Speed Runner Forex Trading Strategy

Imagine being able to buy a simple item cheap, then going back to the store the next week and being able to sell it back at twice the price when you first bought it. You grinned ear to ear for the profit you have made. Then you thought to yourself, why not come back to tomorrow to buy another item, then sell it the next week. So, you did. True enough, the price of the same item doubled in price. You may think to yourself this is crazy, and I hope trading was that easy, but in a nutshell that is what trading is about.

This is what most swing traders do. They take positions, come back in a few days and hope to be giving it back to the market at a better price for a profit. And they do make money doing this again and again. But what if you are allowed to do this several times in a day? Then, more money could be made. That is the beauty of day trading.

Many who come into trading dream of being a successful day trader. But most just don’t know where to start or how to do it. Let’s try do explore a strategy that would allow us to do this again and again on most days.

Day Trading on the Right Environment

You could make money on all market conditions, but not all market environments are worth the risk. Most of the time, 80% of the time, the market just chops around doing whatever it wants to do and not showing a clear direction of where it wants to go. Many traders trade in this environment but given that it usually doesn’t show a clear direction, the odds aren’t usually in your favor. Then there is the other 20% of the time when the market shows a clear strong trend, one that has momentum and clear direction. During these times, you exponentially increase your odds just because you know where the market is more likely to go. This is trend trading.

Trend trading is the method of trading wherein you attempt to identify if the market has momentum and is going in one direction. This is often done through technical analysis and the use of charts. The thesis is that because of the strong momentum that is carrying the trend, price is more likely to go towards the same direction and traders take their positions based on this assumption.

This type of trading tends to have a higher probability of success. The key though is in identifying the right market condition – a strong enough trending market.

Trading Strategy Concept

This strategy is a trend continuation type of strategy that should be taken exclusively on a trending market environment. Although the market trends only 20% of the time, because day trading is done on the lower timeframes, odds are that there will be smaller trends that could be traded within the day. Although this doesn’t happen every day, but trends do occur more often than not in a single day.

