FXOpen Trader

Active Member

GBP/USD Faces Resistance While EUR/GBP Eyes More Gains

GBP/USD started a fresh increase above the 1.2150 resistance. EUR/GBP is showing positive signs above the 0.8550 resistance zone.

Important Takeaways for GBP/USD and EUR/GBP

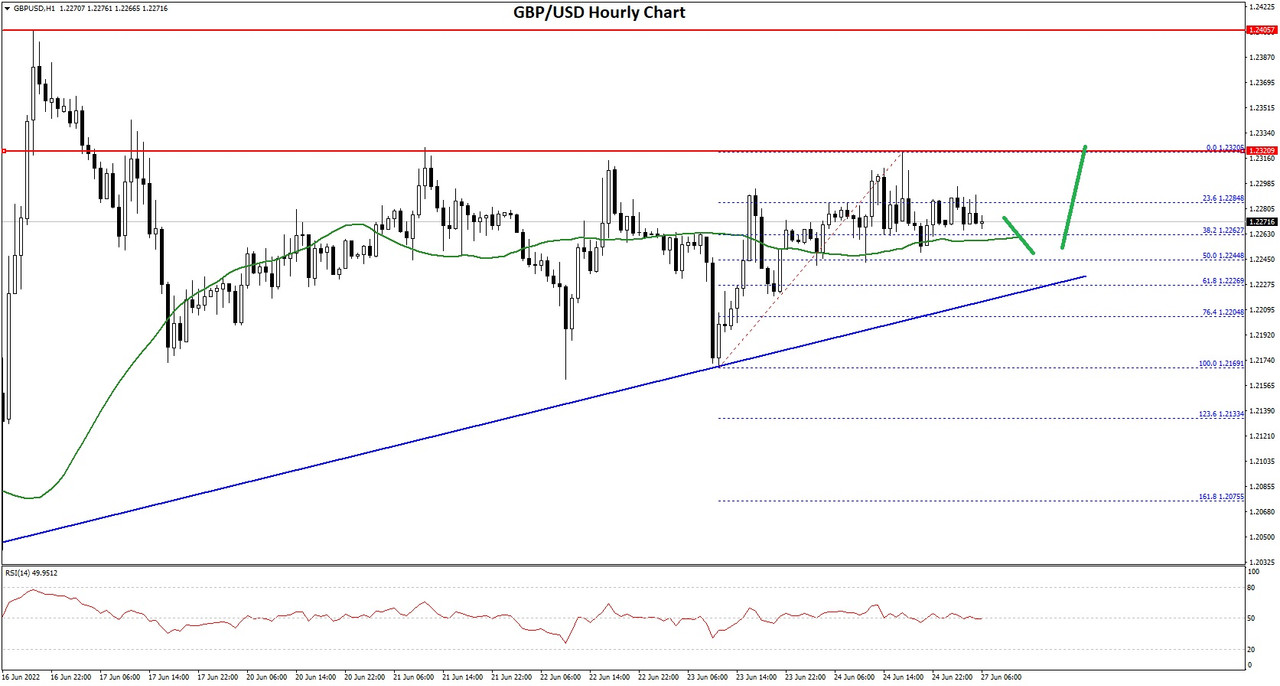

GBP/USD Technical Analysis

The British Pound remained well bid above the 1.1920 zone against the US Dollar. The GBP/USD pair started a decent increase after it broke the 1.2000 resistance.

There was a clear move above the 1.2100 level and the 50 hourly simple moving average. The bulls were even able to clear the 1.2150 resistance. However, the pair struggled near the 1.2400 resistance and started a downside correction.

