benkal

Active Member

What is technical analysis?

~Technical analysis is the study of financial market action. The technician looks at price changes that occur on a day-to-day or week-to-week basis or over any other constant time period displayed in graphic form, called charts. Hence the name chart analysis. A chartist analyzes price charts only, while the technical analyst studies technical indicators derived from price changes in addition to the price charts. Technical analysts examine the price action of the financial markets instead of the fundamental factors that (seem to) effect market prices. Technicians believe that even if all relevant information of a particular market or stock was available, you still could not predict a precise market "response" to that information.

~There are so many factors interacting at any one time that it is easy for important ones to be ignored in favor of those that are considered as the "flavor of the day." The technical analyst believes that all the relevant market information is reflected (or discounted) in the price with the exception of shocking news such as natural distasters or acts of God. These factors, however, are discounted very quickly. Watching financial markets, it becomes obvious that there are trends, momentum and patterns that repeat over time, not exactly the same way but similar.

~Charts are self-similar as they show the same fractal structure (a fractal is a tiny pattern; self-similar means the overall pattern is made up of smaller versions of the same pattern) whether in stocks, commodities, currencies, bonds. A chart is a mirror of the mood of the crowd and not of the fundamental factors. Thus, technical analysis is the analysis of human mass psychology. Therefore, it is also called behavioral finance.

Optimism, pessimism, greed and fear

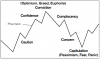

~Why aren´t more people making more money in the financial markets? Because, as we have seen, people are motivated by greed (optimism) when buying and by fear (pessimism) when selling. People are motivated to buy and sell by changes in emotion from optimism to pessimism and vice versa. They formulate fundamental scenarios based on their emotional state (a rationalization of the emotions), which prevents them from realizing that the main drive is emotion. The chart above shows that if investors buy based on confidence or conviction (optimism) they BUY near or at the TOP.

~Likewise, if investors act on concern or capitulation (pessimism) they SELL near or at the BOTTOM. Investors remain under the bullish impression of the recent uptrend beyond the forming price top and during a large part of the bear trend. Vice versa, they remain pessimistic under the bearish impression from the past downtrend through the market bottom and during a large part of the next bull trend. They adjust their bullish fundamental scenarios to bearish AFTER having become pessimistic under the pressure of the downtrend or AFTER having become optimistic under the pressure of the uptrend. Once having turned bearish, investors formulate bearish scenarios, looking for more weakness just when it is about time to buy again.

~The same occurs in an uptrend when mood shifts from pessimism to optimism. Investors formulate bullish scenarios AFTER having turned bullish, which is after a large part of the bull trend is already over. Emotions are the drawback of fundamental analysis. Investors must learn to buy when they are fearful (pessimistic) and sell when they feel euphoric (optimstic). This may sound easy (simple contrary opinion), but without Technical Analysis it is hard to achieve. The main purpose of technical analysis is to help investors identify turning points which they cannot see because of individual and group psychological factors.

~Technical analysis is the study of financial market action. The technician looks at price changes that occur on a day-to-day or week-to-week basis or over any other constant time period displayed in graphic form, called charts. Hence the name chart analysis. A chartist analyzes price charts only, while the technical analyst studies technical indicators derived from price changes in addition to the price charts. Technical analysts examine the price action of the financial markets instead of the fundamental factors that (seem to) effect market prices. Technicians believe that even if all relevant information of a particular market or stock was available, you still could not predict a precise market "response" to that information.

~There are so many factors interacting at any one time that it is easy for important ones to be ignored in favor of those that are considered as the "flavor of the day." The technical analyst believes that all the relevant market information is reflected (or discounted) in the price with the exception of shocking news such as natural distasters or acts of God. These factors, however, are discounted very quickly. Watching financial markets, it becomes obvious that there are trends, momentum and patterns that repeat over time, not exactly the same way but similar.

~Charts are self-similar as they show the same fractal structure (a fractal is a tiny pattern; self-similar means the overall pattern is made up of smaller versions of the same pattern) whether in stocks, commodities, currencies, bonds. A chart is a mirror of the mood of the crowd and not of the fundamental factors. Thus, technical analysis is the analysis of human mass psychology. Therefore, it is also called behavioral finance.

Optimism, pessimism, greed and fear

~Why aren´t more people making more money in the financial markets? Because, as we have seen, people are motivated by greed (optimism) when buying and by fear (pessimism) when selling. People are motivated to buy and sell by changes in emotion from optimism to pessimism and vice versa. They formulate fundamental scenarios based on their emotional state (a rationalization of the emotions), which prevents them from realizing that the main drive is emotion. The chart above shows that if investors buy based on confidence or conviction (optimism) they BUY near or at the TOP.

~Likewise, if investors act on concern or capitulation (pessimism) they SELL near or at the BOTTOM. Investors remain under the bullish impression of the recent uptrend beyond the forming price top and during a large part of the bear trend. Vice versa, they remain pessimistic under the bearish impression from the past downtrend through the market bottom and during a large part of the next bull trend. They adjust their bullish fundamental scenarios to bearish AFTER having become pessimistic under the pressure of the downtrend or AFTER having become optimistic under the pressure of the uptrend. Once having turned bearish, investors formulate bearish scenarios, looking for more weakness just when it is about time to buy again.

~The same occurs in an uptrend when mood shifts from pessimism to optimism. Investors formulate bullish scenarios AFTER having turned bullish, which is after a large part of the bull trend is already over. Emotions are the drawback of fundamental analysis. Investors must learn to buy when they are fearful (pessimistic) and sell when they feel euphoric (optimstic). This may sound easy (simple contrary opinion), but without Technical Analysis it is hard to achieve. The main purpose of technical analysis is to help investors identify turning points which they cannot see because of individual and group psychological factors.