FXGlory Ltd

Member

GOLDUSD H4 Technical and Fundamental Analysis for 12.02.2025

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Gold (XAU/USD) remains under moderate pressure as traders anticipate remarks from Federal Reserve Governor Michelle Bowman, who is scheduled to testify before the House Financial Services Committee in Washington, D.C. A more hawkish tone from her could strengthen the US Dollar (USD) and weigh on gold prices, given the inverse correlation between the two. Additionally, upcoming RealClearMarkets/TIPP Consumer Confidence data and Wards Auto Sales figures may provide further insight into the strength of the U.S. economy. Stronger-than-expected consumer or auto data could reinforce expectations of tighter monetary policy, dampening gold’s short-term bullish outlook. Conversely, dovish commentary or weaker data may revive safe-haven demand for gold in the H4 and daily sessions.

Price Action:

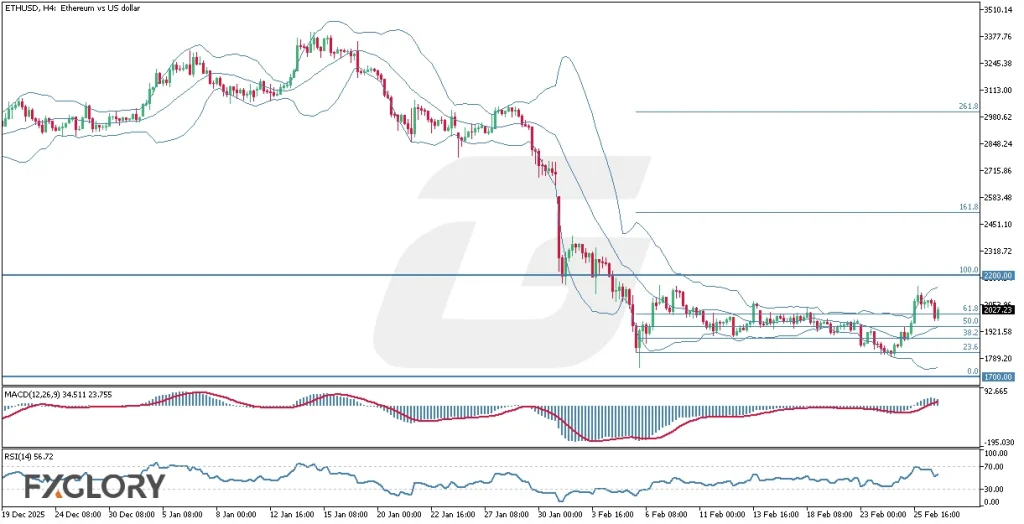

On the H4 chart, GOLD-USD continues to consolidate within a symmetrical triangle pattern, suggesting a potential breakout in either direction. The price recently moved from the upper half of the Bollinger Bands toward the middle band, which is acting as a short-term support zone. The upper Bollinger Band aligns closely with a bearish trendline, forming the upper boundary of the flag-like structure. Meanwhile, the middle Bollinger Band provides support, and the next key support area could be found around the lower band, near the bottom of the triangle. The overall price action remains neutral-to-bullish as long as gold stays above the ascending lower trendline.

Key Technical Indicators:

Bollinger Bands: The price moved from the upper half toward the middle band, which acts as the first support level. The upper band aligns with the bearish trendline, while the lower band near $4,110 is the next support zone.

RSI (14): Currently at 59.55, indicating moderate bullish momentum with room to rise before overbought conditions. A drop below 50 would signal a possible short-term correction.

Stochastic (5,3,3): Values at 32.91 and 39.78 show mild downward momentum, suggesting short-term consolidation. A rebound above 40 could confirm renewed bullish momentum on the H4 chart.

Support and Resistance:

Support: The immediate support is seen near $4,200–$4,180, aligning with the middle Bollinger Band and the lower side of the recent consolidation range.

