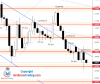

Eurusd bearEURUSD had bull run just in few four hour sessions where the price have reached resistance level.

That level is hard to break up and price formed two bearish Pinbar.

Daily time frame is showing bearish Pinbar. All those signals suggest we could see price moving down to the range area support level.

View attachment 7943

Permission errors

- Permission 'viewOthers' unknown for content type 'node' (src/XF/Entity/User.php:1278)

- Permission 'viewOthers' unknown for content type 'node' (src/XF/Entity/User.php:1278)

- Permission 'viewOthers' unknown for content type 'node' (src/XF/Entity/User.php:1278)

- Permission 'viewOthers' unknown for content type 'node' (src/XF/Entity/User.php:1278)

- Permission 'viewOthers' unknown for content type 'node' (src/XF/Entity/User.php:1278)

- Permission 'viewOthers' unknown for content type 'node' (src/XF/Entity/User.php:1278)

Top Forex Forum | Get Forex Trading Strategies & Feeds | Forex Forum

This is a sample guest message. Register a free account today to become a member! Once signed in, you'll be able to participate on this site by adding your own topics and posts, as well as connect with other members through your own private inbox!

General EURUSD Chart Analysis

- Thread starter Frano Grgić

- Start date

Members Online

- akash1012

- Zero21

- leecadre

- Nelsonpaul2002

- drhmhm

- fire1001

- pit84

- Huncho

- yemiodamo

- houssemgbz

- yennefer

- silentpips

- Bob

- Vasile Sebastian

- Olja

- skorokhod

- daxxer

- Cassey

- sobha

- Kishor

- fxstreet

- extime86

- Louis Chan Chui

- Arvind Kumar

- Ash201922

- Ahmed Mohamed

- Albi Forex

- Dante_s

- ABDOU DJALIL Boukari

- Midofxpro

- Leandro Goncalves

- davit1987

- eugene

- edcarlosmaia

- Mweneni Kamati

- Ronnie

- McKim MDK

- Chu Long Wai

- LEE CHANG SENG

- mATHEW

- Issac

- Pepe

- Angel Francisco Fernandez

- wolterjay

- Marcos Pimentell

- Marcelo Rodrigo Maggi

- Aklib

- Mr Kay

- dunggym

- mahmoud

- shariph17

- Senami Ajose

- Nai Captain

- ericson

- SURESH BABU SATHUPATI

- Firdaus

- Piotr

- ardel santos

- JB Rolim

- jeerus007

- vishal babaria

- jayamal85

- Gizi

- Rhu

- dd mazlie

- Noak

- Ladyreign31

- Jchang

- kishan

- zygotafx

- sunnyillion

- Boll ser

- Onoff2018

- jlennox

- CARVALHOBRANCO

- ABDELRAHMAN83

- berserkwarg

- turbozas

- tshepo11

- dcansi

- billnunez

- Sky99564947

- hcoscarelli

- tusharpremin

- Seiya44

- kiva1212

- ekki@75

- sakane

- jacobn

- azri yahya

- zaidsyed

- Red_Pill

- kradev

- hari

- marker123

- xdsaud

- kaveh

- danhnpc

- Kenbim

- paulowiredu

- Aaisha Makrani

- bunghamzah

- citizen

- Setiawan69

- mentus

- nlm

- amime

- Bernard Sokhulu

- gamechill

- welber

- adolfo3000

- Trader34

- Dannyk junior

- maddydee

- Dominil

- richman

- frodo77

- Scott_H

- rafeiollah

- gregfitzy

- zhoulz38

- shivagorasa

- Csabi

- ppiquet

- ahindal

- AvaDavies

- karov57

- pixel

- Marco Antonio

- mitoos

- ndt

- Dean

- romashko3580

- Shadrack98

- sekxerboi