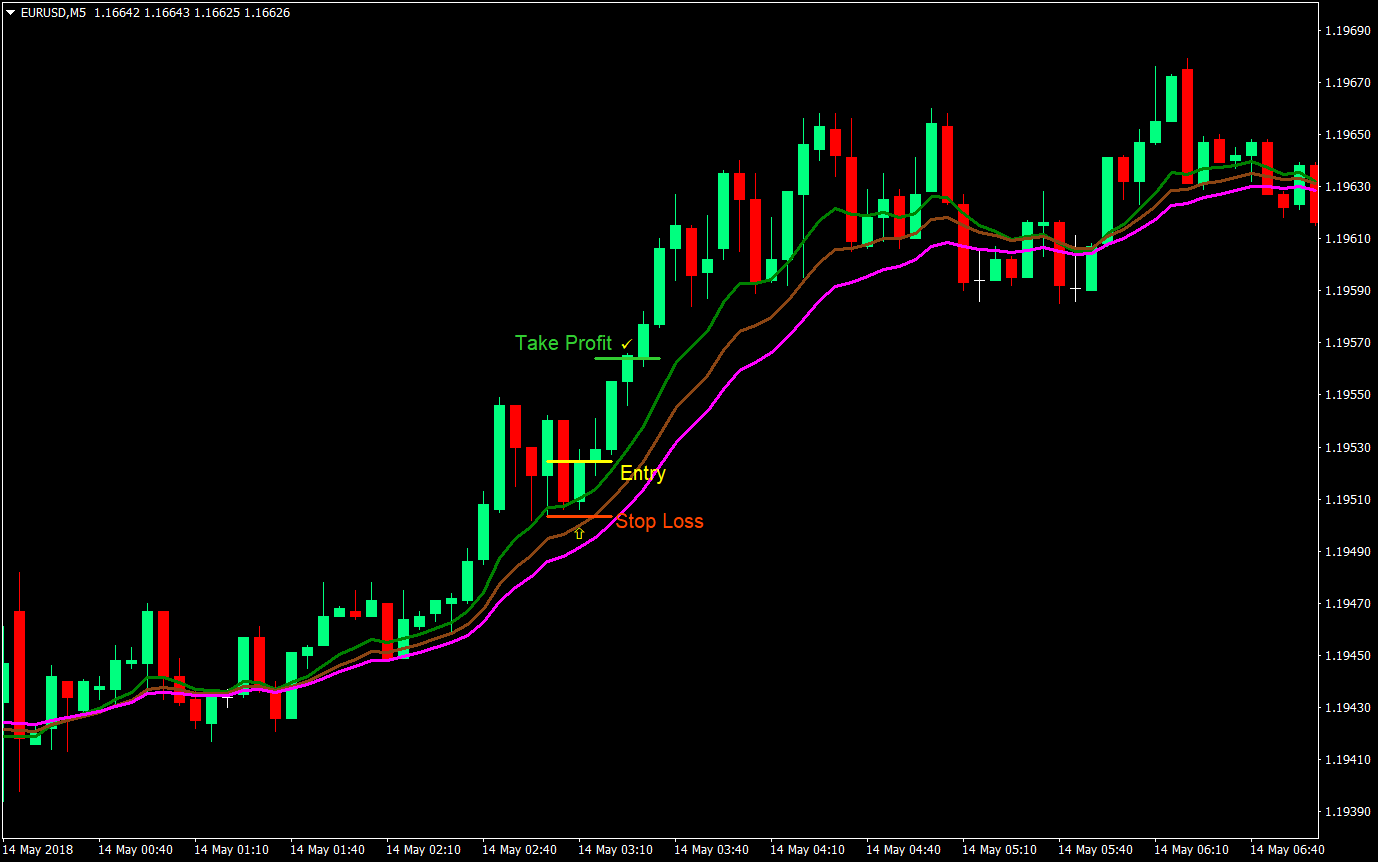

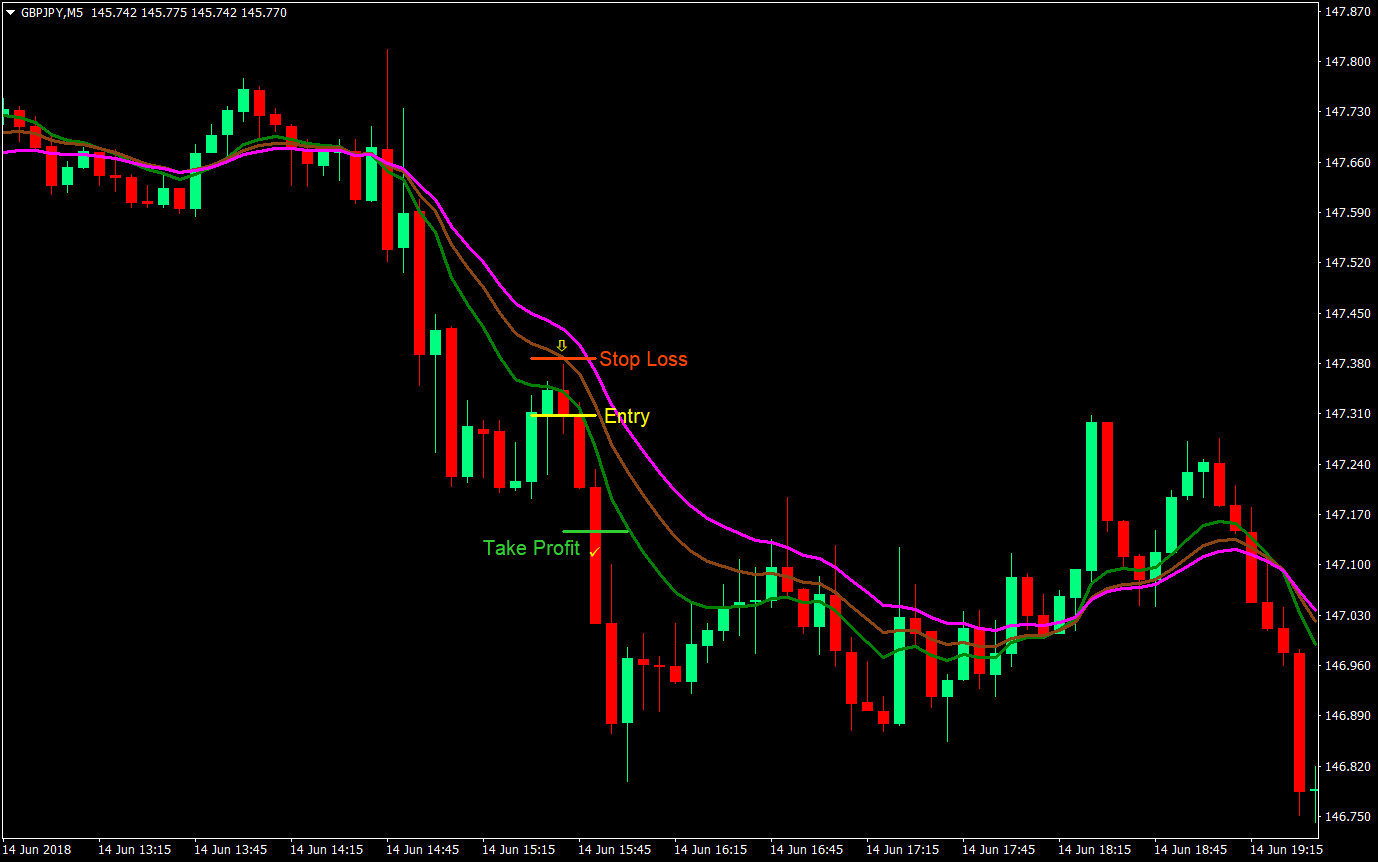

To trade a trend continuation entry, we will be making use of three fast Exponential Moving Averages (EMA) – 10, 15 and 20-period EMAs. On a trending market environment, these three EMAs will be stacked and relatively fanned out and will have more slope, while on a ranging market environment, these EMAs will more constricted and flat.

We will then try to eyeball the chart if the market is indeed in a trending market environment. If so, then we will be using the area between the 10 and 15-period EMA as an area where we will anticipate retracements. We will wait for price to come back in between the EMAs, then close back outside the EMAs on the side of the 10-period EMA, signaling that it is resuming the trend.

Indicators:

- 10-period EMA (Green)

- 15-period EMA (Brown)

- 20-period EMA (Magenta)

Currency Pairs: EURUSD, GBPUSD, EURJPY, GBPJPY and EURGBP

Trading Session: London Session

Buy (Long) Trade Setup Rules

Entry:

- The EMAs should be stacked in the following order:

- 10 EMA: top

- 15 EMA: middle

- 20 EMA: bottom

- Price should come from above the 3 EMAs

- Wait for price to retrace in between the 10 & 15-period EMA

- After retracing between the EMAs, wait for price to close back above the 10 EMA

- Enter a buy market order at the close of the candle

- Set the stop loss a few pips below the entry candle

- Set the take profit target at 2x the risk on the stop loss

Sell (Short) Trade Setup Rules

Entry:

- The EMAs should be stacked in the following order:

- 20 EMA: top

- 15 EMA: middle

- 10 EMA: bottom

- Price should come from below the 3 EMAs

- Wait for price to retrace in between the 10 & 15-period EMA

- After retracing between the EMAs, wait for price to close back below the 10 EMA

