FXOpen Trader

Active Member

GBP/USD Breaks Key Resistance, USD/CAD Extends Decline

GBP/USD started a fresh rally above the 1.4000 resistance. USD/CAD declined heavily below 1.2250 and it remains at a risk of more downsides.

Important Takeaways for GBP/USD and USD/CAD

GBP/USD Technical Analysis

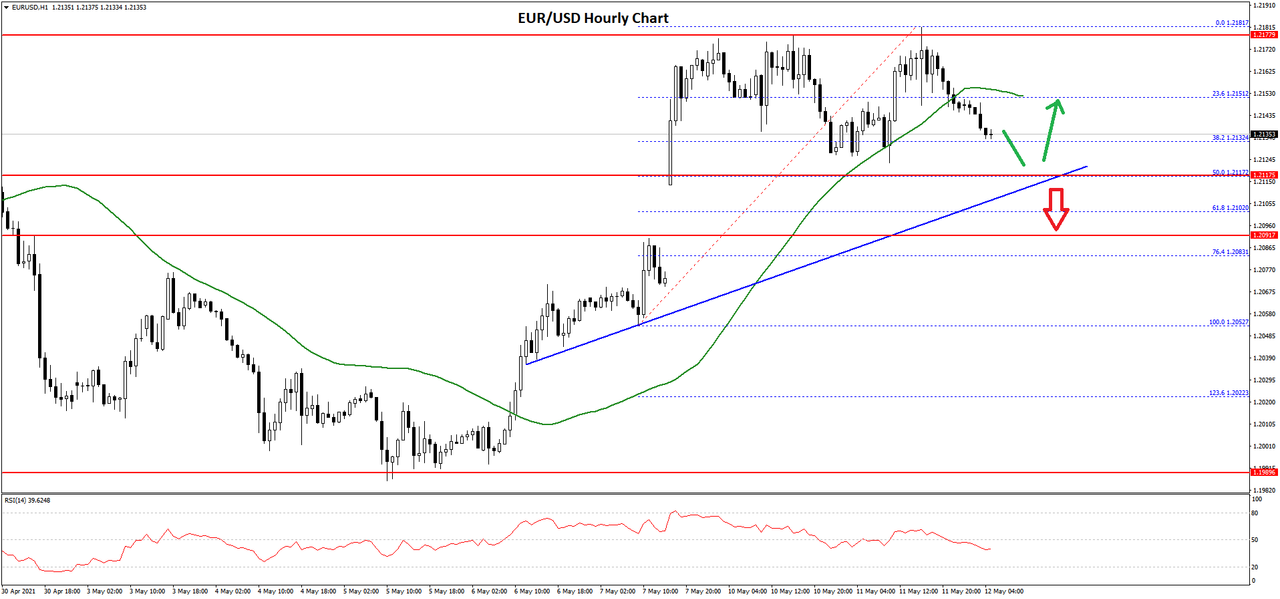

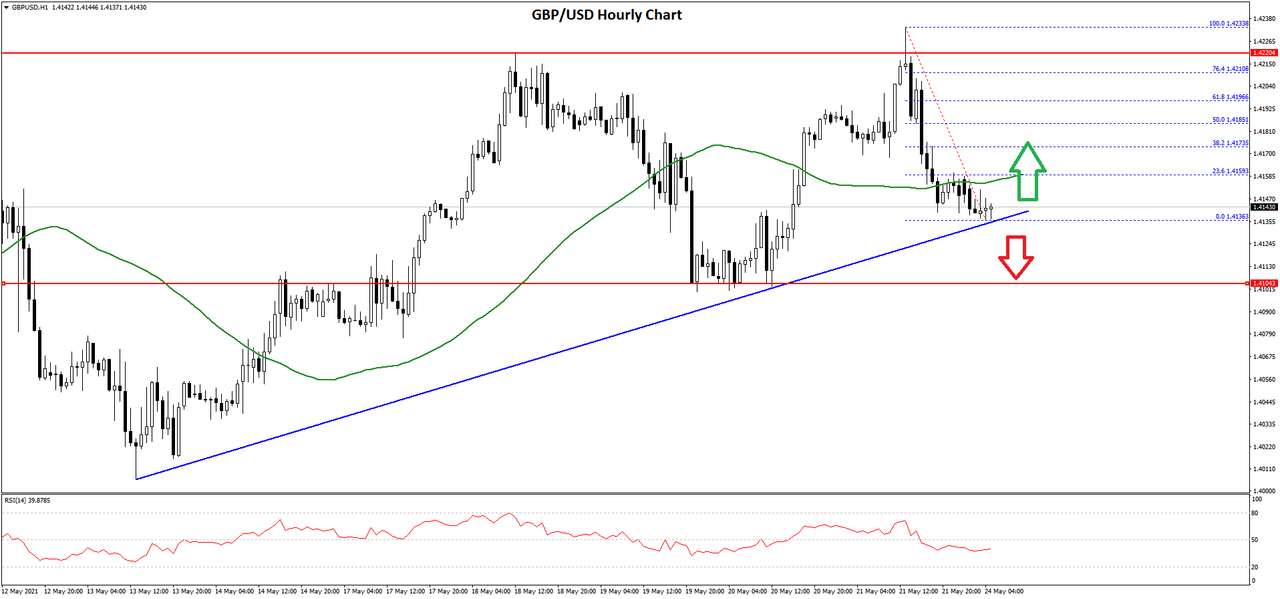

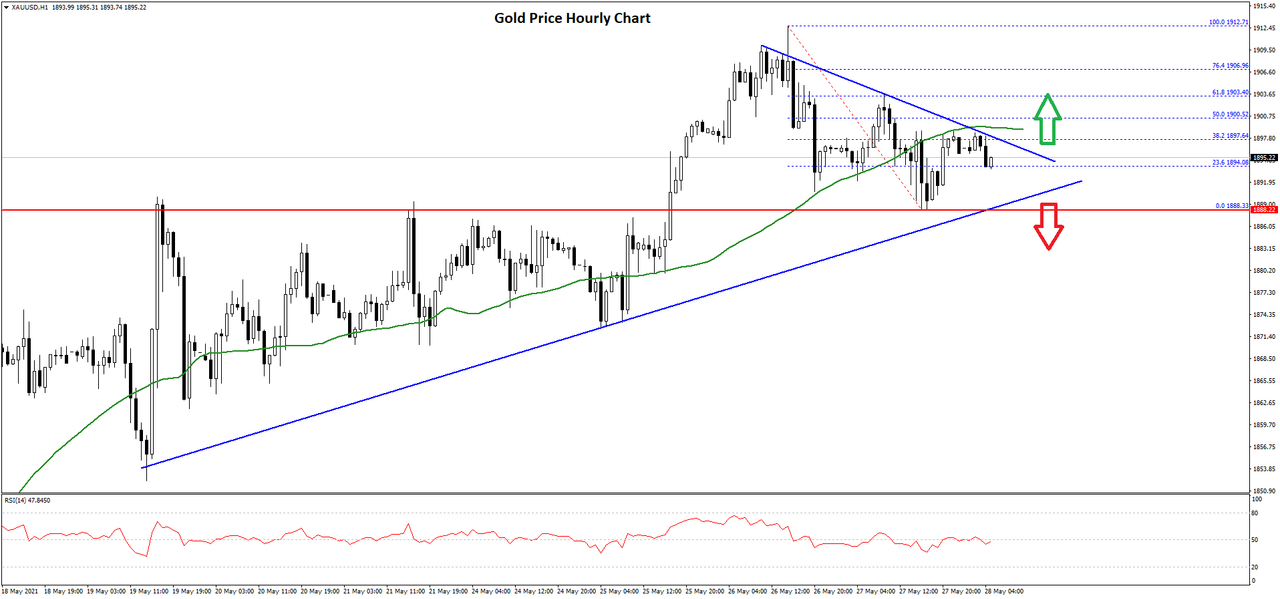

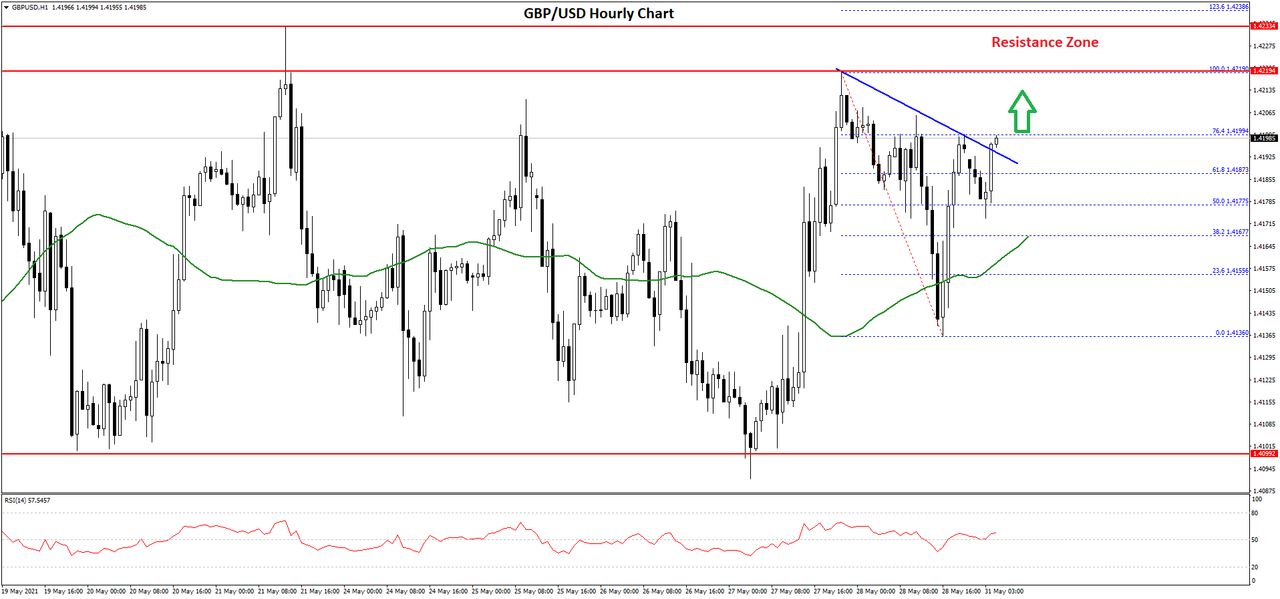

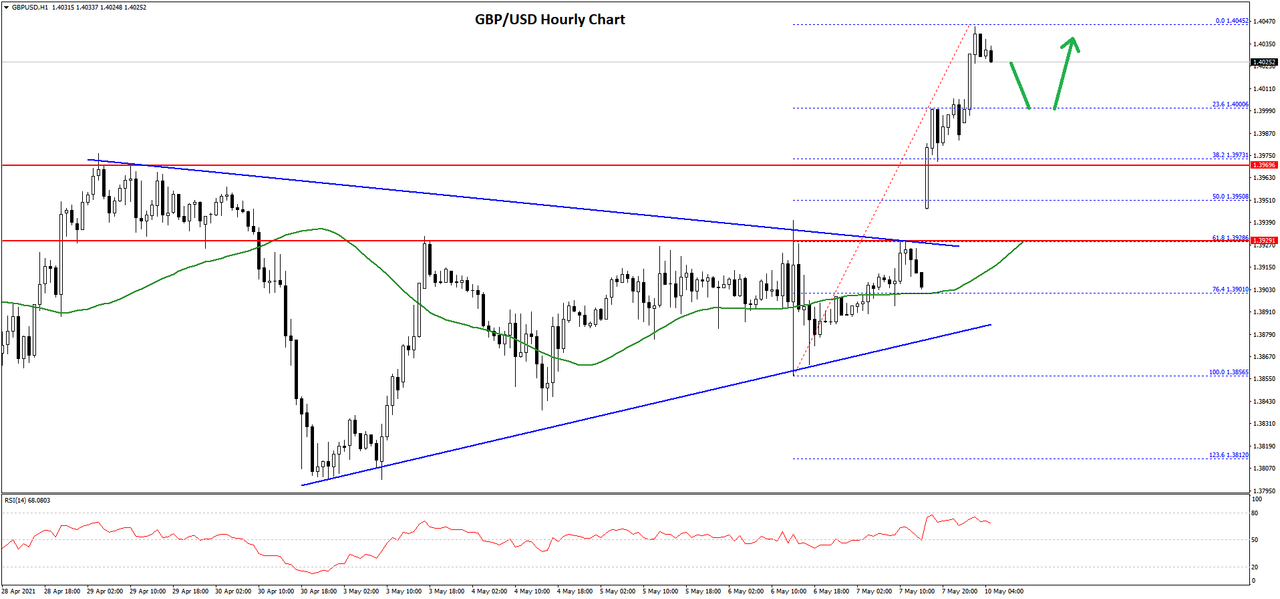

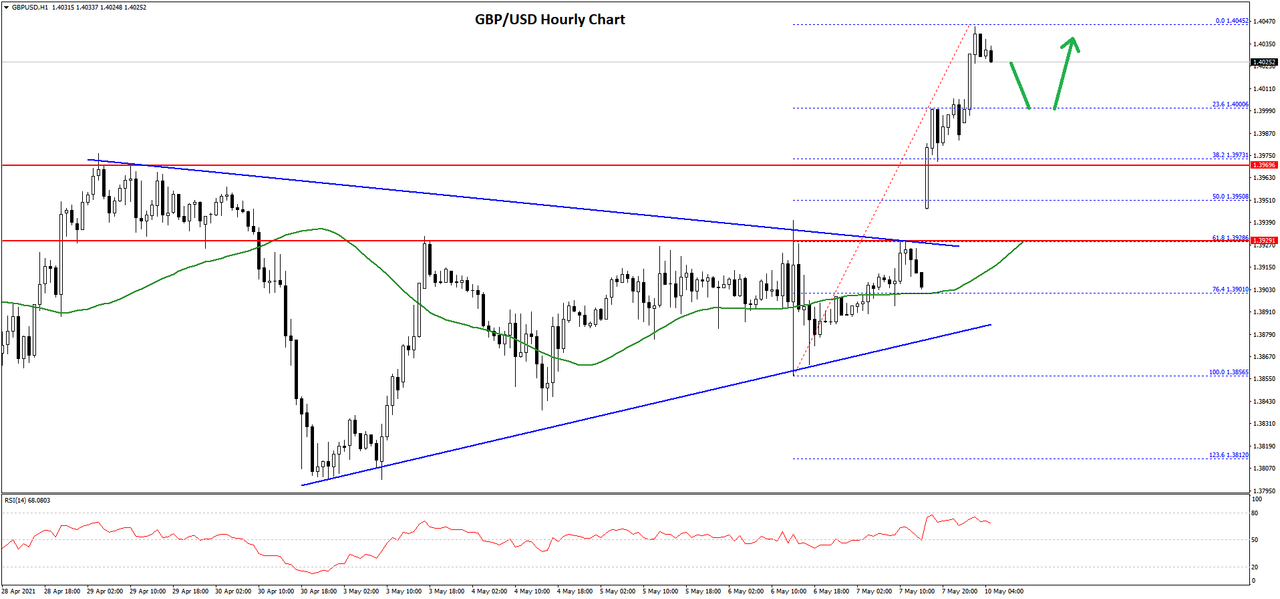

This past week, the British Pound consolidated above the 1.3820 and 1.3850 support levels against the US Dollar. Recently, the US NFP report was released, which posted a disappointing result of 266K.

As a result, the GBP/USD pair started a fresh increase and cleared a couple of important hurdles near the 1.3925 level. There was also a break above a major contracting triangle with resistance near 1.3925 on the hourly chart of GBP/USD.

