Vlad RF

Well-Known Member

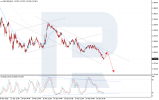

AUDUSD eyes breakout — yearly high under pressure

AUDUSD is trading near its yearly high at 0.6408, continuing a strong uptrend. Further gains are likely. Full analysis for 18 April 2025 below.

AUDUSD technical analysis

AUDUSD is advancing within a clear bullish trend and is currently trading just below 0.6400. The Alligator indicator confirms the strength of the upward impulse.

AUDUSD remains firmly in an uptrend, supported by USD weakness and strong commodity prices.

Read more at RoboForex Website

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

AUDUSD is trading near its yearly high at 0.6408, continuing a strong uptrend. Further gains are likely. Full analysis for 18 April 2025 below.

AUDUSD technical analysis

AUDUSD is advancing within a clear bullish trend and is currently trading just below 0.6400. The Alligator indicator confirms the strength of the upward impulse.

AUDUSD remains firmly in an uptrend, supported by USD weakness and strong commodity prices.

Read more at RoboForex Website

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team