- anpoman

- Miccoli

- achab

- inusuel

- eddystalling

- thorgal

- Ming

- KAY93

- fxtradescbe

- danielsingh9200

- kalixa77

- nrl23105

- ethno911trading

- silent56

- techentrant

- Eajaz

- novinahan

- celebration

- Tony30039

- Sboniso

- Kani_Foex

- Kwena

- Goodkachi

- kaani33

- sbandrews

- trananh24588

- serbay

- TheRedTrouble

- Aciid33

- thecellio

- tweeter7

- mokhaneli

- waza89

- TONIO76FOREX

- kananeeparimal.asus@gmail

- sunrise

- ofor

- Shane7277

- bestgoal

- Wajafx

- Rennz4312

- Soft daddy

- Ndabat

- testtesttest

- mrafim

- dezrael

- linpa

- Nkosikuhle

- Relebohile

- GLENNFX

- Barnie

- Blue trades fx

- Ghost-blaq

- maxbibi88

- calva

- ZANEDUNU

- Oratile99

- Mnyabi89

- PRP Vijaay

- rwhite79

- sunny95

- bitxpower

- KingRomeoRsa

- Tboss

- ishtiaqshafiq

- jamie

- Sally

- Collin8sinswa

- Sheldon.D

- Nayxy

- 81h4456

- PrinciplezSA

- mohamedz87

- jagarcia200

- Gomsh

- MOHAMMED TOUFICK ISSAH

- KombatKate

- esam.binava

- Deusa

- Speciegraphics

- nachat

- pipshunter6519

- takhisys

- mode555

- Nkocy199

- Vino

- Lebo950410

- Favouribe98

- Cobija

- cashgenerator

- Paulo.moreira

- jhordie

- warrenwwx

- Lilyfid

- EsmeRalda

- Richard Motaung

- digi

- monemon

- mlyk1234

- Jboibest

- Deon

- kondo1991

- 1665509

- Tobbyx

- Asanka1234

- aandrianto

- suresh444

- nordestinonato

- Moshi

- cerucci

- zxcvqt

- Joshtriple

- andregds85

- sajith

- elpro

- ejanyanwu

- Zavian123

- Alex123

- Sammycool

- Boipelo

- javyiii

- Sbonelo_20

- Monster

- artanec

- Naviystiles

- mactron

- arif369

- jaycash

- RsMunyai

- Machaile

- Rimvydas

- Tonde

- Simphiwe#1996

- conclauz

- popular20501

- TAQFX

- Mosyo

- markuyen

- Tony Apxfx

- Billycaine

- amat

- Lupembe92

- edson guerreiro duarte

- Salomoner

- rodrigolivei

- Paulisko

- Kwazi 4031

- Al3jmi222

- br3k3l3x

- Jclick

- Alphaco

- mohit dutt

- bayuveneo

- Thalifho

- giscardh

- Samrant

- prashanth861

- marcociencias

- Square007

- weyewer168

- olduz

- winter11

- hossein681

- Sarpong

- Dixielafx

- rennauzo

- Bee Charles

- Olley

- NYASHA MUHWAHWATI

- Katfloyd

- roniyuda1

- mikailhalil

- Shafeek

- budsan2020

- Bongz2

- alwdt

- Jonykruger

- seisaku saito

- Ajith

- cascintia

- andrew4119

- mullar

- nabinoor

- Tompans

- ekif212

- mknazmknaz

- Synthia

- TraderGuru89

- jan.jsp

- DeeDee

- Fernando617

- ronpa

- rajapoetan

- Okekejerry

- zakt

- alpha0099856

- elnino`

- megsiboy

- Lemarck777

- hraza133

- Molf

- Arthurgrand

- Pirie

- Zip

- maverick080

- ICT_player

- fxboi

- Luyas

- BraOT

- jhonatalor

- Lee071

- darcy9999999

- Geert

- Kartso

- Jasonn

- mrnupe1911

- Mohamadfayaz

- JanoZ

- meep

- squish2010

- Tshoarelo Tau

- itfreak777

- thabokota

- Kidwest

- Pk_Mohanoe

- Sam227

- hiphpc

- raminspgc

- ForexFund

- Politem

- jeaw

- Aka

- Bharath vnk

- Max_ alegbe

- Seaphor

- charles2001

- Jaysan 69

- Alexdzu

- Maseloanecaleb

- marktaylorza77

- elbo

- fauzibakti

- Byekas

- santo09

- davideus118

