The United States announced yesterday (10th) that the consumer price index (CPI) was 0% lower than the market expectation of 0.1%, indicating that the US inflation rate is still weak, thus raising the Federal Reserve (Fed) to implement the third year of this year at the end of October. The possibility of a rate cut. Economists pointed out that the current inflation rate of the real economy in the United States has not yet improved, which will undoubtedly weaken the voice of the Fed hawks, which may make market investors more expect the Fed to cut interest rates by another one yard in October ( 0.25%), but if the United States imposes punitive tariffs on China before the end of the year, it is likely to lead to a rapid rise in CPI, so the Fed is not too worried about inflation.

On the other hand, the European Central Bank (ECB) has taken the lead in resuming the quantitative easing policy (QE) last month. At the same time, it has encountered opposition from some internal officials, further indicating the differences of opinion within the European Central Bank (ECB). Officials who oppose continued easing believe that if the interest rate has been lowered, it will hurt the normal operation of the economy and finance, which will cause banks and enterprises to become zombies and thus increase the risk of financial turmoil. Therefore, let the incoming new president Lagarde, There will be many difficulties in monetary policy.

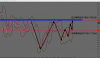

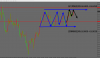

Forex(外汇) - Technical Analysis (Gold XAUUSD):

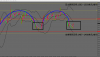

Today's foreign(外汇) exchange analysis gold (October 11) early in the morning at 1493.7 US dollars / ounce, from the technical analysis, the 1 hour level observation trend above the chip formation pressure range, fell below the 0.236 gold return level, there has been a sharp decline, so there is a chance After the fall, there was a rebound.

At present, the pressure range above the short-term line is located at 1502~1503 US dollars / ounce, the downward direction, the initial support range is 1487~1488 US dollars / ounce, the operating mentality is mainly short, and investors who want to enter the market to do more short can consider the 1494 US dollars ounce. To the $1,496/oz range, the light position is bought. The MT4 setting stop loss can be set below $1,491 per ounce.

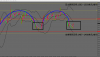

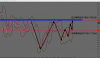

Forex(外汇) - Technical Analysis (EUR/USD EURUSD):

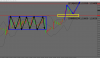

Today's foreign(外汇) exchange analysis of the euro / US dollar (October 11) Early in the 1.10077 near the technical analysis, the 1 hour level observation trend after the box in the map, officially entered the long form, so there is a chance to pull back the correction after the short-term rise.

At present, the pressure range above the short-term line is located at 1.10350~1.10400, the downward direction, the initial support range is from 1.100~1.10050, and the operating mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the 1.10100 to 1.10150 range. MT4 sets the stop loss point to consider setting below 1.10070.

Forex(外汇) - Technical Analysis (GBP/USD GBPUSD):

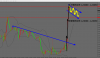

Today's foreign(外汇) exchange analysis GBP/USD (October 11th) Early in the vicinity of 1.24357, from the technical analysis, the 1 hour line level observation trend has skyrocketed, after breaking the pressure line, it is only possible to be affected by international news. The rational increase, as for the reason is nothing more than the Brexit, so there is a chance to increase the amount and then pull back the correction.

At present, the pressure range above the short-term line is located at 1.24600~1.24650, the downward direction, the initial support range is 1.24000~1.24050, and the operational mentality is mainly short-term. Investors who want to enter the short-term market may consider buying in the 1.24350 to 1.24400 range. MT4 sets the stop loss point to consider setting above 1.24500.

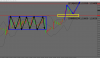

Forex(外汇) - Technical Analysis (NZD/USD NZDUSD):

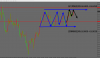

Today's foreign(外汇) exchange analysis NZD/USD (October 11th) Early in the vicinity of 0.63189, cut from the technical analysis, 1 hour line level observation can clearly see the high point volatility interval, forming a short-line box sorting, so there is a chance to ralli Pull back the correction.

At present, the pressure range above the short-term line is located at 0.63400~0.63450, the downward direction, the initial support range is 0.63000~0.63050, and the operation mentality is short-term. The investors who want to enter the short-term market may consider buying in the 0.63260 to 0.63290 range. MT4 sets the stop loss point to consider setting above 0.63360.

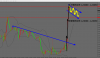

Forex(外汇) - Technical Analysis (Nasdaq Index Nas100):

Today's foreign(外汇) exchange analysis Nasdaq (October 11) Early in the morning near 7772.2, cut from the technical analysis, 1 hour line level observation trend bottom up the challenge above the pressure, the current Bollinger channel opening upwards, but there is a cross star form must be added Note that there is therefore a chance to pull back the correction with a high pressure.

At present, the pressure range above the short-term line is located at 7800~7810 points, the downward direction, the initial support interval is 7700~7710 points, and the operation mentality is short-term. The investors who want to enter the short-term market can consider buying in the 7780-7790 range. In, MT4 set the stop loss point can be considered to set above the 7805.

