skrimon

Active Member

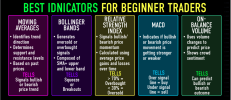

ON-BALANCE VOLUME ( OVB ) IS:

On-balance volume (OBV) is a momentum indicator for technical trading that uses the flow of volume to predict price changes. The theory behind OBV is that institutional investors are smarter than retail investors, who aren't as knowledgeable. When mutual funds and pension funds start to buy a stock that individual investors are selling, the volume may go up even though the price stays about the same. Eventually, the amount sold makes the price go up. At that point, investors with more money start to sell, and investors with less money start to buy.

MOVING AVERAGE IS:

A moving average helps cut down the amount of noise on a price chart. Look at the direction of the moving average to get a basic idea of which way the price is moving. If it is angled up, the price is moving up (or was recently) overall; angled down, and the price is moving down overall; moving sideways, and the price is likely in a range.A moving average can also act as support or resistance

RELATIVE STRENGTH INDEX IS:

The relative strength index (RSI) is a technical analysis momentum indicator. The RSI examines the speed and magnitude of the pair's recent price swings to determine if the pair's price is overvalued or undervalued. It can also indicate couples that are ripe for a trend reversal or price correction. It can tell you when to buy and sell. The RSI is represented as an oscillator (a line graph) with a scale of 0 to 100. Historically, an RSI reading of 70 or higher indicates an overbought condition. A number of 30 or less suggests that the market is oversold.

BOLLINGER BANDS ARE:

Bollinger Bands are a type of technical analysis used by traders to plot trend lines that are two standard deviations apart from a security's simple moving average price. The objective is to assist traders in determining whether to enter or quit a position by identifying overbought or oversold conditions. Bollinger Bands were invented by John Bollinger . Bollinger Bands aid by indicating fluctuations in volatility. For usually constant ranges of a security, such as many currency pairs, Bollinger Bands operate as relatively unambiguous signals for buying and selling

MOVING AVERAGE CONVERGENCE DIVERGENCE( MACD ) IS:

The MACD indicator is based on a simple premise. It computes the difference between the 26-day and 12-day exponential moving averages of an instrument ( EMA ). Both moving averages employ the closing prices of the period being measured to calculate their values. A nine-period EMA of the MACD is also plotted on the MACD chart. This line is known as the signal line, and it serves as a trigger for buy and sell decisions. The MACD is the "faster" line because the points shown move quicker than the signal line, which is the "slower" line.