BTCUSD and XRPUSD Technical Analysis – 14th FEB 2023

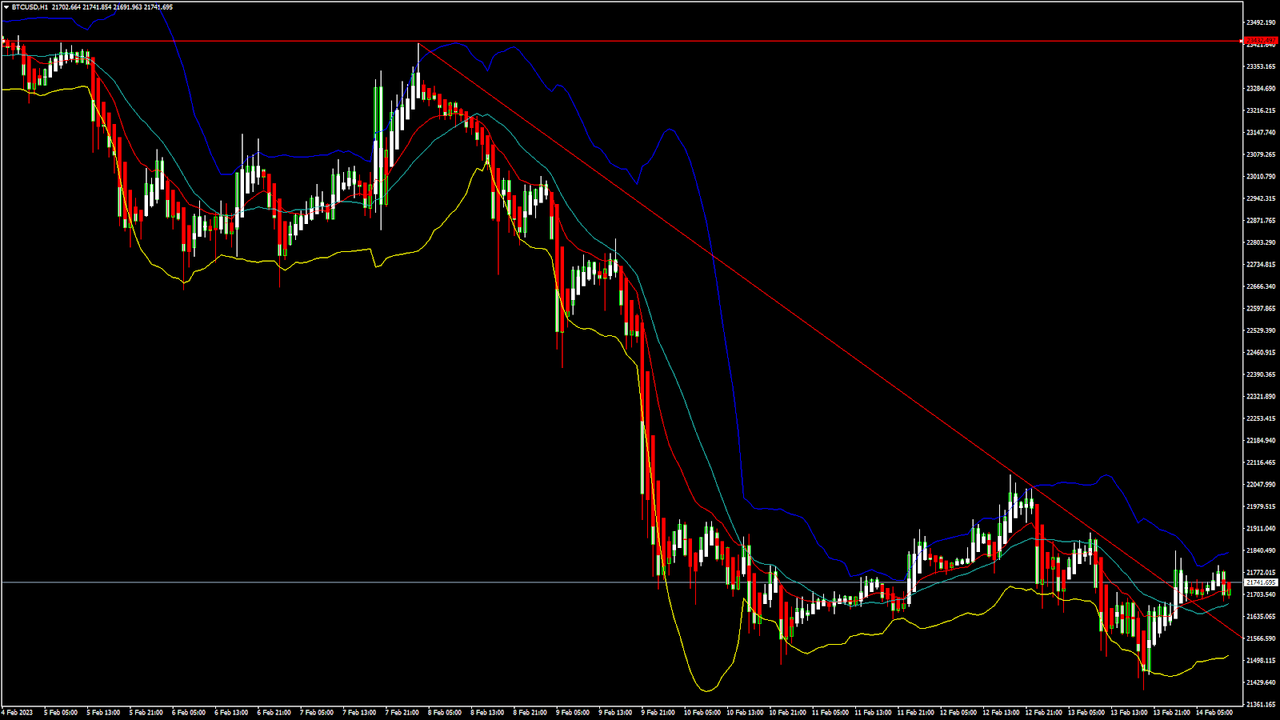

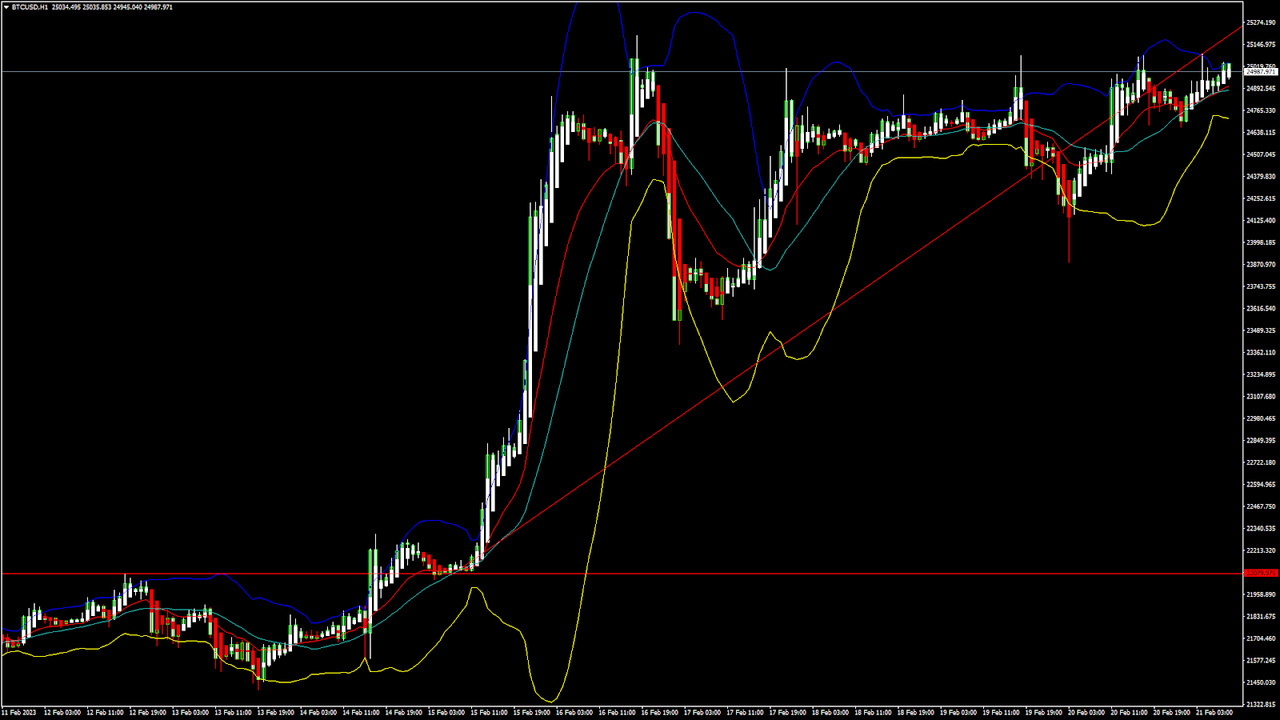

BTCUSD: The Evening Star Pattern Below $23432

Bitcoin was unable to sustain its bullish momentum last week and after touching a high of $22432 started to decline against the US dollar, touching a low of $21450 on 13th Feb.

We have seen a bearish opening of the markets this week.

We can clearly see the evening star pattern below the $23432 handle which is a bearish reversal pattern because it signifies the end of an uptrend and a shift towards a downtrend.

Bitcoin touched an intraday high of 21839 in the Asian trading session and an intraday low of 21683 in the European trading session today.

We can see the formation of a three black crows pattern in the weekly time frame indicating bearish trends.

The Ichimoku price is under the cloud in the 2-hour time frame indicating bearish trends.

Both the STOCH and Williams percent range are indicating overbought levels which means that in the immediate short term a decline in the prices is expected.

The RSI indicator is back under 50 in the 2-hour time frame indicating the bearish nature of the markets.

The relative strength index is at 48.77 indicating a NEUTRAL demand for bitcoin, and the shift towards the consolidation phase in the markets.

Bitcoin is now moving below its 100 hourly simple moving average and below its 100 hourly exponential moving averages.

Some of the major technical indicators are giving a SELL signal, which means that in the immediate short term, we are expecting targets of 21000 and 20500.

The average true range is indicating LESS market volatility with a mildly bearish momentum.

- Bitcoin: bearish reversal seen below $23432.

- The commodity channel index is indicating a NEUTRAL level.

- The price is now trading just below its pivot levels of $21764.

- The short-term range is mildly bearish.

Bitcoin: Bearish Reversal Seen Below $23432

The price of Bitcoin was unable to cross the $24K mark last week, and we can see a continuous fall in the levels now trading below the $22K handle.

