Solid ECN

Member

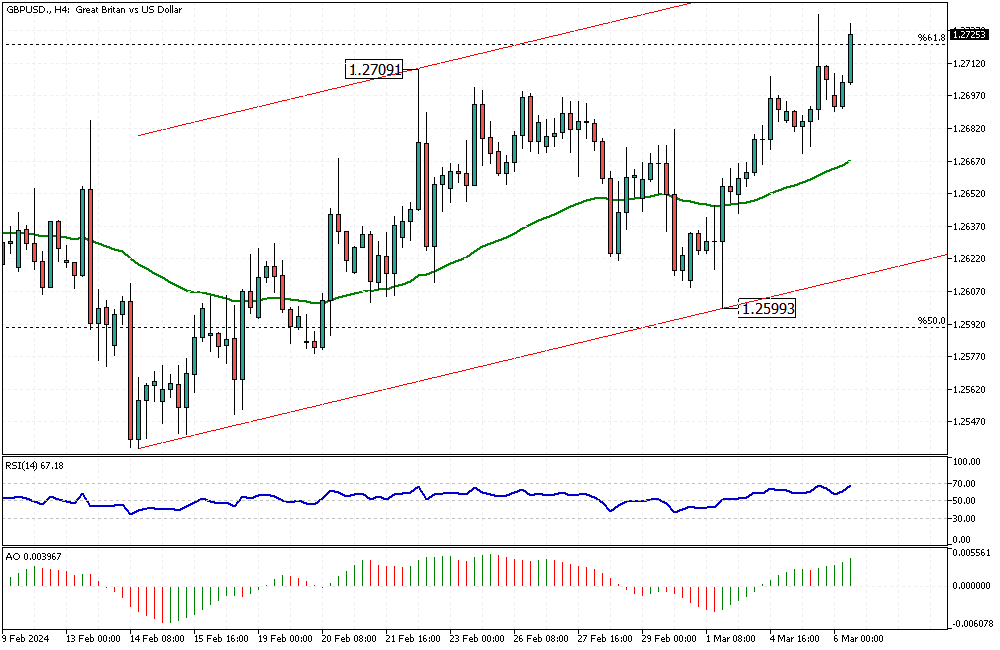

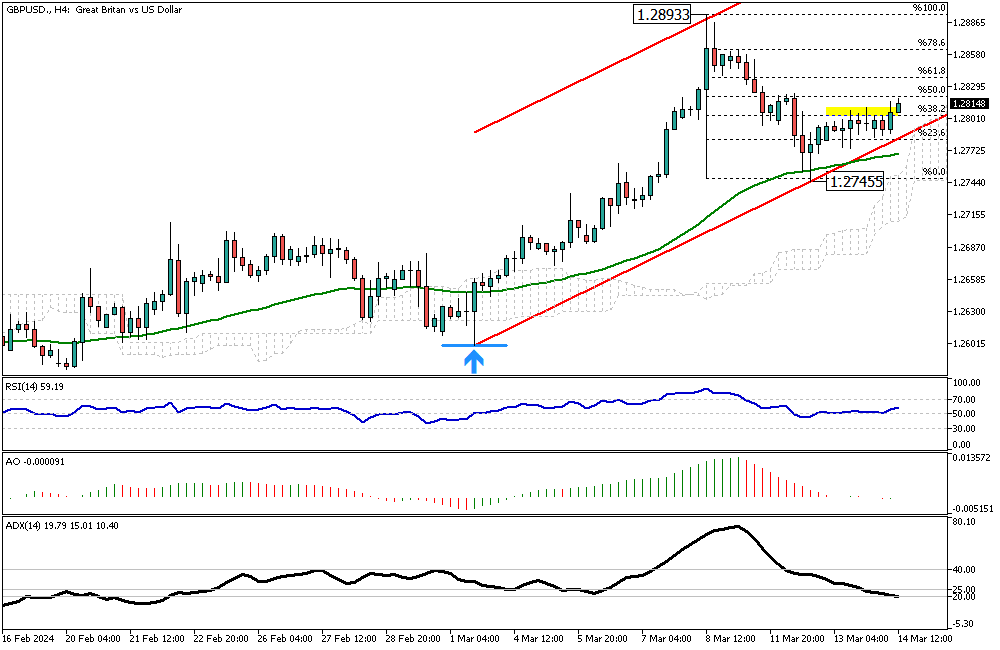

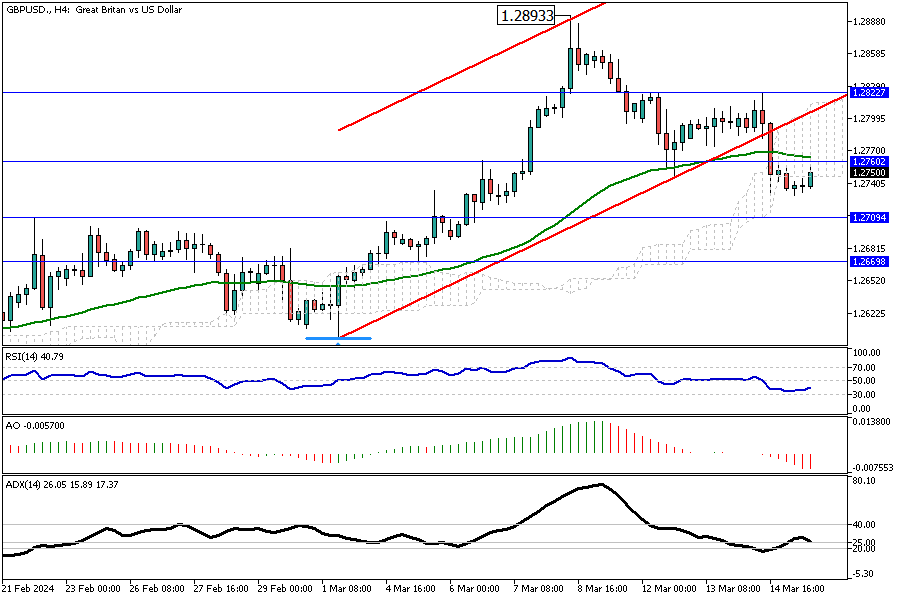

Anticipated Rise of Pound Sterling: A Clear Signal from Technical Indicators

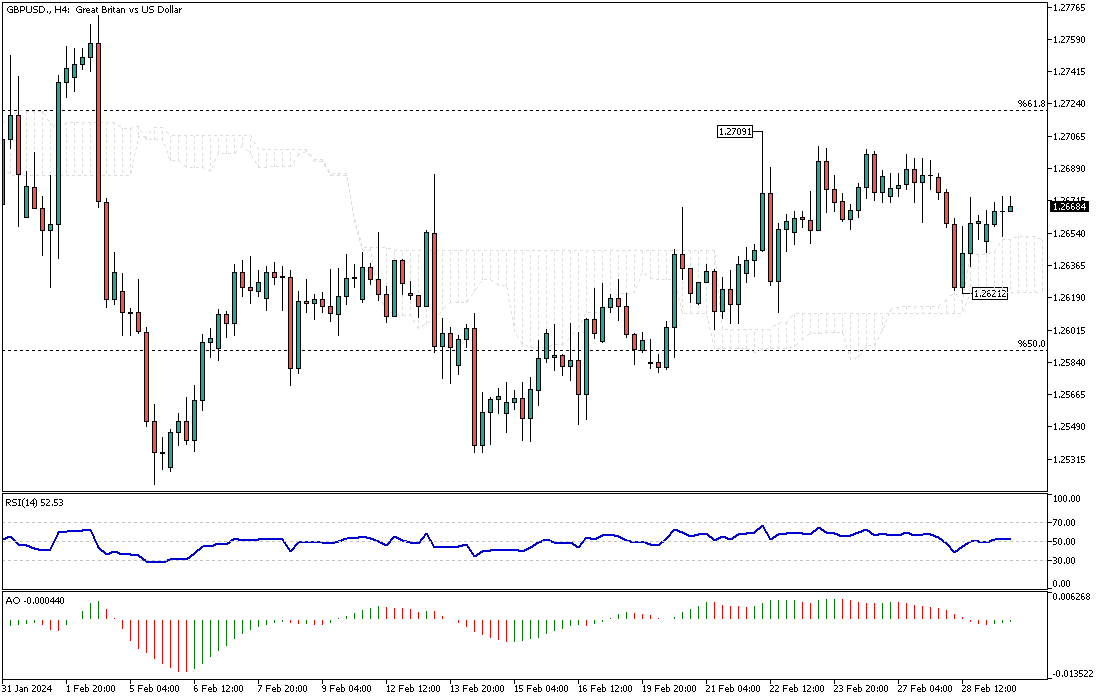

As anticipated, the pound sterling has once again ascended from the resistance zone of the Ichimoku cloud, starting from 1.2621. Today, the technical indicators are providing a more distinct signal. With the RSI flipping above the median line and the appearance of green bars on the awesome oscillator, we can forecast that the bull market will likely expand further.

The first significant milestone for the bulls is reaching the February high of 1.2709. Interestingly, this resistance level is reinforced by the 61.8% Fibonacci retracement, adding to its significance.

However, it's important to note that if the GBPUSD price falls below the cloud, the validity of the bull market could be called into question. This is a crucial point to remember as we monitor market trends.

The first significant milestone for the bulls is reaching the February high of 1.2709. Interestingly, this resistance level is reinforced by the 61.8% Fibonacci retracement, adding to its significance.

However, it's important to note that if the GBPUSD price falls below the cloud, the validity of the bull market could be called into question. This is a crucial point to remember as we monitor market trends.