Vlad RF

Well-Known Member

Basket Trading: Using Interrelations Between Trading Instruments

Dear Clients and Partners,

In this overview, we will discuss such as trading method as “Basket Trading”. It helps to diversify risks and create a market-neutral trading strategy.

What is Basket Trading?

Basket Trading is a method of trading that uses not just one instrument but a whole bunch (“basket”) of them. For example, instead of trading a single currency, you focus on a set of currencies. Or, instead of trading stocks of one company, you trade a portfolio of several companies in a certain sector.

The most popular way of creating a basket (portfolio) of instruments is finding a group of underpriced instruments, counting on their subsequent growth. The instruments can be stocks, currency pairs, ETFs, etc. A bright example is the portfolio of legendary Warren Buffett: he invests in the most promising stocks.

Basket Trading presumes trading one or several baskets of interrelated instruments. The peculiarity of this method is that it helps to diversify risks and create a market-neutral portfolio that helps you make money regardless of the market conditions and a certain trend. Let us discuss some strategies of Basket Trading.

How to do Basket Trading?

There are two main strategies of Basket Trading: investment (trendy) and market-neutral (arbitrary).

Investment strategy

This is a trend strategy that uses a basket of instruments. It is good for various investment ideas and helps to diversify risks. Instead of investing in one asset, we proportionally divide our capital among several instruments. As a rule, such instruments are interrelated and have similar characteristics.

In the stock market, this means investing in several similar companies instead of just one. For example, you expect stocks in the healthcare sector to grow supported by the fight with the coronavirus. Instead of investing in just one famous company, it will be wiser to put your money in several companies in the sector. This will help to avoid corporate risks – the stocks of one company might get stuck due to some inner reasons while the rest are likely to live up to your expectations.

