FXOpen Trader

Active Member

EUR/USD Eyes Recovery, USD/CHF Remains Elevated

EUR/USD declined heavily below 1.2000 and it tested 1.1850. USD/CHF is rising and it could rally further if it clears the 0.9200 and 0.9220 resistance levels.

Important Takeaways for EUR/USD and USD/CHF

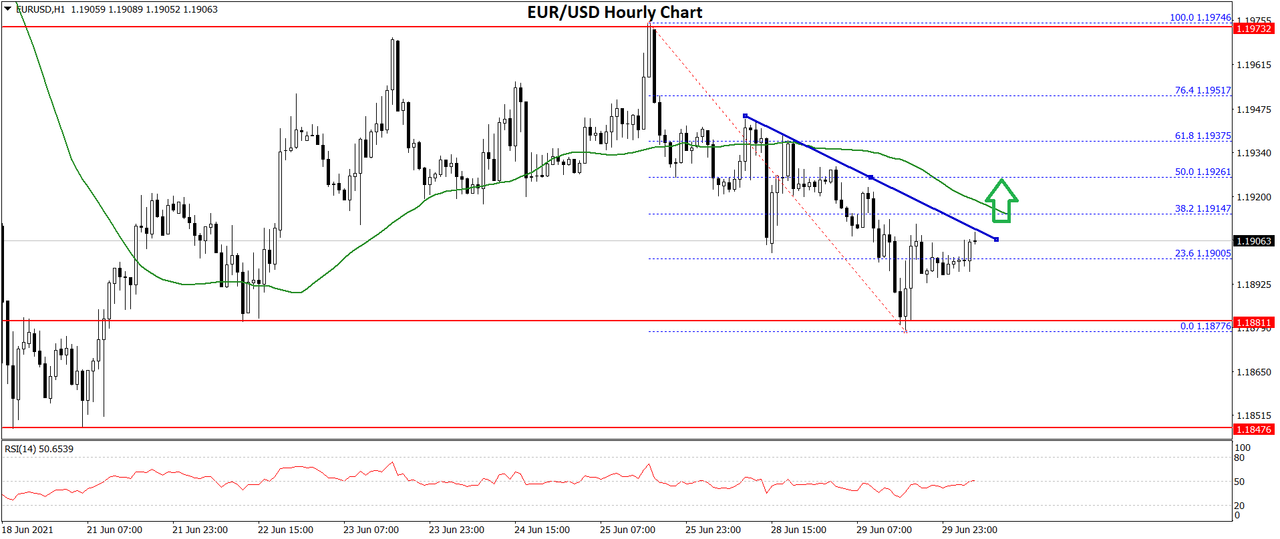

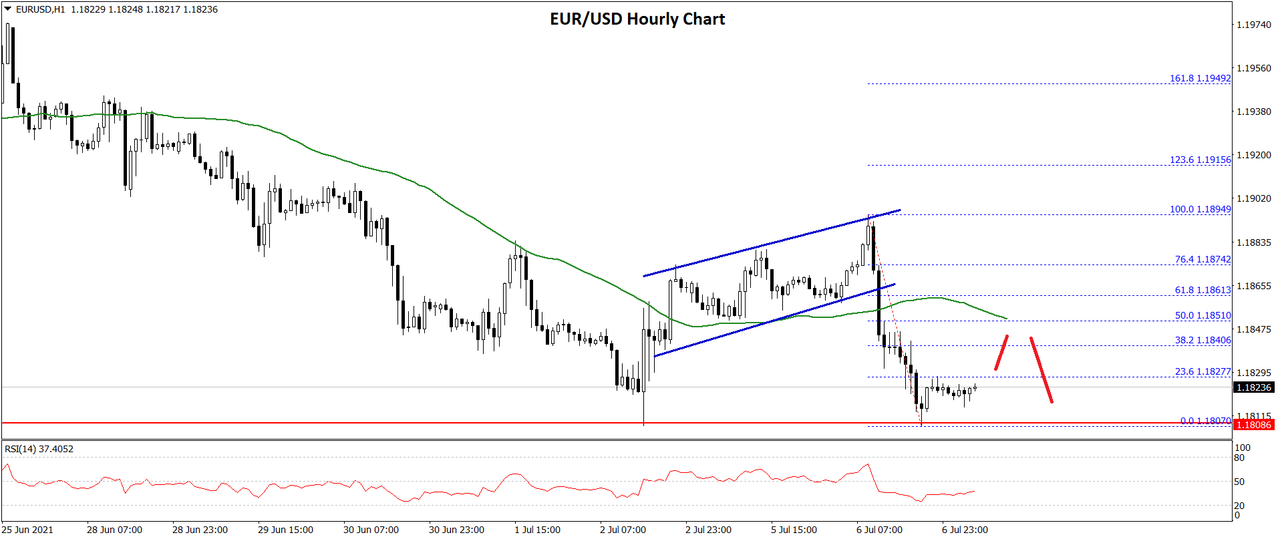

EUR/USD Technical Analysis

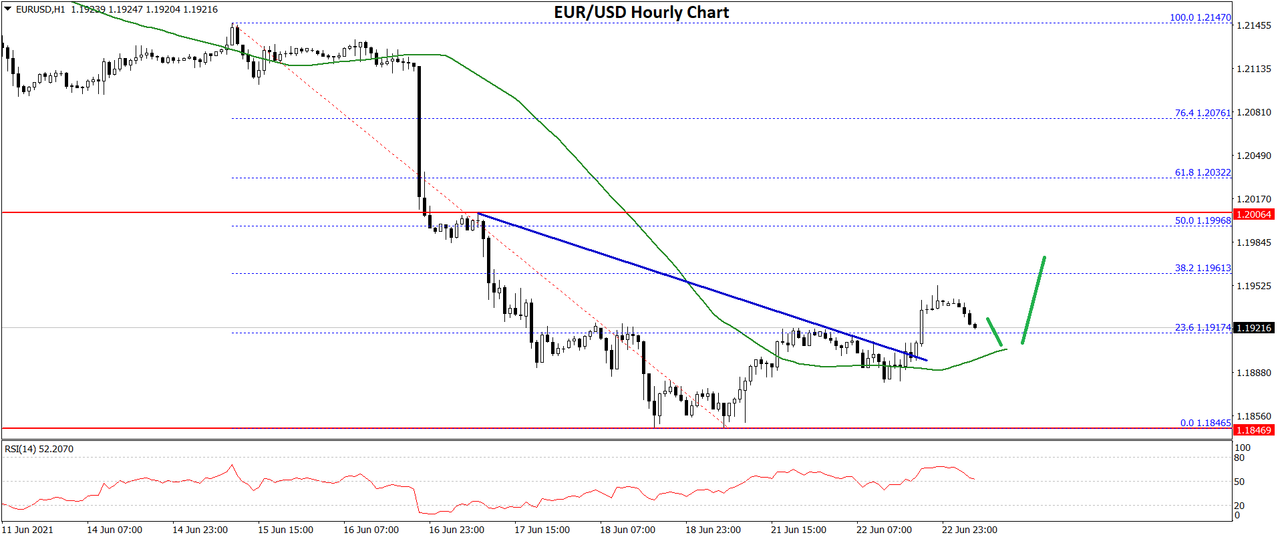

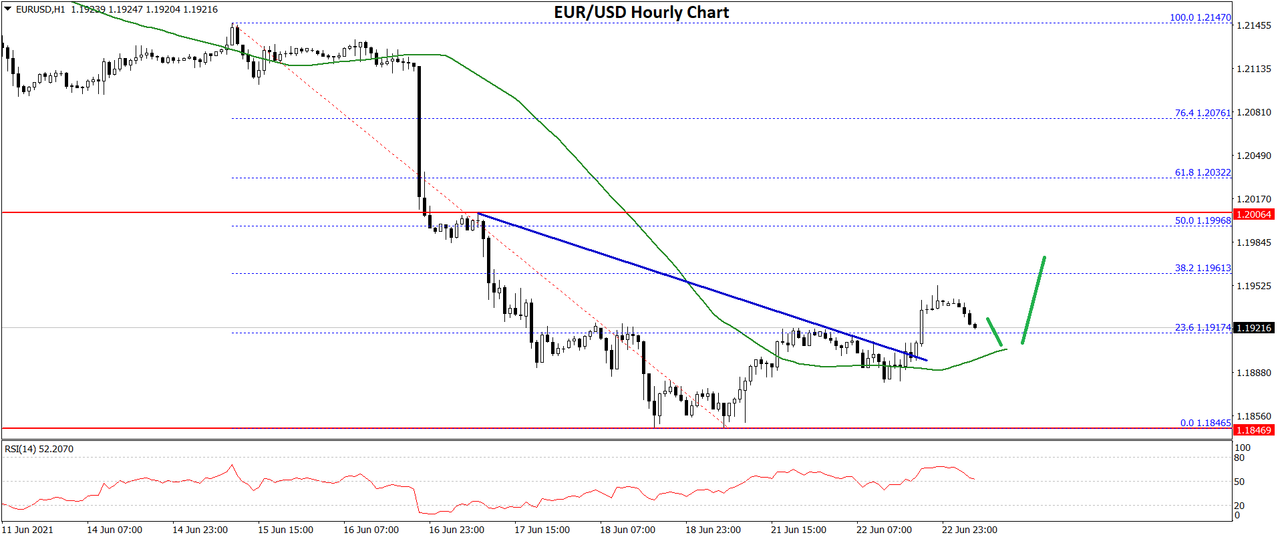

The Euro struggled to gain pace above the 1.2150 level and it started a major decline against the US Dollar. As a result, the EUR/USD pair broke the main 1.2000 support zone to move into a bearish zone.

The pair even declined below the 1.1920 support zone and settled below the 50 hourly simple moving average. A low was formed near 1.1846 on FXOpen and the pair is now correcting losses. It corrected above the 1.1880 and 1.1900 resistance levels.

There was a break below the 23.6% Fib retracement level of the recent decline from the 1.2147 high to 1.1846 low. There was also a break above a connecting bearish trend line with resistance near 1.1900 on the hourly chart of EUR/USD.