- Mashoto_Madira

- mokoena

- Sim

- Mavusane

- snozar

- calixte

- yogi rachma

- charlyemes

- Peterwale

- ALAE13

- 789012345

- hein8010

- abu husam

- Ishmael 12

- Nnqo

- folou22

- RONNY18

- falebtoosure

- ragnarook

- guiainversiones

- Michaelvn

- Mashka

- Farrell-WP

- Mohau Kedamile

- coderboi

- Buggy

- bambo

- Grandkai07

- Baila

- Hlonibless016

- albermunir

- angga98

- Mathye2000

- basenombuso

- crack

- kphil

- Kelebogile Sehoa

- Simeonqwwee7

- Golden Boy

- jimbobule

- ZEUS123

- DuncanMaster

- cabilla

- TheBoiMedusi

- tarek fathi

- andsg94

- SuneBasun

- Avumile

- Rebone sekwati

- jameslaw

- MrChuck88

- derek2209

- Sule

- Jazz T

- khanhnguyen93

- Freddy_trade

- chamb37

- Poordevil

- amjed2222

- lamartinepereira555@gmail

- krol

- OneNeo

- korol

- angelhfbyesfyueyuebf

- OdysuessTHEII

- 8427111

- Asanuma

- JuniorJay05

- bolali

- fahadibr

- Kabee2544

- Anggors

- geferenc

- Miguelsqa

- malosi

- mahiar0099

- waheed.surrani

- Cent

- starmild

- Agape

- KELVIN KING

- IvanFx89

- shukrifibo94

- johnbazfeargod

- akimfauzi22

- anakmonster

- holandec

- kashifali6517qalandr@gmai

- EdwinB

- Motlakase

- f7ztrader

- Lindsay247

- Romeo552T

- Sbonelo_alexkid

- Shizniz

- Bobfrank3

- jnchris

- tranthai

- Alfaone

- Zolile123

- ThandoOkuhle

- thejackkkk

- far1212

- ALITHEBOY

- DineoMaruma

- lih

- asadgaciye

- Wayne102

- antonsaja

- Herrella

- Sanjaykeith

- rare01

- metall

- Tlhomamo

- simon77

- mwelase

- Uche@001

- YabberF

- Deanzwana

- Thokozane

- pollo

- Space Canteena

- Empire

- Lukmanz

- Chantznc

- Ufuos

- samanmax

- BoShumal

- Tshepo molosiwa

- silver6crew

- Nkosinathi21

- lawrence01

- Mikey1662

- mustafa1980

- Pipadox

- nikonikoniko

- Aeonn

- Nkingho

- Skyper21

- widowadas

- iamsimsonfdo

- cryptoexchanger

- Ankur4everbullish

- michaes

- sapater0

- Harry Fakri

- Star kaay

- satyamap

- khufunocap

- Oremane

- Unruly Vex

- zaharaia

- Thuso123

- phuongnguyen2008

- mdsaykatfx1

- Productif29

- richoney2020

- aropman

- rieruu

- Unarine dokotela

- dr sushil malik

- Fargosgrandson

- Hojo168

- johnpaul Okpere

- SFIDISH

- yhdbgef5465

- digizzz

- elydreams

- mmahlaola

- Leonic

- tuanvu1982

- KrakyeKoby

- S"PHEPHELO

- pumlley

- Khethi

- dhmsmaulana

- Vatsyk

- Xlm

- Nosequiensoy

- Jefres

- goddypaps

- Evidence

- Moredj

- Samizz

- sjjdmrd

- Junz

- Baluk

- Junior Zulu

- Abdulmoss22

- Marcelo Alves Soares

- Farmaster

- EZ12bet

- mtf786

- Mad Max

- Charles2012

- tboi

- Patricioflorexfx

- 123@

- indra87

- Mjuby22

- mrclap

- grimaldy

- skosyrev

- Lol1234

- titox

- patchsegway

- masterfoto

- Morata

- Hungchienle

- Tabber

- Tariq7866

- Matheus barreto

- Dediaw007

- Kweyama

- Moodleygot

- BarryCardenas

- Letta

- Leboo

- samuelhenryx

- Teentitankt

- Phutiane

- mfurukijr

- iCream

- gazsando

- santaclaus

- mvr123

- Anbr

- MZKGOPYANE

- Karabo Handa

- akin12

- gienek8123

- cwgmarkets

- devilino18

- Abnormalkxng

- Khumo Mokgatle