Today's foreign(外汇) exchange key data (data name / importance / previous value / expected):

1. Germany September CPI monthly rate final value / three stars / 0% / 0%

2. China's M2 money supply annual rate in September / three stars / 8.2% / 8.2%

3. US September import price index monthly rate / three stars / -0.5% / 0%

4. US October University of Michigan Consumer Confidence Index initial value / three stars / 93.2 / 92

For more information on Forex(外汇) and MT4, please click here to watch.

On the other hand, the European Central Bank (ECB) has taken the lead in resuming the quantitative easing policy (QE) last month. At the same time, it has encountered opposition from some internal officials, further indicating the differences of opinion within the European Central Bank (ECB). Officials who oppose continued easing believe that if the interest rate has been lowered, it will hurt the normal operation of the economy and finance, which will cause banks and enterprises to become zombies and thus increase the risk of financial turmoil. Therefore, let the incoming new president Lagarde, There will be many difficulties in monetary policy.

Forex(外汇) - Technical Analysis (Gold XAUUSD):

Today's foreign(外汇) exchange analysis gold (October 11) early in the morning at 1493.7 US dollars / ounce, from the technical analysis, the 1 hour level observation trend above the chip formation pressure range, fell below the 0.236 gold return level, there has been a sharp decline, so there is a chance After the fall, there was a rebound.

At present, the pressure range above the short-term line is located at 1502~1503 US dollars / ounce, the downward direction, the initial support range is 1487~1488 US dollars / ounce, the operating mentality is mainly short, and investors who want to enter the market to do more short can consider the 1494 US dollars ounce. To the $1,496/oz range, the light position is bought. The MT4 setting stop loss can be set below $1,491 per ounce.

Forex(外汇) - Technical Analysis (EUR/USD EURUSD):

Today's foreign(外汇) exchange analysis of the euro / US dollar (October 11) Early in the 1.10077 near the technical analysis, the 1 hour level observation trend after the box in the map, officially entered the long form, so there is a chance to pull back the correction after the short-term rise.

At present, the pressure range above the short-term line is located at 1.10350~1.10400, the downward direction, the initial support range is from 1.100~1.10050, and the operating mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the 1.10100 to 1.10150 range. MT4 sets the stop loss point to consider setting below 1.10070.

Forex(外汇) - Technical Analysis (GBP/USD GBPUSD):

Today's foreign(外汇) exchange analysis GBP/USD (October 11th) Early in the vicinity of 1.24357, from the technical analysis, the 1 hour line level observation trend has skyrocketed, after breaking the pressure line, it is only possible to be affected by international news. The rational increase, as for the reason is nothing more than the Brexit, so there is a chance to increase the amount and then pull back the correction.

At present, the pressure range above the short-term line is located at 1.24600~1.24650, the downward direction, the initial support range is 1.24000~1.24050, and the operational mentality is mainly short-term. Investors who want to enter the short-term market may consider buying in the 1.24350 to 1.24400 range. MT4 sets the stop loss point to consider setting above 1.24500.

Forex(外汇) - Technical Analysis (NZD/USD NZDUSD):

Today's foreign(外汇) exchange analysis NZD/USD (October 11th) Early in the vicinity of 0.63189, cut from the technical analysis, 1 hour line level observation can clearly see the high point volatility interval, forming a short-line box sorting, so there is a chance to ralli Pull back the correction.

At present, the pressure range above the short-term line is located at 0.63400~0.63450, the downward direction, the initial support range is 0.63000~0.63050, and the operation mentality is short-term. The investors who want to enter the short-term market may consider buying in the 0.63260 to 0.63290 range. MT4 sets the stop loss point to consider setting above 0.63360.

Forex(外汇) - Technical Analysis (Nasdaq Index Nas100):

Today's foreign(外汇) exchange analysis Nasdaq (October 11) Early in the morning near 7772.2, cut from the technical analysis, 1 hour line level observation trend bottom up the challenge above the pressure, the current Bollinger channel opening upwards, but there is a cross star form must be added Note that there is therefore a chance to pull back the correction with a high pressure.

At present, the pressure range above the short-term line is located at 7800~7810 points, the downward direction, the initial support interval is 7700~7710 points, and the operation mentality is short-term. The investors who want to enter the short-term market can consider buying in the 7780-7790 range. In, MT4 set the stop loss point can be considered to set above the 7805.

Today's foreign(外汇) exchange key data (data name / importance / previous value / expected):

1. Germany September CPI monthly rate final value / three stars / 0% / 0%

2. China's M2 money supply annual rate in September / three stars / 8.2% / 8.2%

3. US September import price index monthly rate / three stars / -0.5% / 0%

4. US October University of Michigan Consumer Confidence Index initial value / three stars / 93.2 / 92

For more information on Forex(外汇) and MT4, please click here to watch.