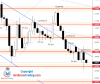

Eurusd bearEURUSD had bull run just in few four hour sessions where the price have reached resistance level.

That level is hard to break up and price formed two bearish Pinbar.

Daily time frame is showing bearish Pinbar. All those signals suggest we could see price moving down to the range area support level.

View attachment 7943

Permission errors

- Permission 'viewOthers' unknown for content type 'node' (src/XF/Entity/User.php:1278)

- Permission 'viewOthers' unknown for content type 'node' (src/XF/Entity/User.php:1278)

- Permission 'viewOthers' unknown for content type 'node' (src/XF/Entity/User.php:1278)

- Permission 'viewOthers' unknown for content type 'node' (src/XF/Entity/User.php:1278)

- Permission 'viewOthers' unknown for content type 'node' (src/XF/Entity/User.php:1278)

- Permission 'viewOthers' unknown for content type 'node' (src/XF/Entity/User.php:1278)

Top Forex Forum | Get Forex Trading Strategies & Feeds | Forex Forum

This is a sample guest message. Register a free account today to become a member! Once signed in, you'll be able to participate on this site by adding your own topics and posts, as well as connect with other members through your own private inbox!

General EURUSD Chart Analysis

- Thread starter Frano Grgić

- Start date

Members Online

- eduardotameiraopires@gmai

- guty88

- Wkw888

- Thanawat

- FxTeen

- Molisticfx

- Rjha76525

- zazzyfx

- gwara

- bradnich

- AZZONAD

- luneducar

- Lukman818

- ash998@

- visaandmigration

- riverviewabbey

- mosila21

- cdboy11

- hmidovic

- NanouFX

- Arnata

- devontebrown11

- Ezzi

- ajnabifree73

- Roets

- crypt0b0tt3r

- hjbasdclibSDV

- Mosaghosty05

- Taimoor Pal

- AdrianBi189

- sulay

- drdre9414

- peladozeta

- ROJASFX

- rdeena

- Bornest

- kangoroo

- kaboomjed

- SyedGhayoorAhmed

- becol

- Gathem24s

- icolumna

- rnsbp

- wisdad

- Shaka-ZA

- manou1993

- jacopo

- yogik

- dekekker

- isdory