It is now trading nicely above the 1.1900 support zone and the 50 hourly SMA. On the upside, the pair is facing hurdles near the 1.1940 and 1.1950 levels. A clear upside break above 1.1950 could set the pace for a larger recovery.

The next major resistance is near the 1.2000 zone. On the downside, there is a major support forming near the 1.1900 zone. The next key support is near the 1.1880 level. A downside break below the 1.1880 support could restart decline. The next major support could be near the 1.1820 level.

Read Full on FXOpen Company Blog...

EUR/USD declined heavily below 1.2000 and it tested 1.1850. USD/CHF is rising and it could rally further if it clears the 0.9200 and 0.9220 resistance levels.

Important Takeaways for EUR/USD and USD/CHF

- The Euro started a fresh decline from well above the 1.2000 zone against the US Dollar.

- There was a break above a connecting bearish trend line with resistance near 1.1900 on the hourly chart of EUR/USD.

- USD/CHF gained bullish momentum above the 0.9050 and 0.9120 resistance levels.

- There is a key bearish trend line forming with resistance near 0.9200 on the hourly chart.

EUR/USD Technical Analysis

The Euro struggled to gain pace above the 1.2150 level and it started a major decline against the US Dollar. As a result, the EUR/USD pair broke the main 1.2000 support zone to move into a bearish zone.

The pair even declined below the 1.1920 support zone and settled below the 50 hourly simple moving average. A low was formed near 1.1846 on FXOpen and the pair is now correcting losses. It corrected above the 1.1880 and 1.1900 resistance levels.

There was a break below the 23.6% Fib retracement level of the recent decline from the 1.2147 high to 1.1846 low. There was also a break above a connecting bearish trend line with resistance near 1.1900 on the hourly chart of EUR/USD.

It is now trading nicely above the 1.1900 support zone and the 50 hourly SMA. On the upside, the pair is facing hurdles near the 1.1940 and 1.1950 levels. A clear upside break above 1.1950 could set the pace for a larger recovery.

The next major resistance is near the 1.2000 zone. On the downside, there is a major support forming near the 1.1900 zone. The next key support is near the 1.1880 level. A downside break below the 1.1880 support could restart decline. The next major support could be near the 1.1820 level.

Read Full on FXOpen Company Blog...