- Enter a sell market order at the close of the candle

- Set the stop loss a few pips above the entry candle

- Set the take profit target at 2x the risk on the stop loss

Conclusion

Day trading strategies that are done on trending markets tend to be higher probability strategies. The key though is to correctly identify if the market is trending or not. The EMAs are just a tool to identify a trending market, but you must put more weight on your own judgement based on how price is behaving and how the market structure looks on the chart.

There will be times when you will be having multiple trades on a single trend. The two samples on the buy trade setups have two to three probable entries on it on a single trend.

However, there will also be times when the trend is too strong, the retracements wouldn’t reach the area between the 10 & 15 EMAs. The first sell sample had two more retracements that didn’t retrace in between the 10 & 15 EMAs. You could err towards the side of safety and avoid taking those types of trades, or as you get a feel of how the markets behave you could be more aggressive and take trades that haven’t fully complied with our retracement rules. Anyway, these types of retracements are more of a pause on the trend rather than a full price retracement. It tends to have more momentum behind it but stop loss placement would be a bit tricky because price might still retrace a bit further.

Lastly, you should also get a feel if the market is already too overextended and might soon be reversing. Some traders try to milk every possible trade out of a trend while others take only the first few trades. Some just have quite the intuition on when to stop. This would be up to you though.

Use this strategy on the correct market environment and you will surely be making money out of it.