forexnews

Member

TECHNICAL ANALYSIS REPORT BY OUR EXPERT – 05 SEPTEMBER 2022

OIL PRICES UP $2/BBL AHEAD OF OPEC+ MEETING

Asian Pacific markets fell after strong U.S. jobs data raised the prospect of more steep interest rate hikes by the Federal Reserve. The Shanghai Composite is up 0.19% at 3,192.47. Overall, the Singapore MSCI is up 0.52% at 288.65. Over in Hong Kong, the Hang Seng Index is down 1.28% at 19,143.00. In Japan, the Nikkei 225 is down 0.07% at 27,640.00, while the Topix index is up 0.16% at 1930.00. South Korea’s Kospi is down 0.24% at 2,403.68. Australia S&P/ASX 200 up 0.34% at 6852.20.

Top News of the Day:

Oil prices rose more than $2 a barrel on Monday, extending gains as investors eyed possible moves by OPEC+ producers to cut output and support prices at a meeting later in the day.

At their meeting later on Monday, the Organization of the Petroleum Exporting Countries (OPEC) and its allies, a group known as OPEC+, may decide to keep current output levels or even cut production to bolster prices, despite supplies remaining tight.

Market Summary as per 02/09/2022:

European equities Friday closing. The DAX futures contract in Germany traded up 3.33% at 13,050.27, CAC 40 futures down 1.73% at 6061.03 and the UK 100 futures contract in the U.K. down 0.65% at 7,234.88.

In the U.S. on Wall Street, the Dow Jones Industrial Average closed down 1.07% at 31318.45. The S&P 500 down 1.07% at 3924.27 and the Nasdaq 100 down 1.44% at 12098.44, NYSE closes down 0.56% at 14689.50.

TECHNICAL SUMMARY

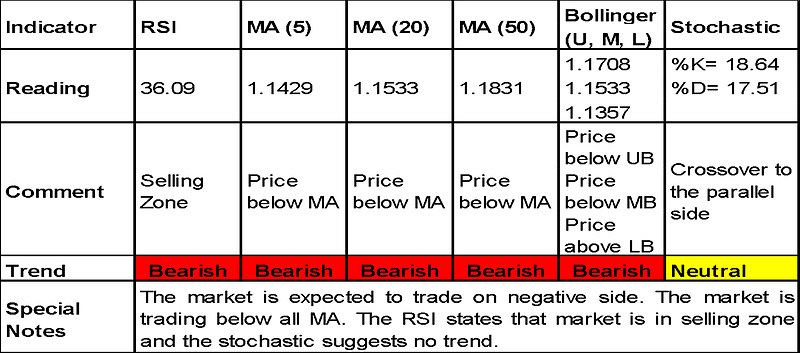

GBPUSD TECHNICAL ANALYSIS

TRADE SUGGESTION- SELL AT 1.1462, TAKE PROFIT AT 1.1444 AND STOP LOSS AT 1.1475

VIEW FULL REPORT VISIT - CAPITALSTREETFX