The pair even climbed above the 1.4000 level and settled nicely above the 50 hourly simple moving average. It traded as high as 1.4045 on FXOpen and it is now consolidating gains.

An initial support on the downside is near the 1.4000 level. It is close to the 23.6% Fib retracement level of the upward move from the 1.3856 low to 1.4045 high. If the pair fails to stay above the 1.4000 level, it could correct lower towards the 1.3950 level.

The 50% Fib retracement level of the upward move from the 1.3856 low to 1.4045 high is also near 1.3950. Any more losses might call for a test of the 1.3925 support.

On the upside, the 1.4050 zone is an initial barrier for the bulls. A successful close above the 1.4045 and 1.4050 levels could open the doors for a steady increase towards 1.4120 or even 1.4200.

Read Full on FXOpen Company Blog...

GBP/USD started a fresh rally above the 1.4000 resistance. USD/CAD declined heavily below 1.2250 and it remains at a risk of more downsides.

Important Takeaways for GBP/USD and USD/CAD

- The British Pound started a fresh increase from the 1.3800 support zone.

- There was a break above a major contracting triangle with resistance near 1.3925 on the hourly chart of GBP/USD.

- USD/CAD declined heavily after it broke the 1.2260 and 1.2250 support levels.

- There is a key bearish trend line forming with resistance near 1.2200 on the hourly chart.

GBP/USD Technical Analysis

This past week, the British Pound consolidated above the 1.3820 and 1.3850 support levels against the US Dollar. Recently, the US NFP report was released, which posted a disappointing result of 266K.

As a result, the GBP/USD pair started a fresh increase and cleared a couple of important hurdles near the 1.3925 level. There was also a break above a major contracting triangle with resistance near 1.3925 on the hourly chart of GBP/USD.

The pair even climbed above the 1.4000 level and settled nicely above the 50 hourly simple moving average. It traded as high as 1.4045 on FXOpen and it is now consolidating gains.

An initial support on the downside is near the 1.4000 level. It is close to the 23.6% Fib retracement level of the upward move from the 1.3856 low to 1.4045 high. If the pair fails to stay above the 1.4000 level, it could correct lower towards the 1.3950 level.

The 50% Fib retracement level of the upward move from the 1.3856 low to 1.4045 high is also near 1.3950. Any more losses might call for a test of the 1.3925 support.

On the upside, the 1.4050 zone is an initial barrier for the bulls. A successful close above the 1.4045 and 1.4050 levels could open the doors for a steady increase towards 1.4120 or even 1.4200.

Read Full on FXOpen Company Blog...