Unitedpips

Member

EUR/JPY Forex Forecast: Bullish Signals from Indicators

Introduction to EUR/JPY

The EUR/JPY pair, representing the Euro and Japanese Yen, is one of the most popular currency pairs in the forex market. It combines the European Union’s Euro, a global reserve currency, with Japan’s Yen, which is heavily influenced by economic policies and global market conditions. This pair is often referred to as a "cross-currency pair" because it involves two currencies that don't include the US dollar, providing traders with additional opportunities for profit. The EUR/JPY is known for its volatility, often reacting to economic data releases and geopolitical events.

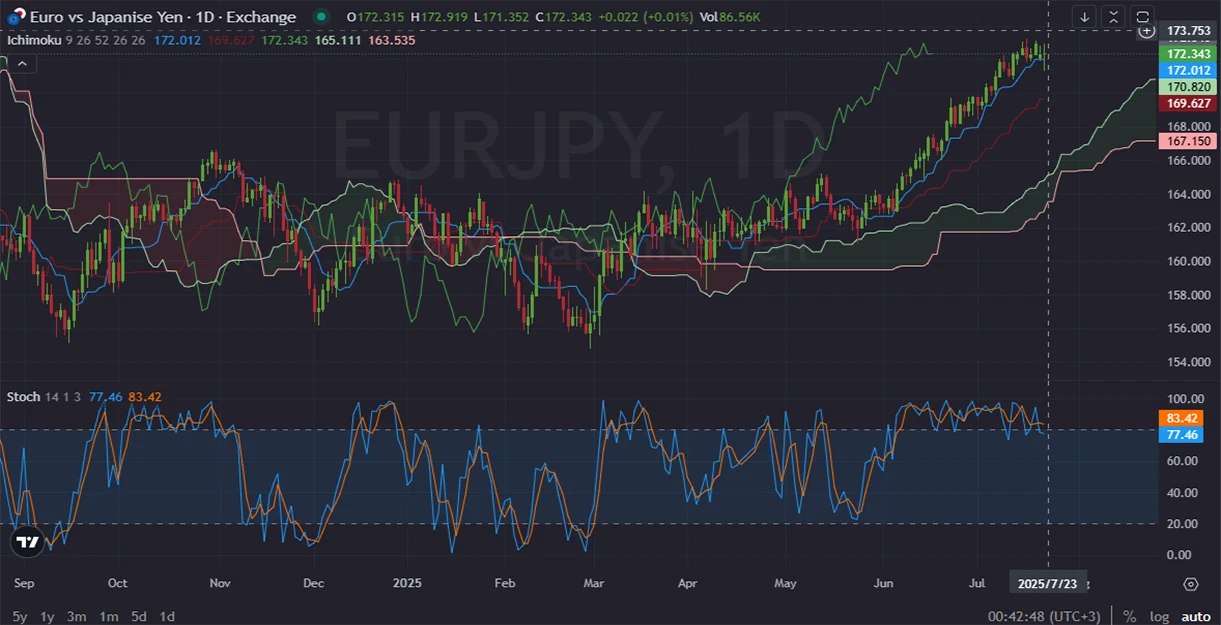

EURJPY Market Overview

In recent days, EURJPY has been in a notable uptrend, with the price moving above key support levels. The global market sentiment has been mixed, with inflation figures in Europe and Japan showing some signs of stability but also volatility due to changing global conditions. Recent news out of Europe indicates stable growth with better-than-expected industrial output and retail sales data. This has provided the Euro with some support. In Japan, while consumer spending remains robust, analysts are monitoring whether the inflationary pressures from global markets will affect the Bank of Japan’s policies. These global developments are critical as they might influence future movements in EUR/JPY. As traders digest these fundamental factors, price action has been relatively bullish, supported by the strengthening of the Euro against the Yen.

