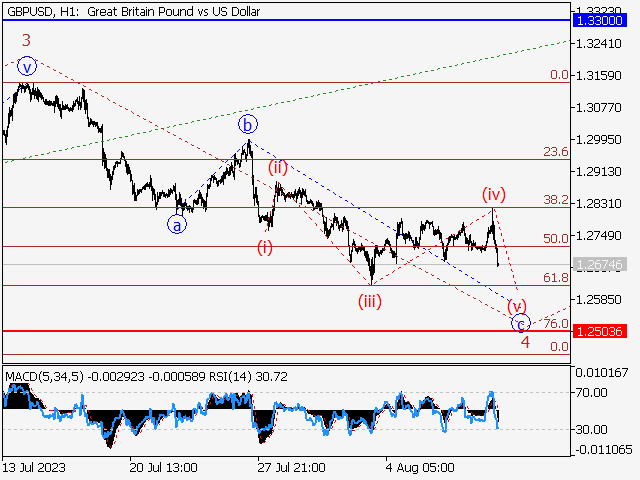

Main scenario: consider long positions above the level of 1.2503 with a target of 1.3300 – 1.3500 once a correction is formed.

Alternative scenario: breakout and consolidation below the level of 1.2503 will allow the pair to continue declining to the levels of 1.2300 – 1.2000.

Analysis: the first wave of larger degree (1) is presumably formed, a corrective wave (2) finished developing, and the third wave (3) is unfolding on the daily chart. The third wave of smaller degree 3 of (3) is formed on the H4 chart, and a local correction is ending as the fourth wave 4 of (3). Wave c of 4 appears to coming to its end on the H1 chart, with the fifth wave (v) of c of 4 forming inside. If the presumption is correct, the pair will continue to rise to the levels of 1.3300 – 1.3500 after correction. The level of 1.2503 is critical in this scenario as its breakout will enable the pair to continue declining to the levels of 1.2300 – 1.2000.

Alternative scenario: breakout and consolidation below the level of 1.2503 will allow the pair to continue declining to the levels of 1.2300 – 1.2000.

Analysis: the first wave of larger degree (1) is presumably formed, a corrective wave (2) finished developing, and the third wave (3) is unfolding on the daily chart. The third wave of smaller degree 3 of (3) is formed on the H4 chart, and a local correction is ending as the fourth wave 4 of (3). Wave c of 4 appears to coming to its end on the H1 chart, with the fifth wave (v) of c of 4 forming inside. If the presumption is correct, the pair will continue to rise to the levels of 1.3300 – 1.3500 after correction. The level of 1.2503 is critical in this scenario as its breakout will enable the pair to continue declining to the levels of 1.2300 – 1.2000.