- reyep ascalus

- Fortunejah

- bielaurance

- wallacebin43

- master2501

- pieterd

- tri

- duhnah24

- Vhavha

- razza

- k8ter2much

- Harrice

- jafardousti

- gajen

- Ekaaja

- peter123456

- ichkmlsdr

- FXautomateEA

- zobo bona

- RAMA28

- bhoss007

- ummimemo

- 0018razanajatovo

- iamsahebzada

- Anhzaya

- metaforismo

- luuvv

- ftmoo

- ande

- chaito200

- bambal

- gabrosh

- Investfox

- QUAYM

- yuan

- Bary Raj

- chutimachu33

- Tumelo0

- Katss00

- Tester123

- kasunsss

- Geo1510

- Techrobert1

- angeltamang1

- heist

- Mjamba

- thesafe

- rzkheel

- bassem michel

- xinhyahong

- Kpocha

- bolt31

- Naleny

- gabriktm

- andremcr

- Rudrakhya

- bob merveille

- puket32

- ziganalindiwe

- Outis

- ivyshanty

- VitsTada

- svebgntn

- sebek1981

- sjrasmuss

- dunggd

- Mafika

- lime73

- mmovn

- Lyzaramirez17

- yagh67

- Legoh

- charles wamanda

- heyyounotyou12

- topdriver

- susilini98

- prem210

- Thapelo13

- alibaba121

- TheBroker

- fotografpatriklindqvist

- martinsav

- pablos789

- Thelondon

- simplemankim

- Ege

- Jose Pablo

- hazzanjr

- soneroguz

- Conleigh

- EDUARDO_ARH

- italytrading

- botasylum

- karabomnguni

- rajadhiraja

- Demingx

- CristianM

- StonkBender

- GhostBoyykiie

- Mhlengi2005

- Lindokuhle 28

- Elena martin

- hslayal

- Joshkid

- rightfix

- mshika99

- novicetrader

- SGD

- wnck

- Juice263

- Sbong

- Bodytech1231

- Alex1705

- MeganciKoral

- KIDDOFX

- tshediso_fx

- asdasdad

- jhayzha26

- magneto710

- kangoroo

- DAN983

- Leddyadoe

- raufaliyev1988

- okeyaserv

- cleaningbyjen

- forexkosice

- sardella.dav

- lwb503352012

- HATZER

- JOHNCOHRNER

- Johnny Walker

- rhinomaps

- michaelanthonyramos

- Rafaelgarcia

- osnatw

- PropGrow

- Утемис

- chiquinho1973

- kisano

- Mun Feruka

- katbi

- khauta1991

- bulldog

- onlyuch210

- ostwest

- tynoemoosa

- homegWSA

- ihwief

- Wolverinetony

- damro

- rebornx01

- benua

- juniorkazzy17

- Xcrino

- NelMac25

- SJBEE01

- vinhphuoc91

- Kelvin King 007

- TayoFX

- Harisss

- drhanidaudish

- Ramil111111

- jackreverse

- guadalupe

- chudung

- sean_f

- cleopp

- rodq

- poojan

- peter_pan06

- anorousta

- TshepxngMC

- kostassda85

- nandosiick

- ygyg

- xfxfg

- ene99

- esrindia

- Viebk

- Bullfx24

- hansagarten24

- gopolangbw05

- araguaiadeliverymt@gmail.

- krnomxgab3

- nickcoy

- Avelino

- David Biswas

- mariawshier

- danegwu

- Irfankakar2050

- natansebben

- proworld

- Desmondbones

- sunbird65

- nani123

- Topstrikert

- skains

- MMHouston

- itokianaaa

- ggftyf

- KATLEGO MK

- Huge hole

- raajtrader

- Gilberttm

- Harisafedriving

- khnurulbd

- baclavva

- Joker9999

- ahmed4564534

- virtualorigin_2025

- Mikebrown

- VEESION

- delfz

- taha5

- kennedy3

- indicatorfx

- ngirufide

- Free1328

- mohitsangwan2143

- madhappy932

- EdnaTennan

- Jose miguel

- HassieJeff

- BeatrizBra

- KassandraV

- ElsaEberha

- LizetteCli

- cukcuk

- Virgie77C0

- MelisaSutt

- Maximo74A

- EPCKristia

- GiuseppeLo

- AllanBosti

- LesliDowne