Vlad RF

Well-Known Member

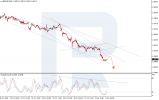

USDCAD rebounds after positive US news

The USDCAD pair starts the week with a recovery attempt after last week’s decline, currently trading at 1.4023. Find more details in our analysis for 20 October 2025.

USDCAD technical analysis

The USDCAD pair continues to move within an ascending channel despite sellers’ attempts to trigger a correction.

After a short-term decline, the price is testing the lower boundary of the channel, indicating that buying interest remains intact. The Stochastic Oscillator shows a rebound from oversold territory, with a potential upward crossover forming, confirming the market’s readiness to resume growth.

With the US dollar strengthening and steady investor interest in Canadian assets, the short-term USDCAD outlook remains bullish.

Read more at RoboForex Website

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

The USDCAD pair starts the week with a recovery attempt after last week’s decline, currently trading at 1.4023. Find more details in our analysis for 20 October 2025.

USDCAD technical analysis

The USDCAD pair continues to move within an ascending channel despite sellers’ attempts to trigger a correction.

After a short-term decline, the price is testing the lower boundary of the channel, indicating that buying interest remains intact. The Stochastic Oscillator shows a rebound from oversold territory, with a potential upward crossover forming, confirming the market’s readiness to resume growth.

With the US dollar strengthening and steady investor interest in Canadian assets, the short-term USDCAD outlook remains bullish.

Read more at RoboForex Website

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team