Kacper2995

New Member

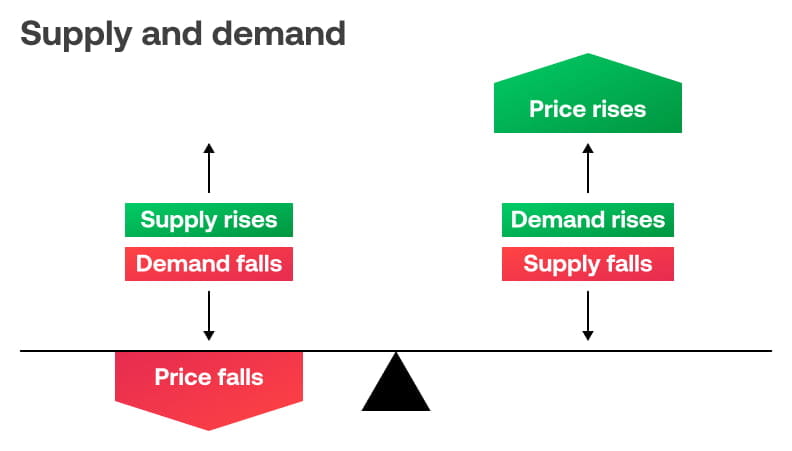

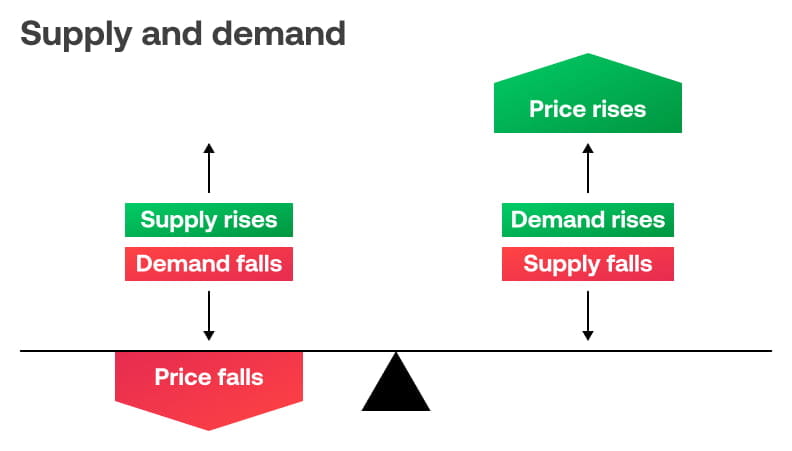

Buyers and sellers impact market prices by altering the supply and demand balance for an asset. When there are more buyers on a market, prices rise as demand outstrips supply.

But as price climbs, those buyers might turn into sellers – after all, they want to see some return on their investment. Eventually, when there are more sellers than buyers, prices will fall as supply floods the market.

The factors that impact this relationship vary from market to market. For example, gold prices will respond to economic conditions, mining strikes and jewellery trends, whereas the share price of a beverage company would be impacted by consumer cycles, earnings reports and industry trends.

The spread is used as a measure of liquidity – a tighter spread indicates that there are plenty of buyers and sellers on the market, but a wider spread indicates little activity. The better the liquidity, the more likely it is that you’ll execute a trade at your preferred price.

When you trade, you’ll also normally be charged via the spread. You’ll execute your trade slightly above the market price and sell slightly below it.

For example, if the current market price of the FTSE 100 is 7205 points, and there is a 1 point spread, you’d open a buy position at 7205.5 and a sell position at 7204.5.

But as price climbs, those buyers might turn into sellers – after all, they want to see some return on their investment. Eventually, when there are more sellers than buyers, prices will fall as supply floods the market.

The factors that impact this relationship vary from market to market. For example, gold prices will respond to economic conditions, mining strikes and jewellery trends, whereas the share price of a beverage company would be impacted by consumer cycles, earnings reports and industry trends.

Bid and ask prices

Bid and ask prices make up the two-way quotation that shows traders the current levels at which an asset can be bought or sold. The bid price indicates the highest price that buyers are willing to pay, and the ask price represents the lowest price sellers are willing to accept.What is the bid-ask spread?

The spread is the term used to describe the difference between the bid and ask prices. The spread will be influenced by a range of factors such as supply and demand, as well as trading activity.The spread is used as a measure of liquidity – a tighter spread indicates that there are plenty of buyers and sellers on the market, but a wider spread indicates little activity. The better the liquidity, the more likely it is that you’ll execute a trade at your preferred price.

When you trade, you’ll also normally be charged via the spread. You’ll execute your trade slightly above the market price and sell slightly below it.

For example, if the current market price of the FTSE 100 is 7205 points, and there is a 1 point spread, you’d open a buy position at 7205.5 and a sell position at 7204.5.