Solid ECN

Member

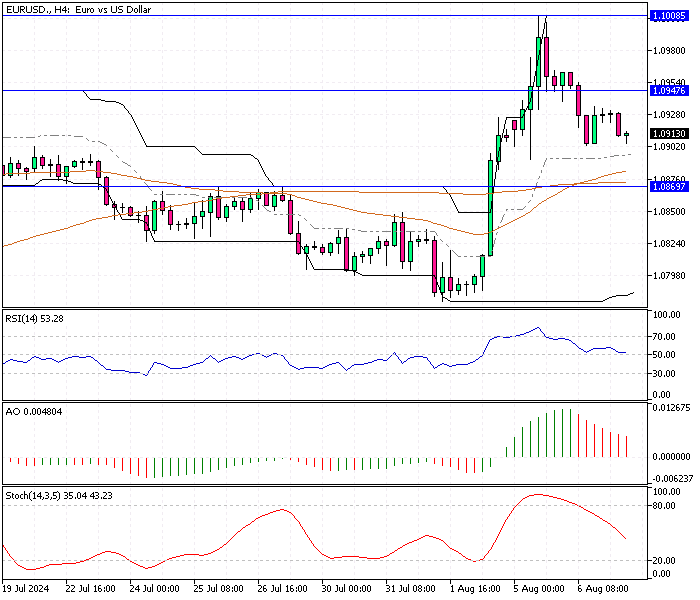

Bearish Trend Expected for EUR/USD

Solid ECN—The EUR/USD price returned from the 50-period simple moving average, and as of writing, the pair trades inside the bearish flag at approximately 1.081. The technical indicators suggest the primary trend is bearish and should resume.

From a technical standpoint, the price will likely test the 1.079 level in today's trading session. If the selling pressure exceeds 1.079, the next supply zone will be the 1.077 mark.

Conversely, the bear market should be invalidated if the EUR/USD price exceeds the key resistance level at 1.086, backed by the 100-period simple moving average.

From a technical standpoint, the price will likely test the 1.079 level in today's trading session. If the selling pressure exceeds 1.079, the next supply zone will be the 1.077 mark.

Conversely, the bear market should be invalidated if the EUR/USD price exceeds the key resistance level at 1.086, backed by the 100-period simple moving average.