Resistance: The nearest resistance lies around $4,260–$4,280, matching the upper Bollinger Band and the bearish trendline forming the upper boundary of the triangle.

Conclusion and Consideration:

The GOLD/USD H4 chart analysis indicates that the market is currently in a consolidation phase within a symmetrical triangle, reflecting indecision before a potential breakout. The technical indicators, including RSI and Stochastic, show a balance between bullish and bearish forces, suggesting a cautious trading environment. Traders should closely monitor fundamental catalysts—particularly the Federal Reserve testimony—as any hawkish commentary could push gold lower toward the lower Bollinger Band support. Conversely, dovish statements or weak USD data could spark a bullish breakout above $4,280.

Disclaimer: The analysis provided for GOLD/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on GOLDUSD. Market conditions can change quickly, so staying informed with the latest data is essential.

FXGlory

12.02.2025

Time Zone: GMT +2

Time Frame: 4 Hours (H4)

Fundamental Analysis:

Gold (XAU/USD) remains under moderate pressure as traders anticipate remarks from Federal Reserve Governor Michelle Bowman, who is scheduled to testify before the House Financial Services Committee in Washington, D.C. A more hawkish tone from her could strengthen the US Dollar (USD) and weigh on gold prices, given the inverse correlation between the two. Additionally, upcoming RealClearMarkets/TIPP Consumer Confidence data and Wards Auto Sales figures may provide further insight into the strength of the U.S. economy. Stronger-than-expected consumer or auto data could reinforce expectations of tighter monetary policy, dampening gold’s short-term bullish outlook. Conversely, dovish commentary or weaker data may revive safe-haven demand for gold in the H4 and daily sessions.

Price Action:

On the H4 chart, GOLD-USD continues to consolidate within a symmetrical triangle pattern, suggesting a potential breakout in either direction. The price recently moved from the upper half of the Bollinger Bands toward the middle band, which is acting as a short-term support zone. The upper Bollinger Band aligns closely with a bearish trendline, forming the upper boundary of the flag-like structure. Meanwhile, the middle Bollinger Band provides support, and the next key support area could be found around the lower band, near the bottom of the triangle. The overall price action remains neutral-to-bullish as long as gold stays above the ascending lower trendline.

Key Technical Indicators:

Bollinger Bands: The price moved from the upper half toward the middle band, which acts as the first support level. The upper band aligns with the bearish trendline, while the lower band near $4,110 is the next support zone.

RSI (14): Currently at 59.55, indicating moderate bullish momentum with room to rise before overbought conditions. A drop below 50 would signal a possible short-term correction.

Stochastic (5,3,3): Values at 32.91 and 39.78 show mild downward momentum, suggesting short-term consolidation. A rebound above 40 could confirm renewed bullish momentum on the H4 chart.

Support and Resistance:

Support: The immediate support is seen near $4,200–$4,180, aligning with the middle Bollinger Band and the lower side of the recent consolidation range.

Resistance: The nearest resistance lies around $4,260–$4,280, matching the upper Bollinger Band and the bearish trendline forming the upper boundary of the triangle.

Conclusion and Consideration:

The GOLD/USD H4 chart analysis indicates that the market is currently in a consolidation phase within a symmetrical triangle, reflecting indecision before a potential breakout. The technical indicators, including RSI and Stochastic, show a balance between bullish and bearish forces, suggesting a cautious trading environment. Traders should closely monitor fundamental catalysts—particularly the Federal Reserve testimony—as any hawkish commentary could push gold lower toward the lower Bollinger Band support. Conversely, dovish statements or weak USD data could spark a bullish breakout above $4,280.

Disclaimer: The analysis provided for GOLD/USD is for informational purposes only and does not constitute investment advice. Traders are encouraged to perform their own analysis and research before making any trading decisions on GOLDUSD. Market conditions can change quickly, so staying informed with the latest data is essential.

FXGlory

12.02.2025