EUR-JPY Technical Analysis

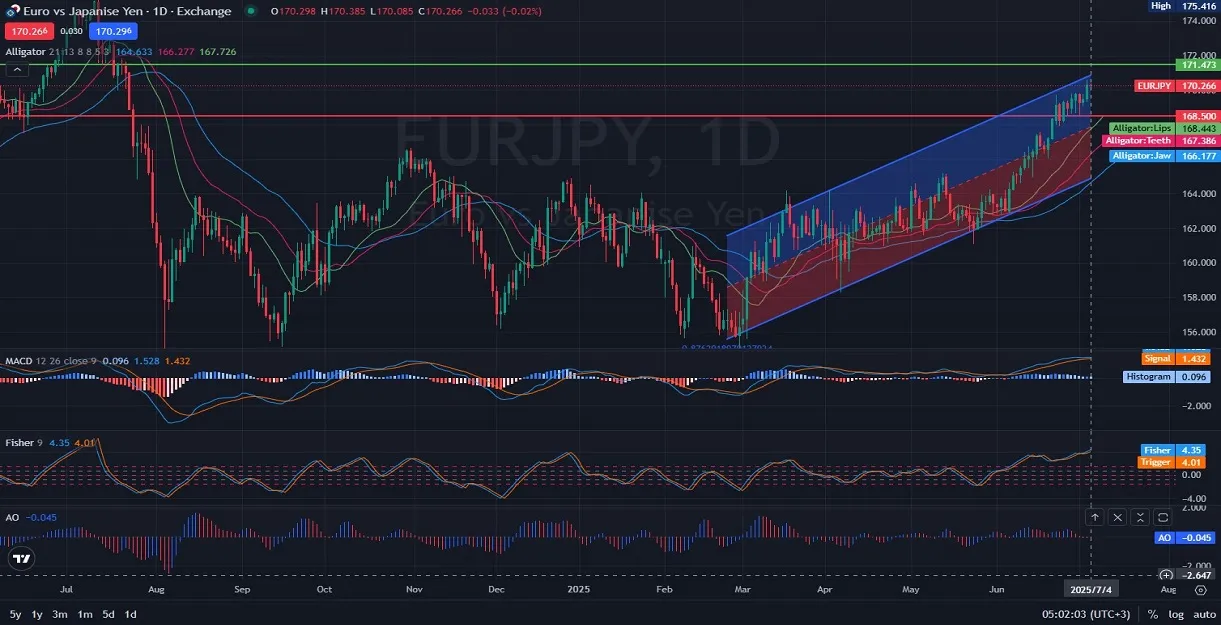

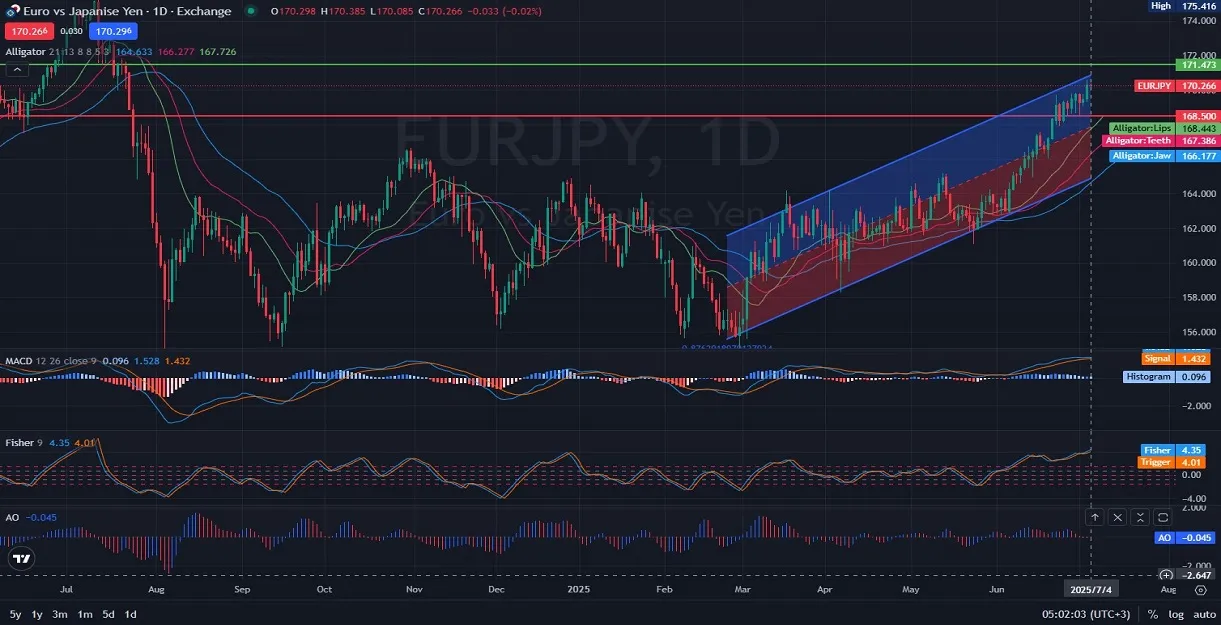

On the daily chart, EUR-JPY is showing a strong bullish trend. The price is positioned in the upper half of the regression channel, indicating the market is in an uptrend. The price remains well above all the Alligator lines, with the green lips at the top, red teeth in the middle, and blue jaws at the bottom, signaling a bullish market structure. Additionally, the MACD indicator shows the MACD and signal lines are both above the zero line, suggesting that the momentum is in favor of the bulls. The histogram supports this with a positive reading, reinforcing the bullish sentiment. Furthermore, the Fisher indicator shows that both the Fisher line and the Trigger line are positioned above the neutral level, indicating strong bullish momentum. Finally, the Accelerator Oscillator (AO) is at -0.045, showing that while the market is still in a bullish phase, the buying pressure might be slowing down slightly. This overall technical outlook suggests that EUR JPY has strong bullish potential in the short term, though caution should be taken as the price approaches resistance levels.

Final Words about EUR vs JPY

The current technical indicators strongly support the bullish trend in EUR/JPY. With the price above the key support levels and the majority of indicators aligning for a continued upward movement, traders can be optimistic for the short term. However, it is crucial to watch out for upcoming economic releases, particularly from the Eurozone and Japan, which could provide fresh direction to the pair. As the market approaches key resistance levels, a careful assessment of price action near those levels will be important. For traders looking to take advantage of the trend, staying informed about both technical and fundamental factors is essential to navigate potential volatility in the coming days.

07.04.2025

Introduction to EUR/JPY

The EUR/JPY pair, representing the Euro and Japanese Yen, is one of the most popular currency pairs in the forex market. It combines the European Union’s Euro, a global reserve currency, with Japan’s Yen, which is heavily influenced by economic policies and global market conditions. This pair is often referred to as a "cross-currency pair" because it involves two currencies that don't include the US dollar, providing traders with additional opportunities for profit. The EUR/JPY is known for its volatility, often reacting to economic data releases and geopolitical events.

EURJPY Market Overview

