Yesterday (1st), the United States announced a sharp decline in the manufacturing index in September, which is a new low point in more than 10 years, making market investors more worried about the impact of Sino-US trade frictions. The US economy is in trouble. After the data is released, it will hit the US stock market. The index has fallen below the important quarterly line, and the gold market has risen sharply by nearly $20. The US ISM's September Purchasing Managers' Index (PMI) fell to 47.8% from 49.1% in August, not only the lowest since June 2009, but also far below the market's original forecast of 50.1%. Below 50 is a sign that the real economy is entering a recession.

After the news was announced, US President Trump immediately attacked the Fed's actions. He pointed out that the reason for the weak US manufacturing data was caused by the Fed's wrong policy to keep interest rates too high. Moreover, the strength of the dollar is also a factor of damage to the US manufacturing industry. Although Trump has been hoping for the Federal Reserve to increase interest rate cuts, it is unclear whether the Federal Reserve will cut interest rates again in the future, because in the September interest rate meeting, Federal Reserve Chairman Powell said that the Fed members (FOMC) has stated that it supports the current interest rate, unless the future data has significantly deteriorated, so this week's non-agricultural data may affect the future interest rate policy.

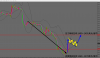

Forex(外汇) - Technical Analysis (Gold XAUUSD):

Today's foreign(外汇) exchange trend gold (October 2) Early in the morning at $1479.1 per ounce, from the technical analysis, the 1-hour level observation coincided with yesterday's (1st) forecast low point turn, the main cause of serious damage to US manufacturing data Under the influence of the decline, the three major indexes of the US stock market have all fallen sharply, which makes the risk aversion rise, so there is a chance to pull back and rise again.

At present, the pressure range above the short-term line is located at 1490~1491 US dollars/ounce. In the downward direction, the initial support range is 1469~1470 USD/oz. The operation mentality is mainly short. The investors who want to enter the market for a short time can consider the price of 1473.5 US dollars. For short-selling to the $1,475/oz range, the MT4 operating stop-loss point can be considered to be set below $1471.5/oz.

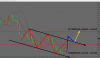

Forex(外汇) - Technical Analysis (EUR/USD EURUSD):

Today's foreign(外汇) exchange trend EUR/USD (October 2) Early in the vicinity of 1.09297, from the technical analysis, the 1-hour level observation is in line with yesterday's (1st) forecast pull back to the lower channel of the decline channel, a sharp rebound, the current trend to break through The upper rail channel, so there is a chance to pull back the correction and then rise again.

At present, the pressure range above the short-term line is located at 1.09600~1.09650, the downward direction, the initial support range is from 1.09150~1.09180, and the operational mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the 1.09230 to 1.09250 range. The MT4 operation stop loss point can be considered to be set below 1.09170.

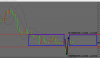

Forex(外汇) - Technical Analysis (GBP/USD GBPUSD):

Today's foreign(外汇) exchange trend GBP/USD (October 2) Early in the vicinity of 1.22887, cut in from technical analysis, 1 hour line level observation trend yesterday (1st), there is a standard bottoming pattern, complete V-shaped reversal strong rising signal Therefore, there is a chance to rise again after the bottoming.

At present, the pressure range above the short-term line is located at 1.23400~1.23450, the downward direction, the initial support range is 1.22600~1.22650, and the operating mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the 1.22777 to 1.22800 range. The MT4 operation stop loss point can be considered to be set below 1.22680.

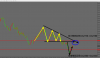

Forex(外汇) - Technical Analysis (NZD/USD NZDUSD):

Today's foreign(外汇) exchange trend NZD/USD (October 2) Early in the vicinity of 0.62381, cut from technical analysis, 1 hour line level observation yesterday (1st) trend in line with the forecast continued to fall after bottoming began to reverse, so there is a chance to be The dollar weakened and pulled back again.

At present, the pressure range above the short-term line is located at 0.62750~0.62780, in the downward direction, the initial support interval is 0.62300~0.62330, and the operating mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the range of 0.62400 to 0.62430. The MT4 operation stop loss point can be considered to be set below 0.62350.

Forex(外汇) - Technical Analysis (Nasdaq Index Nas100):

Today's foreign(外汇) exchange trend Nasdaq (October 2) Early in the morning at around 7692.7, cut from the technical analysis, the 1-hour line level observation trend is in line with yesterday's (1st) forecast, and it is also pulled back by the US Purchasing Managers Index (PMI). ) It is lower than market expectations, and even falls below the 50-point line of the glory and stagnation, which makes heavy selling pressure, so there is a chance to rebound and then fall again.

At present, the pressure range above the short-term line is located at 7760~7770 points, the downward direction, the initial support interval is 7620~7630 points, and the operation mentality is mainly short-term. Investors who want to enter the short-term market may consider buying in the 7715 to 7730 range. In, the MT4 operation stop loss point can be considered to set above the 7755.