As some of the technical indicators are also giving a neutral stance of the markets, we are expecting that a bullish reversal is possible after touching the $20500 level.

We have also detected the formation of bearish engulfing lines in the 30-minute time frame.

The MACD crosses down its moving average in the 15-minute time frame indicating the bearish nature of the markets.

We can see the formation of a bearish price crossover pattern with the adaptive moving average AMA20 in both the 30-minute and 2-hour time frames.

The immediate short-term outlook for bitcoin is mildly bearish, the medium-term outlook has turned bearish, and the long-term outlook remains neutral under present market conditions.

Bitcoin’s support zone is located at $20027 at which the price crosses the 40-day moving average, and at $20937 at which the price crosses the 18-day moving average stalls.

The price of BTCUSD is now facing its classic support level of 21703 and Fibonacci support level of 21502 after which the path towards 21000 will get cleared.

In the last 24hrs BTCUSD has increased by 0.57% by 122.76$ and has a 24hr trading volume of USD 21.364 billion. We can see an increase of 0.42% in the trading volume compared to yesterday, which appears to be normal.

The Week Ahead

Bitcoin is now facing the extended crypto winter due to which the prices are unable to rise above the $25000 level.

We are now heading towards the $21500 level this week.

The daily RSI is printing at 47.08 which indicates a NEUTRAL demand for bitcoin and the continuation of the bearish phase present in the markets in the short-term range.

We can see the formation of a bearish trend line from $23432 towards the $21576 level.

The price of BTCUSD is now facing its support zone located at $20884 which is a 38.2% retracement from a 13-week high.

The weekly outlook is projected at $21000 with a consolidation zone of $20500.

Technical Indicators:

The average directional index (14): It is at 28.57 indicating a SELL.

The ultimate oscillator: It is at 39.72 indicating a SELL.

The rate of price change: It is at -5.67 indicating a SELL.

Bull/bear power (13): It is at -1085.58 indicating a SELL.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.