In recent days, EURJPY has been in a notable uptrend, with the price moving above key support levels. The global market sentiment has been mixed, with inflation figures in Europe and Japan showing some signs of stability but also volatility due to changing global conditions. Recent news out of Europe indicates stable growth with better-than-expected industrial output and retail sales data. This has provided the Euro with some support. In Japan, while consumer spending remains robust, analysts are monitoring whether the inflationary pressures from global markets will affect the Bank of Japan’s policies. These global developments are critical as they might influence future movements in EUR/JPY. As traders digest these fundamental factors, price action has been relatively bullish, supported by the strengthening of the Euro against the Yen.

EUR-JPY Technical Analysis

On the daily chart, EUR-JPY is showing a strong bullish trend. The price is positioned in the upper half of the regression channel, indicating the market is in an uptrend. The price remains well above all the Alligator lines, with the green lips at the top, red teeth in the middle, and blue jaws at the bottom, signaling a bullish market structure. Additionally, the MACD indicator shows the MACD and signal lines are both above the zero line, suggesting that the momentum is in favor of the bulls. The histogram supports this with a positive reading, reinforcing the bullish sentiment. Furthermore, the Fisher indicator shows that both the Fisher line and the Trigger line are positioned above the neutral level, indicating strong bullish momentum. Finally, the Accelerator Oscillator (AO) is at -0.045, showing that while the market is still in a bullish phase, the buying pressure might be slowing down slightly. This overall technical outlook suggests that EUR JPY has strong bullish potential in the short term, though caution should be taken as the price approaches resistance levels.

Final Words about EUR vs JPY

The current technical indicators strongly support the bullish trend in EUR/JPY. With the price above the key support levels and the majority of indicators aligning for a continued upward movement, traders can be optimistic for the short term. However, it is crucial to watch out for upcoming economic releases, particularly from the Eurozone and Japan, which could provide fresh direction to the pair. As the market approaches key resistance levels, a careful assessment of price action near those levels will be important. For traders looking to take advantage of the trend, staying informed about both technical and fundamental factors is essential to navigate potential volatility in the coming days.

07.04.2025