City Traders Imperium CTI

CTI-funded trading platform

FUNDED TRADING PLUS ALTERNATIVE: CITY TRADERS IMPERIUM (CTI) VS FUNDED TRADING PLUS (FTP)

Introduction

Funded Trader Programs have become increasingly common in recent years. The latest of these is offered by Funded Trading Plus (FTP), established in 2021. In their brief time of existence, increased traders have joined their service over the likes of FTMO and The 5ers.

Another key player in the space is City Traders Imperium (CTI), a proprietary trading firm that has been in operation since 2018. So, Choosing the best prop firm to partner with only makes sense when wanting to get funded.

So, how do CTI and FTP compare?

Here, we will look at the offerings of each firm and why City Traders Imperium is the better option, easily!!

Fortunately, CTI and FTP have the same type and number of programmes, making an accurate like-for-like comparison possible.

CTI Challenge vs FTP Advanced Trader Programme

The Challenge and Advanced Trader programmes are designed for short-term traders like scalpers and day traders.

Both consist of two phases: higher leverage, higher drawdown, and refundable fees upon completion.

Let’s examine how City Traders Imperium (CTI) and Funded Trading Plus (FTP) stack up when compared directly.

1. Lower Prices

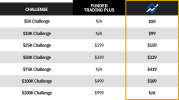

The logical starting point when comparing prop firms is typically the cost of their challenge. So, let’s delve into the fees associated with various account balances at both prop firms.

The first thing the data shows is that CTI offers, overall, slightly lower prices.

- $40 cheaper on the $25k account

- $20 cheaper on the $50k account

2. Offers a Monthly Salary

The cost may not be a convincing differentiator, but the potential to earn a monthly salary should be, which is what you get with City Traders Imperium.

CTI was the first prop firm to launch this incentive for funded traders in January 2023 and remains among the few that do; Funded Trading Plus currently doesn’t.

Participants in the CTI Challenge can receive Up to $1000 in monthly salary per funded account for life. The monthly salary amount depends on the account size, and whether the funded trader qualifies for the weekly withdrawals and maintains a monthly average net profit of 3%.

Of course, the salary is on top of a trader’s funded account profit share. CTI introduced this incentive to help traders maintain consistency after getting funded to ensure they can profit without facing the financial pressures of trading for a living.

The earning potential is two-fold and greater with CTI’s challenge programme compared to Funded Trading Plus.

3. Fixed Absolute Drawdown vs Relative Trailing Drawdown

Relative Drawdown (applied by FTP) involves a trailing loss amount that is not flexible with your account growth.

On the other hand, Absolute Drawdown (offered by CTI) is better as it provides more ‘wiggle room’ for losses as you increase your bottom line.

Let’s demonstrate a hypothetical example of trading a $100,000 account with a 10% Relative Drawdown that you get with Funded Trading Plus. Initially, your termination level would be $90,000 (10% of $100,000).

But then when you grow your balance to $120,000, guess what? The new termination point would be $108,000 (10% of the new balance).

Meanwhile, with CTI, you have a 10% Absolute Drawdown, and under the same circumstances, the termination level would remain fixed at $90,000.

Therefore, you would have more breathing room with CTI to risk an additional $18,000 (or +18% Buffer). This +$18,000 would act as an extra drawdown buffer, a stark contrast to the trailing model offered by FTP.

4. Easier Withdrawals with CTI

With the 10% fixed absolute drawdown offered by CTI, you will always have the 10% drawdown buffer on top of the net profit you generate. It gives you a huge advantage and flexibility to withdraw profits while maintaining the original drawdown as a buffer.

On the other hand, with FTP, withdrawals come with a negative consequence due to the Max Trailing Drawdown rule mentioned above.

With Funded Trading Plus, any profit you withdraw will be counted as part of your trailing drawdown.

So, let’s say you are 6% in profit, and the maximum Trailing Drawdown is 10%. Once you withdraw that profit, your remaining trailing drawdown will be only 4% (10%–6%)).

This rule is a major factor that punishes you each time you withdraw and forces you not to withdraw any profit. The more you withdraw, the closer you get to your maximum Trailing drawdown limit.

5. Higher Profit Share

With Funded Trading Plus, your maximum profit share is 90%. Meanwhile, with CTI, the funded trader could get up to a 100% profit share once they scale up three times. The share difference may be slight. Yet it plays a key role as your earnings increase, provided you are consistently profitable.

Now, you might ask: how could CTI make any profit when giving away 100% of the profit share to the funded trader?

The answer is simply by copying the trader into a second live account. CTI could profit on the second live account and allow the funded trader to each 100% profit on his account.

6. Allows Weekend Trading

Short-term traders don’t hold their orders over the weekend. Yet, you can rest assured of doing so in the rare case with City Traders Imperium.

Unfortunately, FTP doesn’t have this feature, as they close your trades automatically by 21:30 GMT (16:30 NY Time) on Friday.

7. Lower Profit Target to scale up

Profit share isn’t the only factor in assessing earning potential with a prop firm. It’s also about the progressive growth of your account balance once you start making profits; this is where scaling comes in.

At City Traders Imperium, traders only need a 10% profit to advance to a higher account balance tier. Unfortunately, the threshold at Funded Trading Plus is double that, requiring traders to make a 20% profit before scaling up.

Summary

The Challenge program from City Traders Imperium (CTI) and the Advanced Trader program from Funded Trading Plus (FTP) bear a lot of resemblances, with slight differences in aspects like profit targets, leverage, and drawdowns.

Yet, the major factors that set them apart include the type of drawdowns, ease of withdrawals, availability of lower account tiers, higher earning potential, weekend trading, and monthly salary.

Initiating your trading journey with City Traders Imperium is more budget friendly as they offer smaller account sizes of $5k and $10k. In addition, a couple of their packages, which offer the same balance size as FTP’s, are priced a bit lower.

The definitive area where CTI outperforms FTP is in its earning potential, and ease of withdrawals. With attractive features like a salary incentive, an unprecedented profit split of up to 100%, and a faster scaling system, CTI positions itself as a more lucrative option for traders.

CTI Instant Funding vs FTP Experienced Trader Program

Next up in our overall comparison is looking at the funded programs geared toward long-term traders.

Here, we have CTI’s Instant Funding versus FTP Experienced Trader packages. In all fairness, the latter program is quite competitive and like CTI’s Instant Funding program. Still, the main differentiation is, again, the drawdown limitation that you would get with FTP.

Each plan has only one phase and no minimum active trading days or maximum time limits.

The profit targets are slightly lower, with CTI at 9%, which it’s 10% with FTP.

Also, the maximum profit share is slightly higher with CTI, with up to 100% profit share, while it’s 90% with FTP.

The main exception which makes City Traders Imperium a better choice is the drawdown type, which can also affect the ease of withdrawals.

1. Refundable Fee

Upon reaching a 10% profit on your live-funded account (following a successful evaluation), Funded Traders Plus refunds the signup fee that you initially paid.

This means to qualify for a refund; you would have to make 20% in total (10% on the Demo evaluation phase and another 10% on the live funded account phase).

In contrast, CTI provides an option to withdraw just two weeks after hitting the 9% profit target in the Instant Funding Phase. This means, once you are funded, you won’t need to hit any profit target objective to get a refund of your fee.