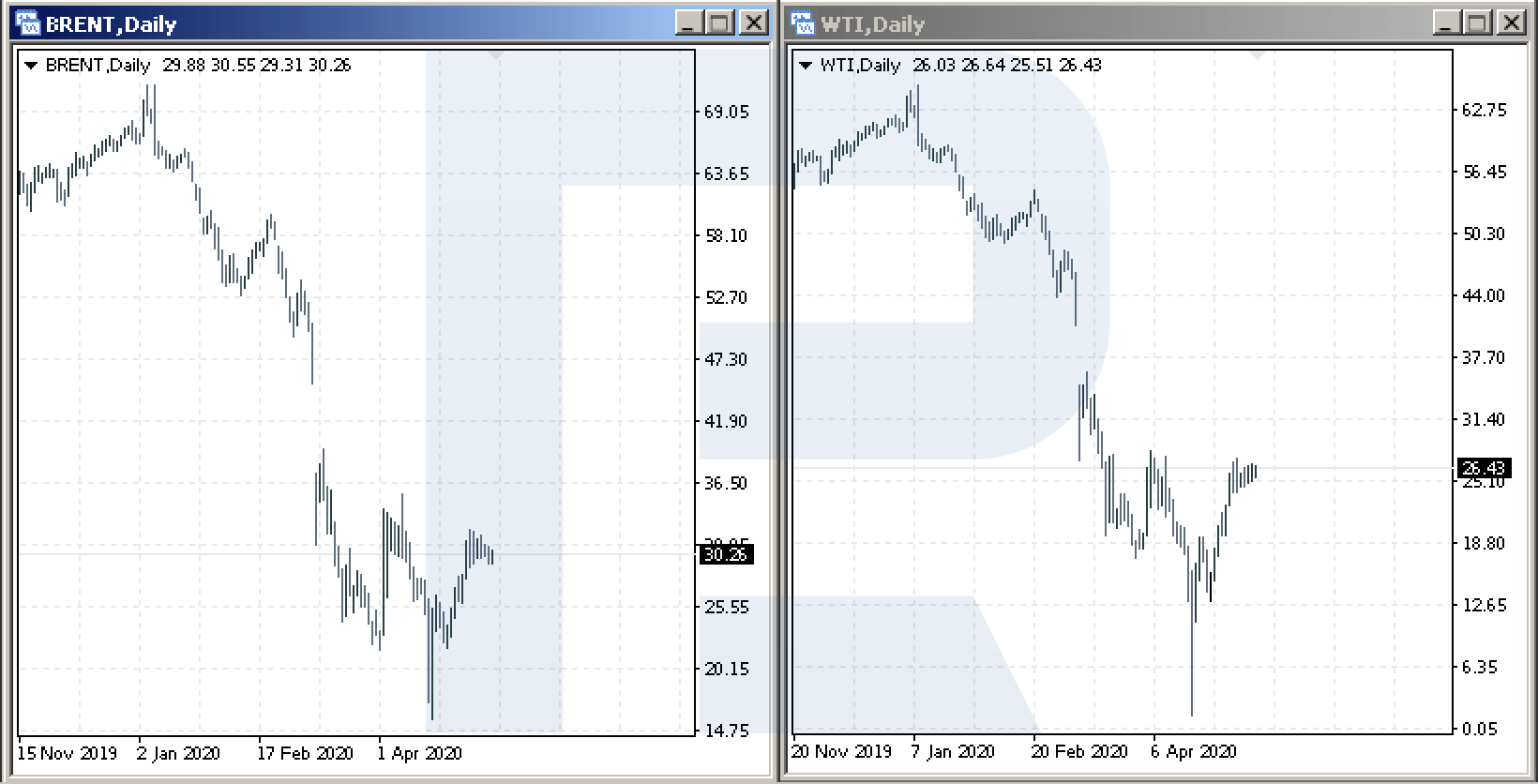

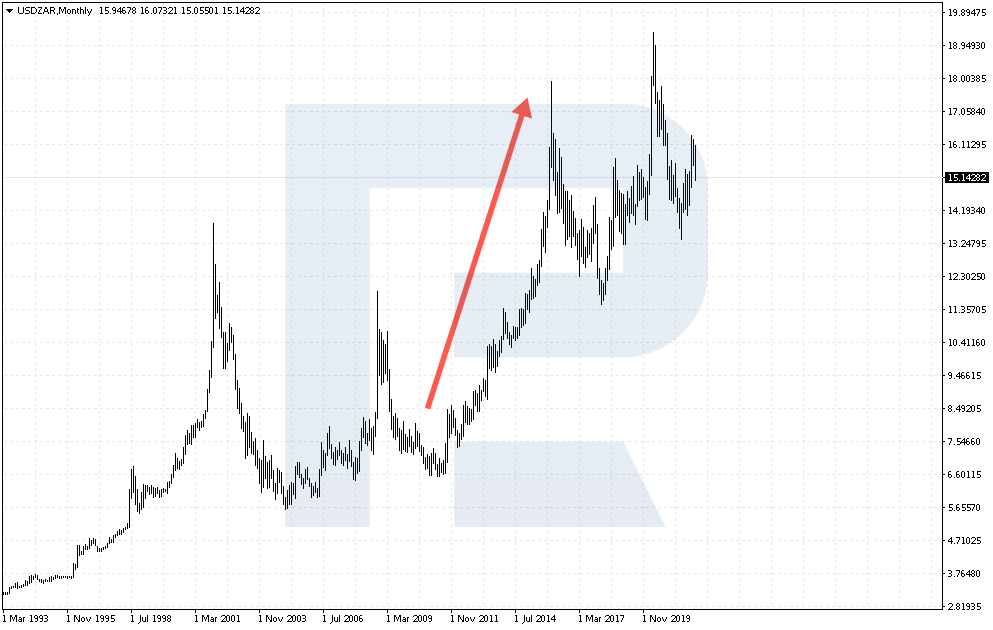

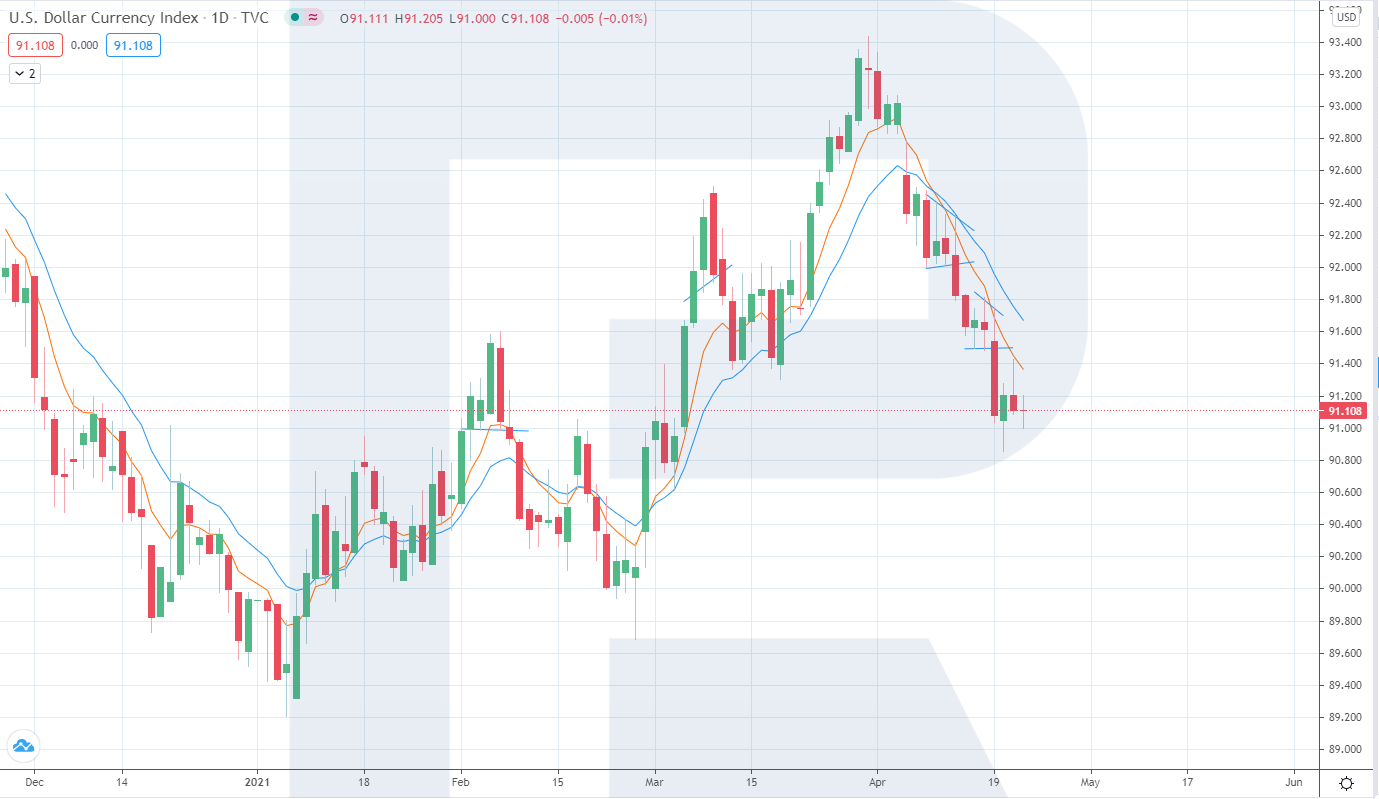

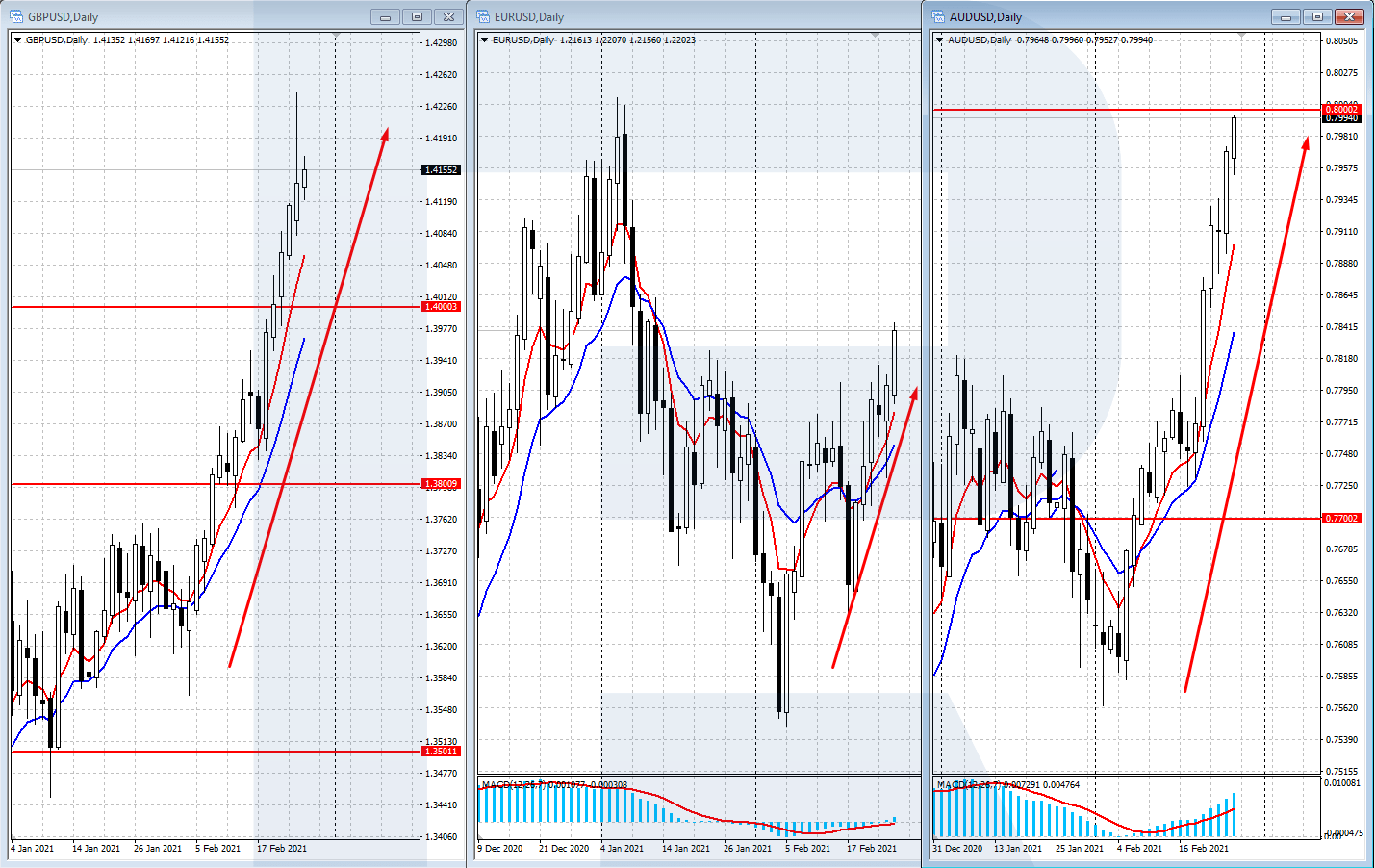

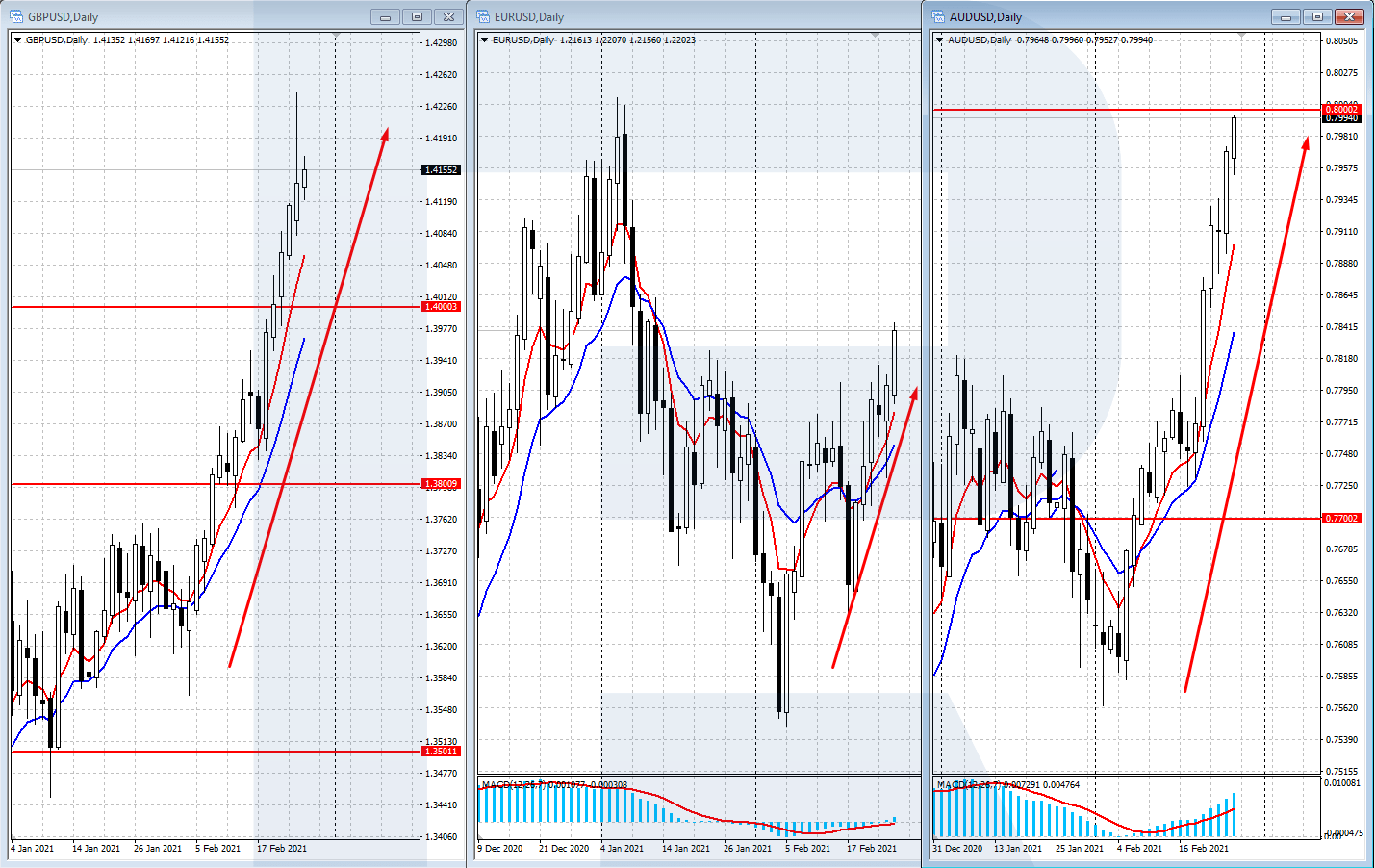

In the currency market, this means trading several currency pairs, not just one. For example, fundamental analysis tells you that the US dollar will be declining in the nearest future. Instead of selling the dollar in just one currency pair (say, with the euro), you can use a basket of several currencies. For example, EURUSD, GBPUSD, AUDUSD (and more) simultaneously. As a result, you decrease the risks of investing in just one currency pair.

Market-neutral strategy

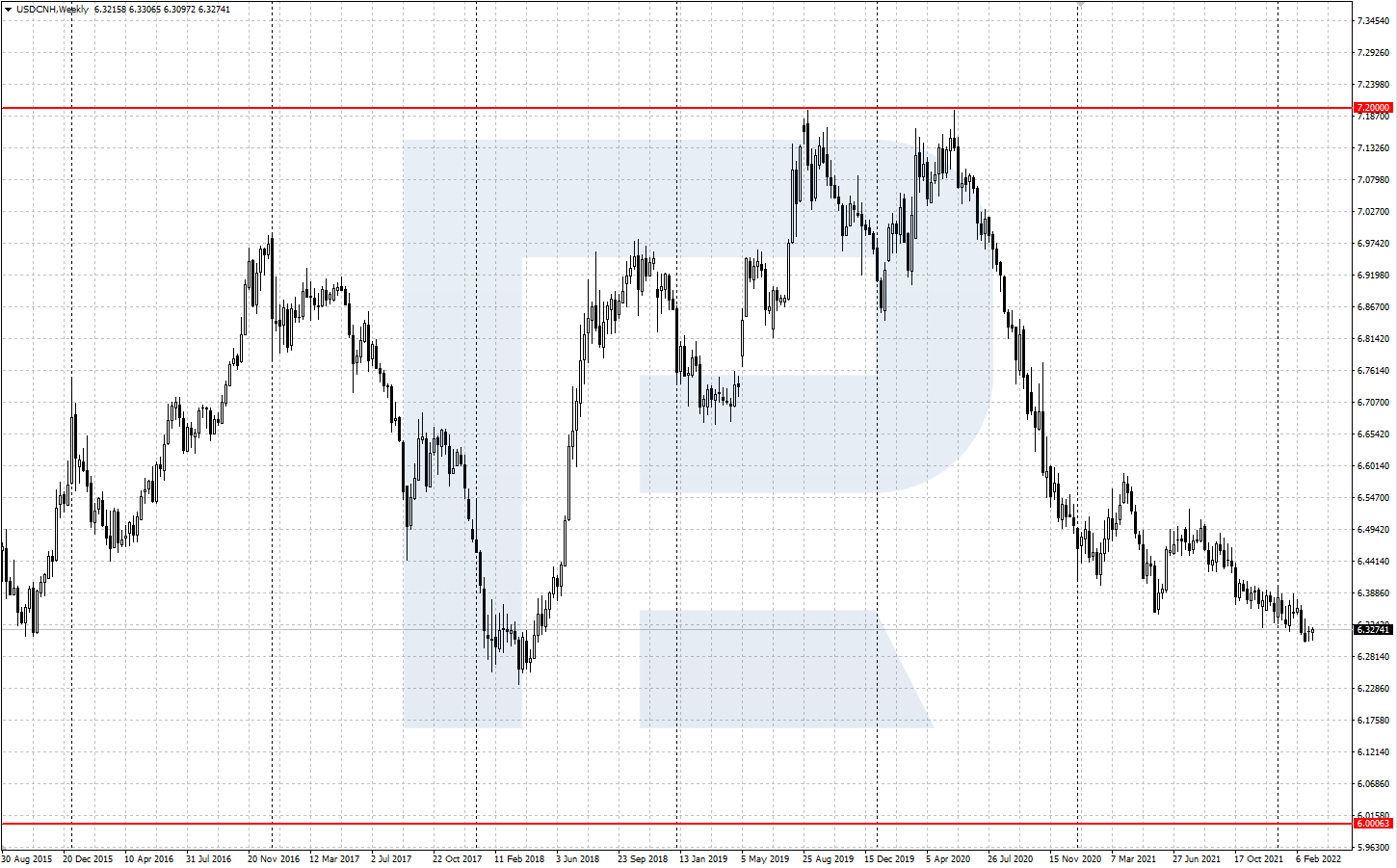

This strategy suggests buying and selling several interrelated instruments at once. The idea of the strategy is to track the difference in the prices of correlating instruments and use deviations of the price from the average to open positions in opposite directions. The hope is that after the deviation, the price will go back to average, bringing you a profit.

In the stock market, you can sell the stocks of several companies that have already shown decent growth and simultaneously buy a corresponding number of the stocks of companies from the same sector that have just started to grow. You expect the stocks that have leaped up will stabilize or even correct a bit while those that are just at the start will catch up; thus you will take the aggregate profit when the price difference of these two baskets decreases.

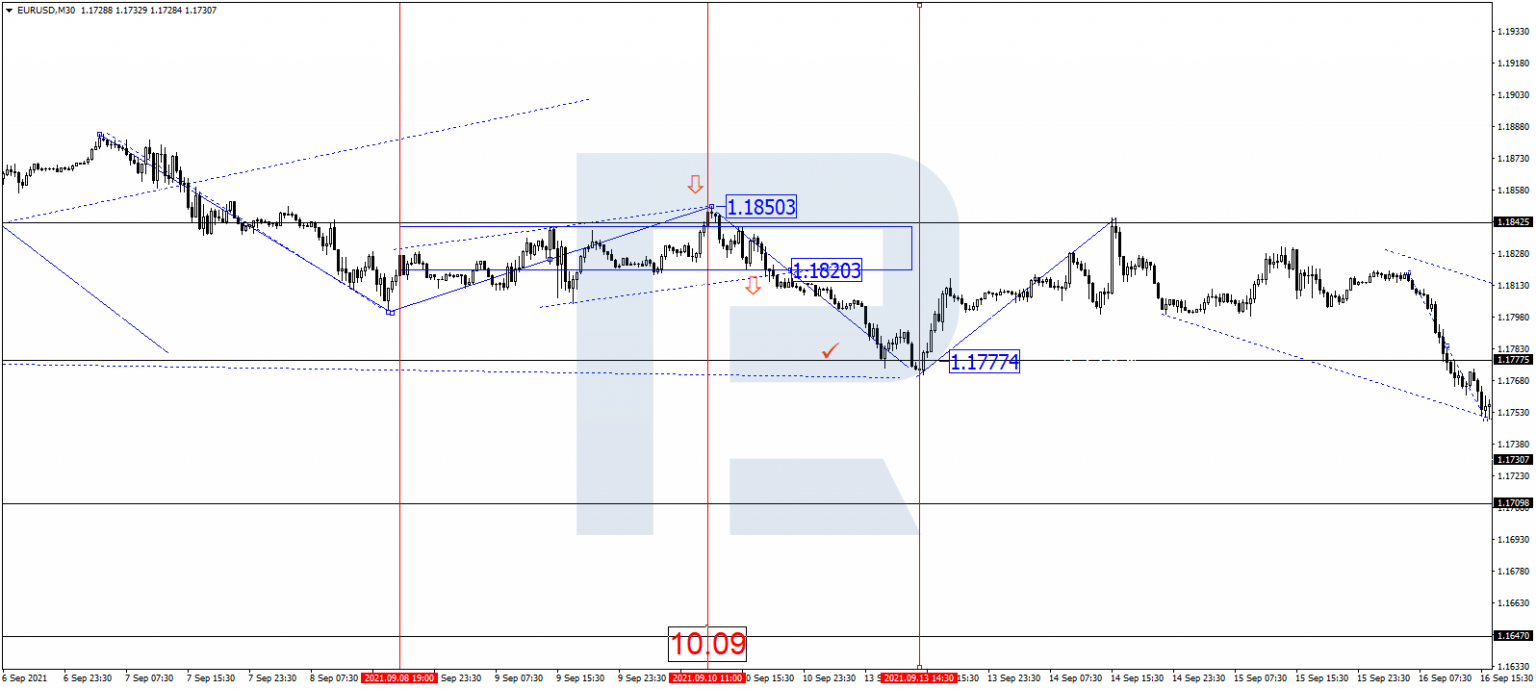

In the currency market, this can be a basket of opposite positions in currency pairs. For example, if the pound has gone down significantly in pairs with other currencies but is expected to grow, you can buy GBPUSD and sell EURUSD and AUDUSD in proportions, corresponding to the price and volatility of the pairs. This makes the positions market-neutral towards the USD.

Advantages and drawbacks of Basket Trading

Like other trading methods, Basket Trading has its advantages and drawbacks.

Advantages

Sincerely,

The RoboForex team

Dear Clients and Partners,

In this overview, we will discuss such as trading method as “Basket Trading”. It helps to diversify risks and create a market-neutral trading strategy.

What is Basket Trading?

