FXOpen Trader

Active Member

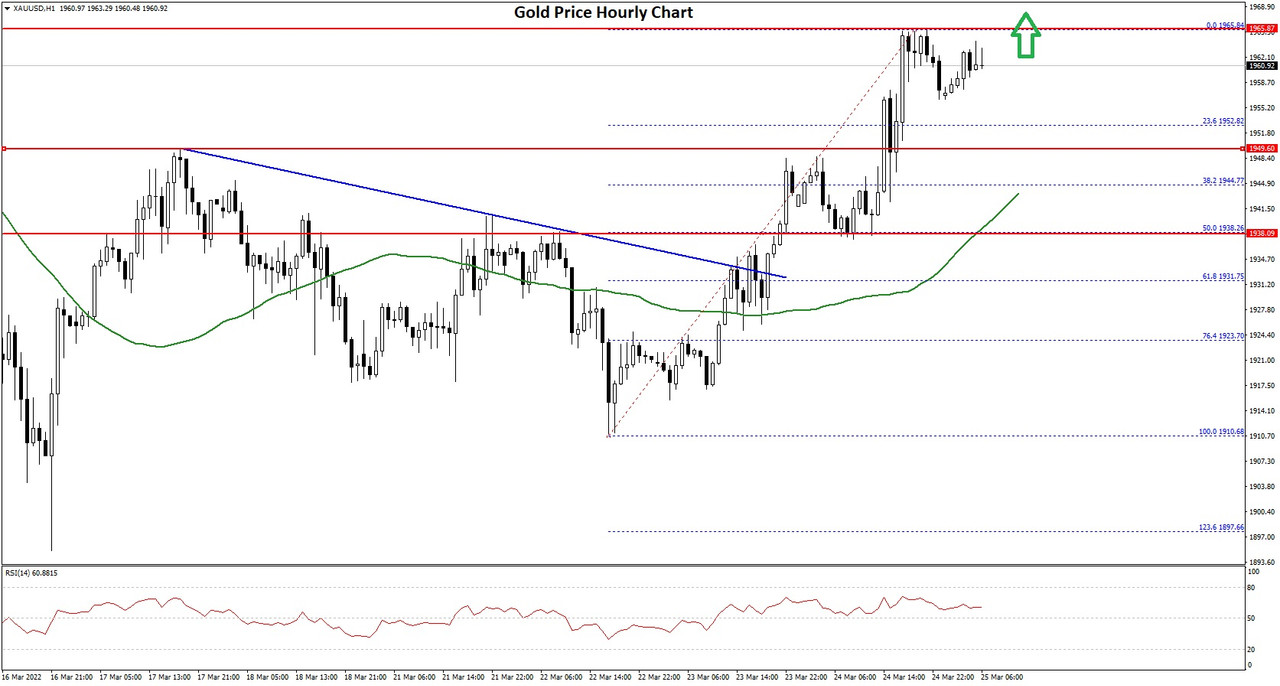

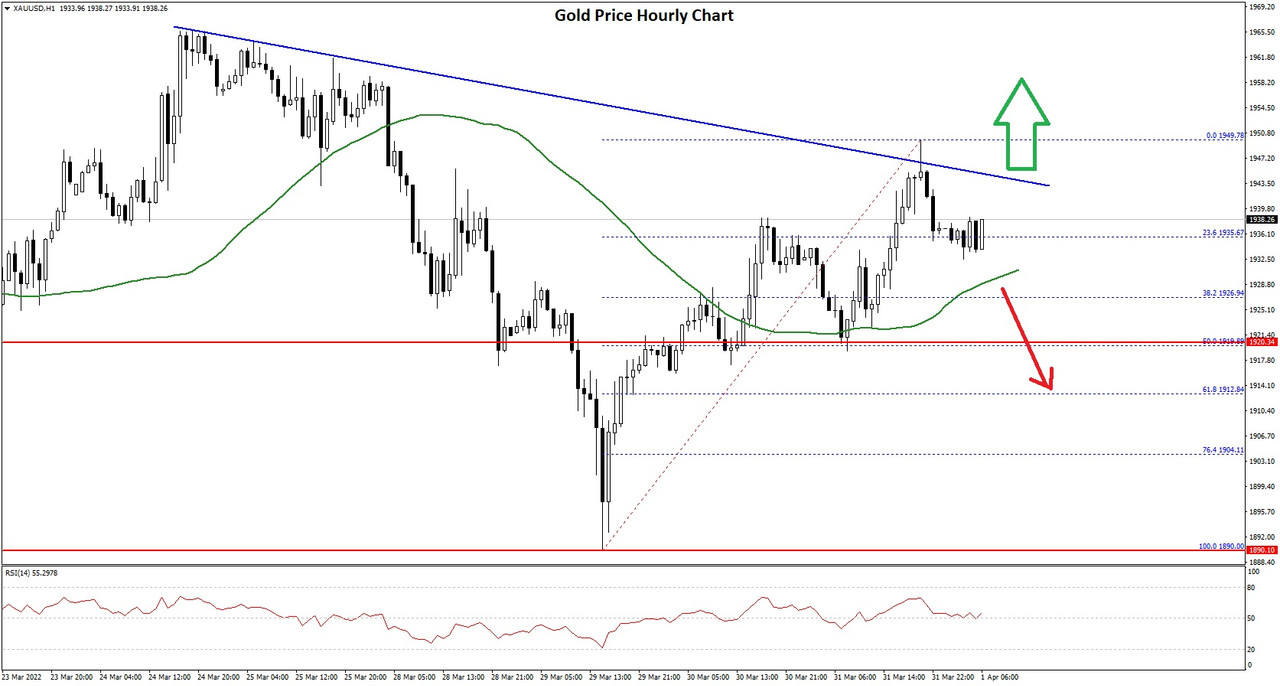

Gold approaching record high as instability fuels switch to physical assets

Ever since the very first items were made from gold over 3,500 years ago in the ancient Egyptian period, this particular precious metal has been held in high esteem as a means of storing a potentially appreciating physical asset.

Throughout the ages, whenever an ancient kingdom came under siege, its population would attempt to accumulate gold.

As time developed, and the industrialization of the world began, gold became a benchmark for investment, and has been constantly regarded as one of the most reliable physical commodities available on the global markets. Even in modern times, when a war occurs, or a political catastrophe, people buy gold.

These past few days have been no exception.

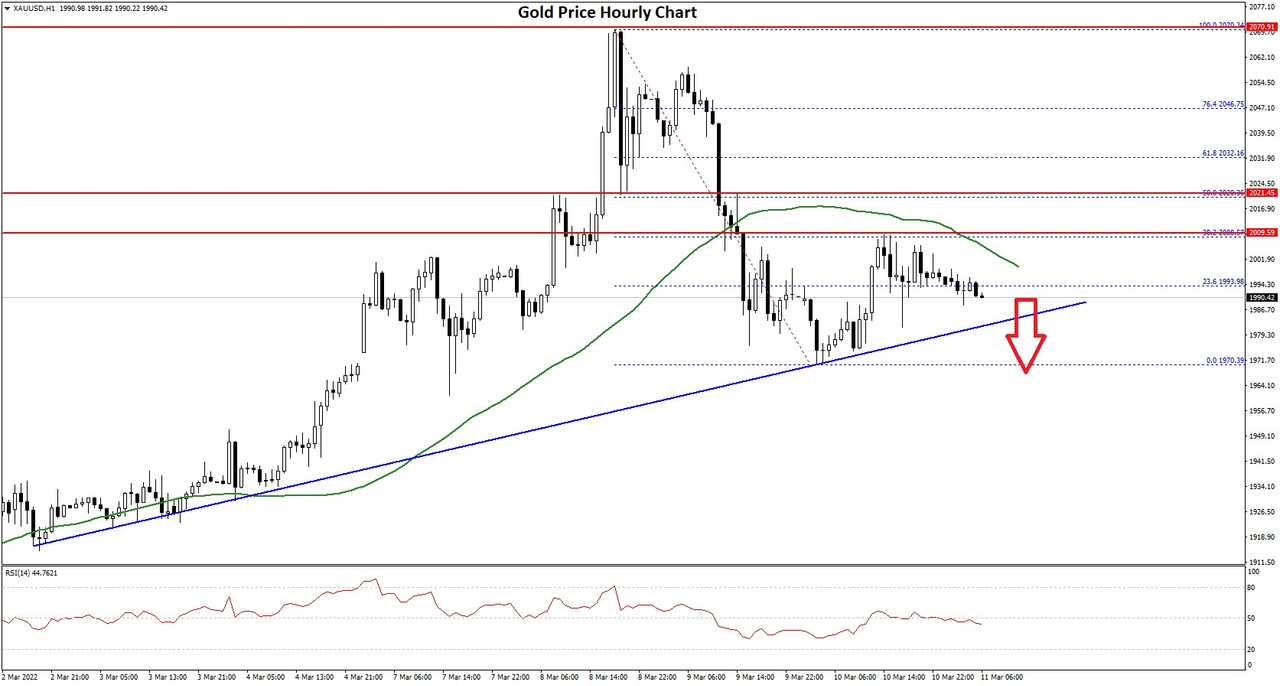

During the course of yesterday (March 8, 2022), gold prices rallied and headed toward an all-time high.

In the United States, by 12.10pm Eastern Standard Time (New York), the trading price of gold had risen by a remarkable 3.5% to $2,068.07 an ounce, which brought it near to its record trading value of $2072.50 which was set in the summer of 2020 during the period in which lockdowns were omnipresent across Europe and America, and fears of losing jobs and private property were widespread.

Those fears are here again, this time fueled by heavy-handed sanctions which are decimating the markets across America and Europe. The US stock market is suffering a tech stock obliteration which is beginning to cause analysts to compare it to the 'dot com' collapse of the early 2000s.

This is a very sudden new direction. Tech stocks were the solid, relatively low-risk investment for most investors and traders all the way from those trading part-time from home, to large hedge funds and wealth managers.

Now, with these in decline, the mainstay of the US economy is being measured and global investors are heading for the hard collateral that is precious metal.

Even nickel, which is used in engineering across most heavy industrial applications worldwide from car manufacturing to construction, has been soaring in price to the extent where pricing has become so difficult in the live market that the London Metal Exchange (LME) has suspended its trading.

One report this morning stated that a Chinese investor is facing losses running into the multi-billion-pound range as a result of the volatility in which nickel soared by as much as 111% to a record $101,365, followed by a two-day increase of up to 250% before falling back to $82,250 a tonne.

The London Metal Exchange has been pricing nickel for over 145 years, and yesterday's volatility was an all time record in the entire trading history of the venue.

Precious metals are therefore in huge demand, and gold is unique in that it is primarily used as a store of value, compared to other high-demand metals like copper and nickel whose primary use is in manufacturing and engineering.

Today, Reuters has explained that one particular futures trader had cited the combination of extremely inflationary energy prices, grain prices and base metal prices has contributed the major underlying support behind gold having increased so much in value.

Certainly investors are hanging onto physical assets, and those metals with an engineering use are rocketing due to the difficulties in obtaining them for factories to be able to meet the demand for their products or remain in business without having to halt production, leaving gold as an outright store of value which is heading for all time highs.

Fascinating market moves brought on by highly well analyzed circumstances.

FXOpen Blog

Ever since the very first items were made from gold over 3,500 years ago in the ancient Egyptian period, this particular precious metal has been held in high esteem as a means of storing a potentially appreciating physical asset.

Throughout the ages, whenever an ancient kingdom came under siege, its population would attempt to accumulate gold.

As time developed, and the industrialization of the world began, gold became a benchmark for investment, and has been constantly regarded as one of the most reliable physical commodities available on the global markets. Even in modern times, when a war occurs, or a political catastrophe, people buy gold.

These past few days have been no exception.

During the course of yesterday (March 8, 2022), gold prices rallied and headed toward an all-time high.

In the United States, by 12.10pm Eastern Standard Time (New York), the trading price of gold had risen by a remarkable 3.5% to $2,068.07 an ounce, which brought it near to its record trading value of $2072.50 which was set in the summer of 2020 during the period in which lockdowns were omnipresent across Europe and America, and fears of losing jobs and private property were widespread.

Those fears are here again, this time fueled by heavy-handed sanctions which are decimating the markets across America and Europe. The US stock market is suffering a tech stock obliteration which is beginning to cause analysts to compare it to the 'dot com' collapse of the early 2000s.

This is a very sudden new direction. Tech stocks were the solid, relatively low-risk investment for most investors and traders all the way from those trading part-time from home, to large hedge funds and wealth managers.

Now, with these in decline, the mainstay of the US economy is being measured and global investors are heading for the hard collateral that is precious metal.

Even nickel, which is used in engineering across most heavy industrial applications worldwide from car manufacturing to construction, has been soaring in price to the extent where pricing has become so difficult in the live market that the London Metal Exchange (LME) has suspended its trading.

One report this morning stated that a Chinese investor is facing losses running into the multi-billion-pound range as a result of the volatility in which nickel soared by as much as 111% to a record $101,365, followed by a two-day increase of up to 250% before falling back to $82,250 a tonne.

The London Metal Exchange has been pricing nickel for over 145 years, and yesterday's volatility was an all time record in the entire trading history of the venue.

Precious metals are therefore in huge demand, and gold is unique in that it is primarily used as a store of value, compared to other high-demand metals like copper and nickel whose primary use is in manufacturing and engineering.

Today, Reuters has explained that one particular futures trader had cited the combination of extremely inflationary energy prices, grain prices and base metal prices has contributed the major underlying support behind gold having increased so much in value.

Certainly investors are hanging onto physical assets, and those metals with an engineering use are rocketing due to the difficulties in obtaining them for factories to be able to meet the demand for their products or remain in business without having to halt production, leaving gold as an outright store of value which is heading for all time highs.

Fascinating market moves brought on by highly well analyzed circumstances.

FXOpen Blog