Vlad RF

Well-Known Member

Inflation surprise: yen strengthens, USDJPY declines

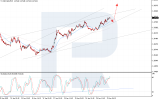

The yen continues to strengthen, pushing the USDJPY rate lower with a potential move towards 142.35. Find out more in our analysis for 23 May 2025.

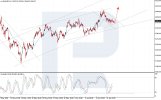

USDJPY technical analysis

Having tested the upper Bollinger Band, the USDJPY price formed a Hanging Man reversal pattern on the H4 chart near the 143.40 level. The pair may now continue its downward wave based on that signal.

The increase in Japan's core CPI has strengthened the yen.

Read more at RoboForex Website

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

The yen continues to strengthen, pushing the USDJPY rate lower with a potential move towards 142.35. Find out more in our analysis for 23 May 2025.

USDJPY technical analysis

Having tested the upper Bollinger Band, the USDJPY price formed a Hanging Man reversal pattern on the H4 chart near the 143.40 level. The pair may now continue its downward wave based on that signal.

The increase in Japan's core CPI has strengthened the yen.

Read more at RoboForex Website

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team