Today's key data:

1. Switzerland September CPI monthly rate

2. US ADP employment in September (10,000 people)

3. EIA crude oil inventories (10,000 barrels) from the US to September 27

For more information on Forex(外汇) and MT4, please click here to watch.

After the news was announced, US President Trump immediately attacked the Fed's actions. He pointed out that the reason for the weak US manufacturing data was caused by the Fed's wrong policy to keep interest rates too high. Moreover, the strength of the dollar is also a factor of damage to the US manufacturing industry. Although Trump has been hoping for the Federal Reserve to increase interest rate cuts, it is unclear whether the Federal Reserve will cut interest rates again in the future, because in the September interest rate meeting, Federal Reserve Chairman Powell said that the Fed members (FOMC) has stated that it supports the current interest rate, unless the future data has significantly deteriorated, so this week's non-agricultural data may affect the future interest rate policy.

Forex(外汇) - Technical Analysis (Gold XAUUSD):

Today's foreign(外汇) exchange trend gold (October 2) Early in the morning at $1479.1 per ounce, from the technical analysis, the 1-hour level observation coincided with yesterday's (1st) forecast low point turn, the main cause of serious damage to US manufacturing data Under the influence of the decline, the three major indexes of the US stock market have all fallen sharply, which makes the risk aversion rise, so there is a chance to pull back and rise again.

At present, the pressure range above the short-term line is located at 1490~1491 US dollars/ounce. In the downward direction, the initial support range is 1469~1470 USD/oz. The operation mentality is mainly short. The investors who want to enter the market for a short time can consider the price of 1473.5 US dollars. For short-selling to the $1,475/oz range, the MT4 operating stop-loss point can be considered to be set below $1471.5/oz.

Forex(外汇) - Technical Analysis (EUR/USD EURUSD):

Today's foreign(外汇) exchange trend EUR/USD (October 2) Early in the vicinity of 1.09297, from the technical analysis, the 1-hour level observation is in line with yesterday's (1st) forecast pull back to the lower channel of the decline channel, a sharp rebound, the current trend to break through The upper rail channel, so there is a chance to pull back the correction and then rise again.

At present, the pressure range above the short-term line is located at 1.09600~1.09650, the downward direction, the initial support range is from 1.09150~1.09180, and the operational mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the 1.09230 to 1.09250 range. The MT4 operation stop loss point can be considered to be set below 1.09170.

Forex(外汇) - Technical Analysis (GBP/USD GBPUSD):

Today's foreign(外汇) exchange trend GBP/USD (October 2) Early in the vicinity of 1.22887, cut in from technical analysis, 1 hour line level observation trend yesterday (1st), there is a standard bottoming pattern, complete V-shaped reversal strong rising signal Therefore, there is a chance to rise again after the bottoming.

At present, the pressure range above the short-term line is located at 1.23400~1.23450, the downward direction, the initial support range is 1.22600~1.22650, and the operating mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the 1.22777 to 1.22800 range. The MT4 operation stop loss point can be considered to be set below 1.22680.

Forex(外汇) - Technical Analysis (NZD/USD NZDUSD):

Today's foreign(外汇) exchange trend NZD/USD (October 2) Early in the vicinity of 0.62381, cut from technical analysis, 1 hour line level observation yesterday (1st) trend in line with the forecast continued to fall after bottoming began to reverse, so there is a chance to be The dollar weakened and pulled back again.

At present, the pressure range above the short-term line is located at 0.62750~0.62780, in the downward direction, the initial support interval is 0.62300~0.62330, and the operating mentality is mainly short. Investors who want to enter the market for a short time may consider buying in the range of 0.62400 to 0.62430. The MT4 operation stop loss point can be considered to be set below 0.62350.

Forex(外汇) - Technical Analysis (Nasdaq Index Nas100):

Today's foreign(外汇) exchange trend Nasdaq (October 2) Early in the morning at around 7692.7, cut from the technical analysis, the 1-hour line level observation trend is in line with yesterday's (1st) forecast, and it is also pulled back by the US Purchasing Managers Index (PMI). ) It is lower than market expectations, and even falls below the 50-point line of the glory and stagnation, which makes heavy selling pressure, so there is a chance to rebound and then fall again.

At present, the pressure range above the short-term line is located at 7760~7770 points, the downward direction, the initial support interval is 7620~7630 points, and the operation mentality is mainly short-term. Investors who want to enter the short-term market may consider buying in the 7715 to 7730 range. In, the MT4 operation stop loss point can be considered to set above the 7755.

Today's key data:

1. Switzerland September CPI monthly rate

2. US ADP employment in September (10,000 people)

3. EIA crude oil inventories (10,000 barrels) from the US to September 27

For more information on Forex(外汇) and MT4, please click here to watch.

Last edited by a moderator: