One of the possibilities in obtaining information about the world is vision.

At the same time, work on finding and correcting errors of different levels of perception is done at a subconscious level, and we are aware of the already processed data array.

In some cases, this can lead to a distortion of the true picture of reality.

Therefore, the training of perception is extremely important if the solution to the problem depends on the conclusions made on the basis of the resulting visual images.

In the description of the exchange pricing process, there is such a thing as Graphic Analysis.

Graphical analysis is the interpretation of information on a graph in the form of graphical formations and the identification of repeating patterns in them in order to make a profit.

There is an opinion that when analyzing the market, it is necessary to understand that, in contrast to the purely technical approach, graphical analysis does not give us a complete answer to the question of how and what to do. This is primarily due to the presence of more complex theoretical models, in some cases imperfect and having certain inaccuracies. For this reason, the automation of finding graphic patterns is a much more voluminous task and creates the very thin line between technical and graphical analysis.

In itself, the use of external tools promotes objective perception and eliminates most of the erroneous primary conclusions made on the basis of emotions. Thus, when it comes to graphical analysis, you can never fully rely on your own perception and you must always confirm your decisions with additional measurements.

One such measurement is Technical Analysis.

Technical analysis - the ability to predict price movements, based solely on the analysis of the historical movement of the price chart

Charles Dow is considered to be the founder of technical analysis

Key points of Charles Dow theory:

1. Indexes take into account everything.

Any factor capable of influencing supply or demand in one way or another will invariably be reflected in the dynamics of the index.

2. Three categories of price trends:

primary

secondary

small.

Of primary importance is given to the primary trend, which lasts more than a year, and sometimes several years.

The secondary trend was corrective to the main trend and usually lasts from three weeks to three months. Such interim adjustments range from one to two-thirds (very often half or 50%) of the distance covered by the price during the previous trend.

Small trends last no more than three weeks and are short-term fluctuations within the secondary trend.

3. Three stages of trend development.

The accumulation phase, when the most far-sighted investors begin to buy, since all adverse economic information has already been taken into account by the market.

The second stage begins when those who use technical methods to follow trends enter the game.

The final stage, when the general public takes effect, and the hype begins in a market fueled by the media.

4. Indexes must confirm each other.

Charles Dow had in mind industrial and rail performance.

He believed that any important signal to increase or decrease the market rate should be reflected in the values of both indices. Of course, the signals should not absolutely coincide with each other, but the less they are separated by time, the more reliable

5. The volume of trade should confirm the nature of the trend.

The Dow does not consider trading volume to be paramount, but, nevertheless, an extremely important factor for confirming signals received on price charts.

Thus, the movement of prices on the exchange is formed on the basis of a variety of numerous factors.

The main problem of Technical Analysis is

Not a single trader, not a single specialist in technical analysis of the market is able to analyze every transaction that occurs on the exchange and the forex market.

Based on this, trading periods are divided into equivalent timeframes - time intervals in the range of which not every price of a trading operation is analyzed, but only the five most significant ones: opening of a trading period, closing of a trading period, a minimum of a period, a maximum of a period, and also volume.

In 1935, Harold Gartley visualized market pricing in his book Profit in the Stock Market. It was thanks to Harold Gartley that it became possible not only to find the optimal e points of current price trends, but also to visualize the price movement, giving it the appearance of harmonious models.

Dealing with the models, Gartley noticed that the sequential development of the main Gartley model includes the formation of a group of secondary patterns. And those price extremes that Harold Gartley did not pay attention to are precisely the key points, which in turn form the main pattern. At the same time, the number of these intermediate models is limited in time of their formation; thereby, it is they that determine the necessary volatility in the formation of the main pattern.

Thus, I was able to formulate a number of rules that form the pricing of one or another exchange ticker

And on the basis of this, I have formed my method of perceiving market movement

The basis of my method

Graphic analysis - the principle of combining three triangles into 1 triangle is laid

The combination of the triangle of the upward trend is based on the combination of Low-High - Low

The combination of the triangle of the upward trend High- Low - High

The trend is due to 5 zones of mining rollback with upward and downward trends.

Thus, the chart of any stock ticker is limited in its construction possibilities by 18– price models with an upward trend, and a similar number of constructions in a downward trend and in the situation - flat.

Continuing the series connection of 3 triangles into 1 triangle, the graph builds a semblance of a wave structure, but with significant distinguishing features, namely

- a clear number of build cycles

- time limit for one cycle

- more specifically in this case, the volatility of the ticker is predictable.

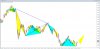

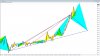

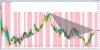

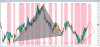

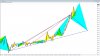

As an example, I will give several charts of various stock tickers

The principle of this association

Three small red triangles merge into 1 black triangle

Three black triangles merge into 1 yellow triangle

Three yellow triangles merge into 1 blue triangle

Three blue triangles merge into 1 red triangle

Etc

Индексы SP500

DAX

Currency market

GBPUSD

AUDUSD

Commodity Market

WHEAT

BRENT

Stock market

GOOGL

Лукойл

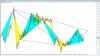

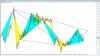

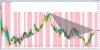

As an example, I detail the GBP futures chart in a 1 day time interval.

The first reference point gives me the opportunity to consider the price model in this perspective

Above is the time for the formation of the blue triangle in the interval - week

Below is the time for the formation of the yellow triangle in the interval - week

I did not display the intermediate constructions of red triangles, which in turn form a yellow triangle, so as not to create confusion.

The second reference point of the same chart allows you to consider the price model from a different perspective

3rd reference point allows you to summarize the price model

Thus, it is possible to combine these models and get an answer,

What particular fragment needs to be finalized by this ticker in order to complete the integrity of the overall construction of the current price model.

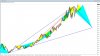

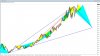

Examining my method for a shorter time interval - 4 hours

There is an opportunity to trace in detail the missing elements of small, intermediate constructions to complete the price model in the interval - day

Building on a 15-minute chart, detailing the formation of 4-hour models

And the construction of a 1-minute chart - specify the work of 15-minute builds

Thus

1 Since all time intervals are combined by the sequential work of combining three triangles into 1 triangle, a definite answer appears how many cycles the price will have to complete in its future development to complete the current cycle of constructions

2 Since the construction of each fragment is limited by tight time frames, on the basis of this, any exchange ticker must develop the necessary volatility to move to the next cyclic construction

3 Such concepts as “random price wandering” “white noise” are fully detailed, which in turn allows us to calculate not only their future development, but also their formation both in the time of formation and in volatility

4 Since price constructions have the ability to rebuild a total of 36 price models, grouping them into patterns does not amount to any difficulty.

To summarize, you can add.

In this case, the trend formation time described by Charles Dow is confirmed by the graphic construction of any stock ticker

The very points that he mentioned in his notes appear

“The accumulation phase, when the most far-sighted investors begin to buy, since all adverse economic information has already been taken into account by the market”

For forecasting or successful trading, it is enough to number the points and work the construction of a triangle in any time interval

At the same time, work on finding and correcting errors of different levels of perception is done at a subconscious level, and we are aware of the already processed data array.

In some cases, this can lead to a distortion of the true picture of reality.

Therefore, the training of perception is extremely important if the solution to the problem depends on the conclusions made on the basis of the resulting visual images.

In the description of the exchange pricing process, there is such a thing as Graphic Analysis.

Graphical analysis is the interpretation of information on a graph in the form of graphical formations and the identification of repeating patterns in them in order to make a profit.

There is an opinion that when analyzing the market, it is necessary to understand that, in contrast to the purely technical approach, graphical analysis does not give us a complete answer to the question of how and what to do. This is primarily due to the presence of more complex theoretical models, in some cases imperfect and having certain inaccuracies. For this reason, the automation of finding graphic patterns is a much more voluminous task and creates the very thin line between technical and graphical analysis.

In itself, the use of external tools promotes objective perception and eliminates most of the erroneous primary conclusions made on the basis of emotions. Thus, when it comes to graphical analysis, you can never fully rely on your own perception and you must always confirm your decisions with additional measurements.

One such measurement is Technical Analysis.

Technical analysis - the ability to predict price movements, based solely on the analysis of the historical movement of the price chart

Charles Dow is considered to be the founder of technical analysis

Key points of Charles Dow theory:

1. Indexes take into account everything.

Any factor capable of influencing supply or demand in one way or another will invariably be reflected in the dynamics of the index.

2. Three categories of price trends:

primary

secondary

small.

Of primary importance is given to the primary trend, which lasts more than a year, and sometimes several years.

The secondary trend was corrective to the main trend and usually lasts from three weeks to three months. Such interim adjustments range from one to two-thirds (very often half or 50%) of the distance covered by the price during the previous trend.

Small trends last no more than three weeks and are short-term fluctuations within the secondary trend.

3. Three stages of trend development.

The accumulation phase, when the most far-sighted investors begin to buy, since all adverse economic information has already been taken into account by the market.

The second stage begins when those who use technical methods to follow trends enter the game.

The final stage, when the general public takes effect, and the hype begins in a market fueled by the media.

4. Indexes must confirm each other.

Charles Dow had in mind industrial and rail performance.

He believed that any important signal to increase or decrease the market rate should be reflected in the values of both indices. Of course, the signals should not absolutely coincide with each other, but the less they are separated by time, the more reliable

5. The volume of trade should confirm the nature of the trend.

The Dow does not consider trading volume to be paramount, but, nevertheless, an extremely important factor for confirming signals received on price charts.

Thus, the movement of prices on the exchange is formed on the basis of a variety of numerous factors.

The main problem of Technical Analysis is

Not a single trader, not a single specialist in technical analysis of the market is able to analyze every transaction that occurs on the exchange and the forex market.

Based on this, trading periods are divided into equivalent timeframes - time intervals in the range of which not every price of a trading operation is analyzed, but only the five most significant ones: opening of a trading period, closing of a trading period, a minimum of a period, a maximum of a period, and also volume.

In 1935, Harold Gartley visualized market pricing in his book Profit in the Stock Market. It was thanks to Harold Gartley that it became possible not only to find the optimal e points of current price trends, but also to visualize the price movement, giving it the appearance of harmonious models.

Dealing with the models, Gartley noticed that the sequential development of the main Gartley model includes the formation of a group of secondary patterns. And those price extremes that Harold Gartley did not pay attention to are precisely the key points, which in turn form the main pattern. At the same time, the number of these intermediate models is limited in time of their formation; thereby, it is they that determine the necessary volatility in the formation of the main pattern.

Thus, I was able to formulate a number of rules that form the pricing of one or another exchange ticker

And on the basis of this, I have formed my method of perceiving market movement

The basis of my method

Graphic analysis - the principle of combining three triangles into 1 triangle is laid

The combination of the triangle of the upward trend is based on the combination of Low-High - Low

The combination of the triangle of the upward trend High- Low - High

The trend is due to 5 zones of mining rollback with upward and downward trends.

Thus, the chart of any stock ticker is limited in its construction possibilities by 18– price models with an upward trend, and a similar number of constructions in a downward trend and in the situation - flat.

Continuing the series connection of 3 triangles into 1 triangle, the graph builds a semblance of a wave structure, but with significant distinguishing features, namely

- a clear number of build cycles

- time limit for one cycle

- more specifically in this case, the volatility of the ticker is predictable.

As an example, I will give several charts of various stock tickers

The principle of this association

Three small red triangles merge into 1 black triangle

Three black triangles merge into 1 yellow triangle

Three yellow triangles merge into 1 blue triangle

Three blue triangles merge into 1 red triangle

Etc

Индексы SP500

DAX

Currency market

GBPUSD

AUDUSD

Commodity Market

WHEAT

BRENT

Stock market

GOOGL

Лукойл

As an example, I detail the GBP futures chart in a 1 day time interval.

The first reference point gives me the opportunity to consider the price model in this perspective

Above is the time for the formation of the blue triangle in the interval - week

Below is the time for the formation of the yellow triangle in the interval - week

I did not display the intermediate constructions of red triangles, which in turn form a yellow triangle, so as not to create confusion.

The second reference point of the same chart allows you to consider the price model from a different perspective

3rd reference point allows you to summarize the price model

Thus, it is possible to combine these models and get an answer,

What particular fragment needs to be finalized by this ticker in order to complete the integrity of the overall construction of the current price model.

Examining my method for a shorter time interval - 4 hours

There is an opportunity to trace in detail the missing elements of small, intermediate constructions to complete the price model in the interval - day

Building on a 15-minute chart, detailing the formation of 4-hour models

And the construction of a 1-minute chart - specify the work of 15-minute builds

Thus

1 Since all time intervals are combined by the sequential work of combining three triangles into 1 triangle, a definite answer appears how many cycles the price will have to complete in its future development to complete the current cycle of constructions

2 Since the construction of each fragment is limited by tight time frames, on the basis of this, any exchange ticker must develop the necessary volatility to move to the next cyclic construction

3 Such concepts as “random price wandering” “white noise” are fully detailed, which in turn allows us to calculate not only their future development, but also their formation both in the time of formation and in volatility

4 Since price constructions have the ability to rebuild a total of 36 price models, grouping them into patterns does not amount to any difficulty.

To summarize, you can add.

In this case, the trend formation time described by Charles Dow is confirmed by the graphic construction of any stock ticker

The very points that he mentioned in his notes appear

“The accumulation phase, when the most far-sighted investors begin to buy, since all adverse economic information has already been taken into account by the market”

For forecasting or successful trading, it is enough to number the points and work the construction of a triangle in any time interval