Basket Trading is a method of trading that uses not just one instrument but a whole bunch (“basket”) of them. For example, instead of trading a single currency, you focus on a set of currencies. Or, instead of trading stocks of one company, you trade a portfolio of several companies in a certain sector.

The most popular way of creating a basket (portfolio) of instruments is finding a group of underpriced instruments, counting on their subsequent growth. The instruments can be stocks, currency pairs, ETFs, etc. A bright example is the portfolio of legendary Warren Buffett: he invests in the most promising stocks.

Basket Trading presumes trading one or several baskets of interrelated instruments. The peculiarity of this method is that it helps to diversify risks and create a market-neutral portfolio that helps you make money regardless of the market conditions and a certain trend. Let us discuss some strategies of Basket Trading.

How to do Basket Trading?

There are two main strategies of Basket Trading: investment (trendy) and market-neutral (arbitrary).

Investment strategy

This is a trend strategy that uses a basket of instruments. It is good for various investment ideas and helps to diversify risks. Instead of investing in one asset, we proportionally divide our capital among several instruments. As a rule, such instruments are interrelated and have similar characteristics.

In the stock market, this means investing in several similar companies instead of just one. For example, you expect stocks in the healthcare sector to grow supported by the fight with the coronavirus. Instead of investing in just one famous company, it will be wiser to put your money in several companies in the sector. This will help to avoid corporate risks – the stocks of one company might get stuck due to some inner reasons while the rest are likely to live up to your expectations.

In the currency market, this means trading several currency pairs, not just one. For example, fundamental analysis tells you that the US dollar will be declining in the nearest future. Instead of selling the dollar in just one currency pair (say, with the euro), you can use a basket of several currencies. For example, EURUSD, GBPUSD, AUDUSD (and more) simultaneously. As a result, you decrease the risks of investing in just one currency pair.

Market-neutral strategy

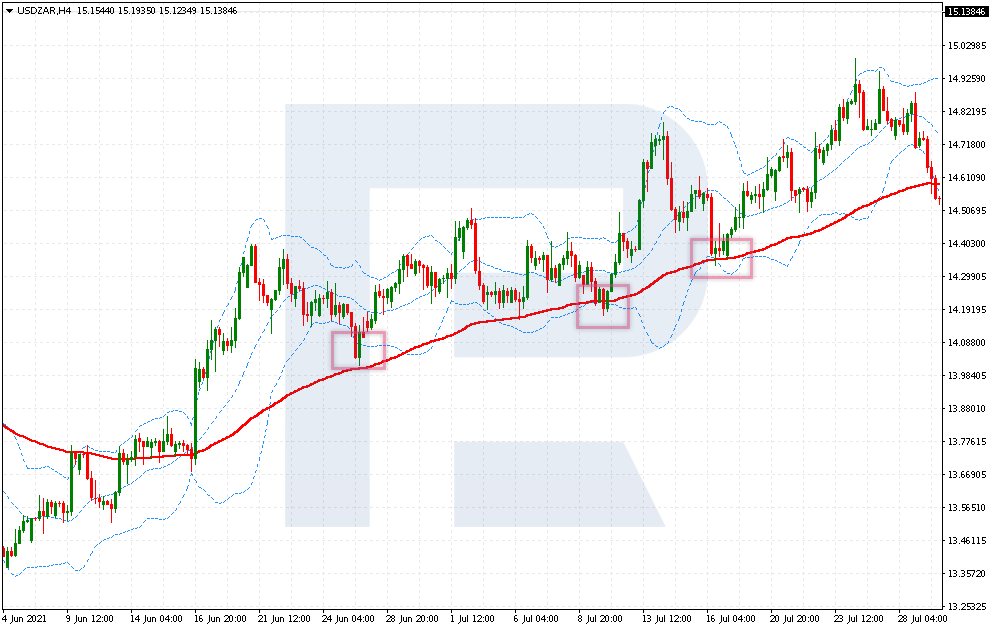

This strategy suggests buying and selling several interrelated instruments at once. The idea of the strategy is to track the difference in the prices of correlating instruments and use deviations of the price from the average to open positions in opposite directions. The hope is that after the deviation, the price will go back to average, bringing you a profit.

In the stock market, you can sell the stocks of several companies that have already shown decent growth and simultaneously buy a corresponding number of the stocks of companies from the same sector that have just started to grow. You expect the stocks that have leaped up will stabilize or even correct a bit while those that are just at the start will catch up; thus you will take the aggregate profit when the price difference of these two baskets decreases.

In the currency market, this can be a basket of opposite positions in currency pairs. For example, if the pound has gone down significantly in pairs with other currencies but is expected to grow, you can buy GBPUSD and sell EURUSD and AUDUSD in proportions, corresponding to the price and volatility of the pairs. This makes the positions market-neutral towards the USD.

Advantages and drawbacks of Basket Trading

Like other trading methods, Basket Trading has its advantages and drawbacks.

Advantages

- Diversification of risks. When we use a basket of instruments, we become less dependent on the dynamics of each of them. If your forecasts are correct, “successful” stocks will pull in tow the “unlucky” ones.

- The use of market-neutral strategies based on the correlation of the assets you use – they are less sensitive to changes in market trends.

- It is suitable for a wide range of assets and markets (Forex, stock, commodities, etc.).

- The method is complicated as you have to keep an eye on several instruments at once.

- Risk increases when something extraordinary happens in the market. Statistical laws and interrelations that worked for you before might cause losses when conditions change.

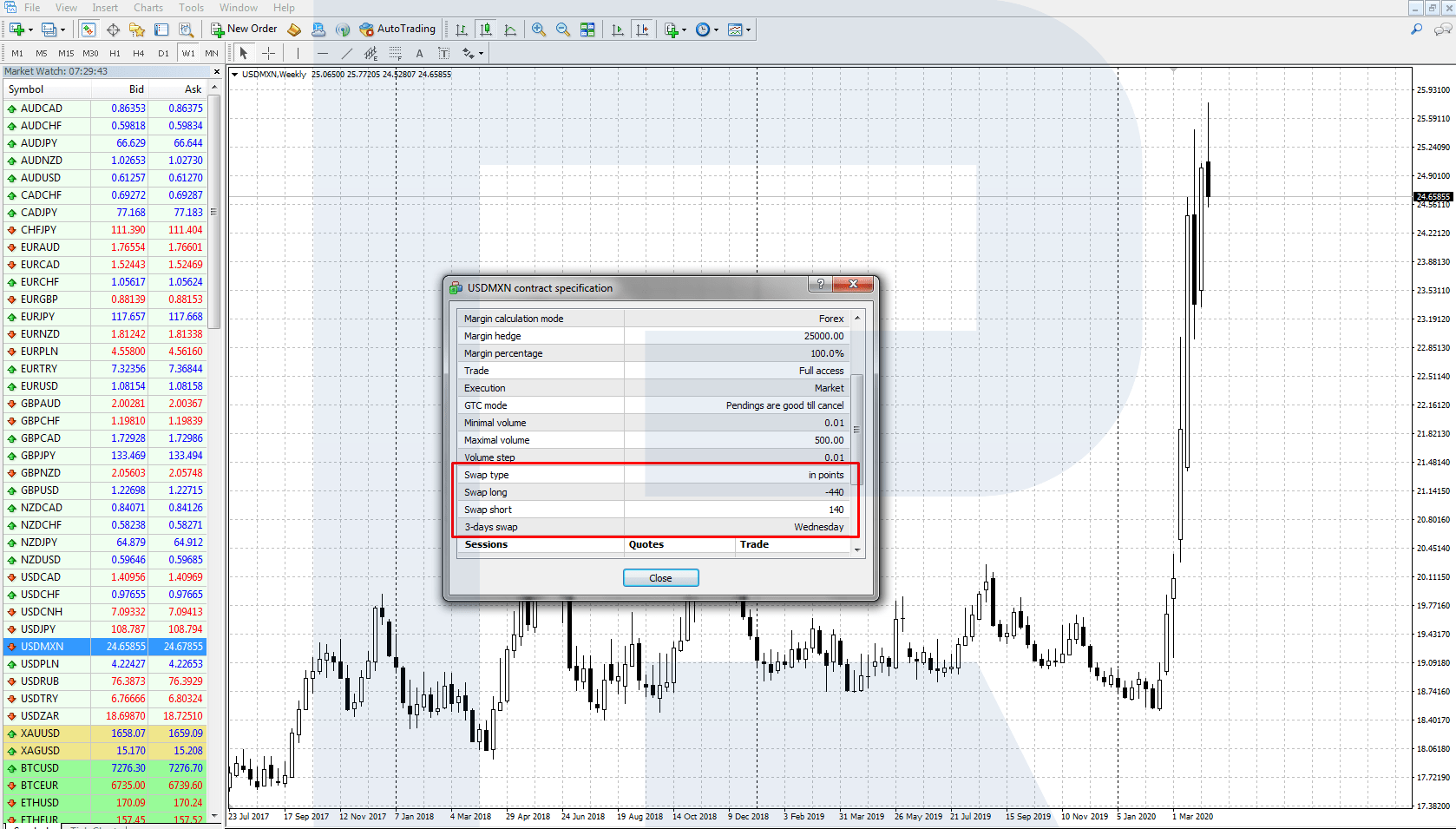

- You need to use some special software (scripts, expert advisors, indicators).

Sincerely,

The RoboForex team