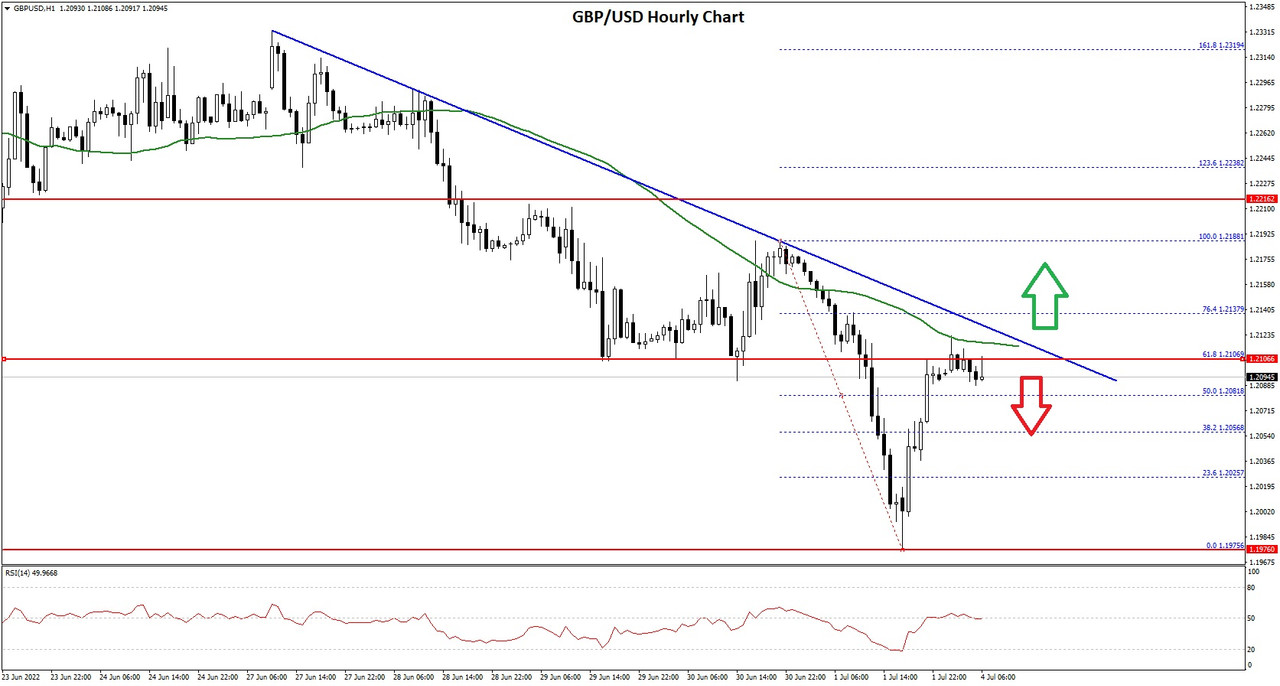

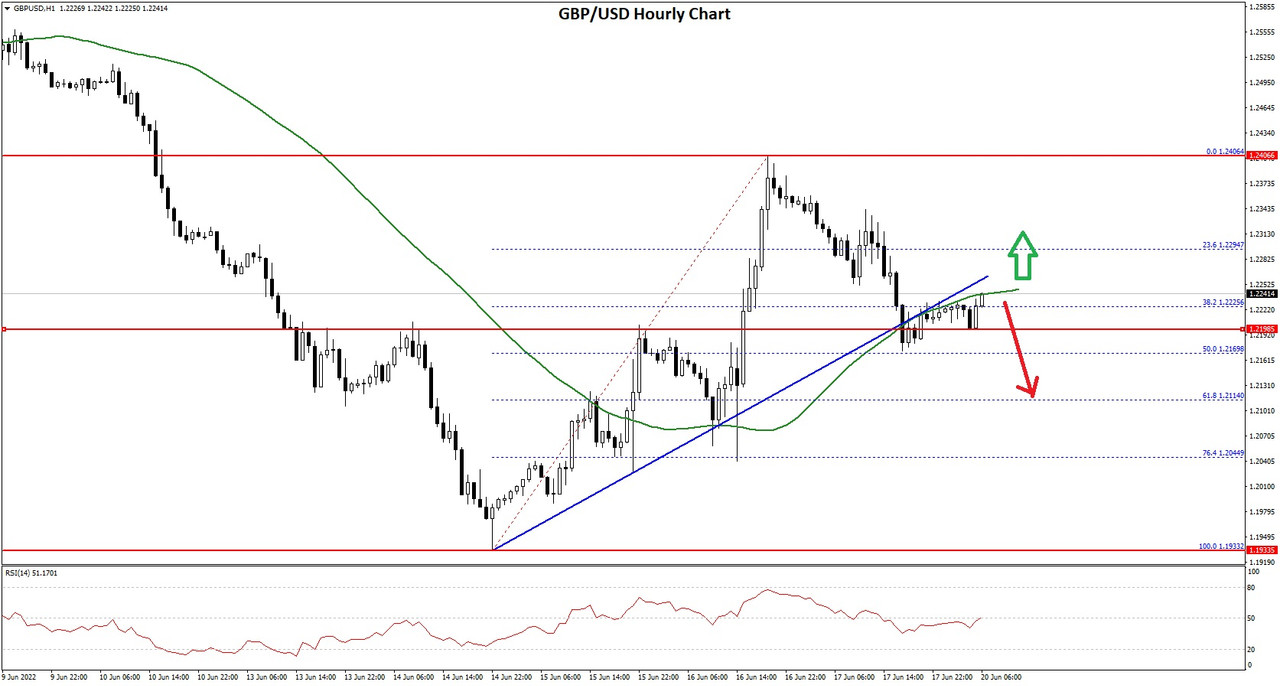

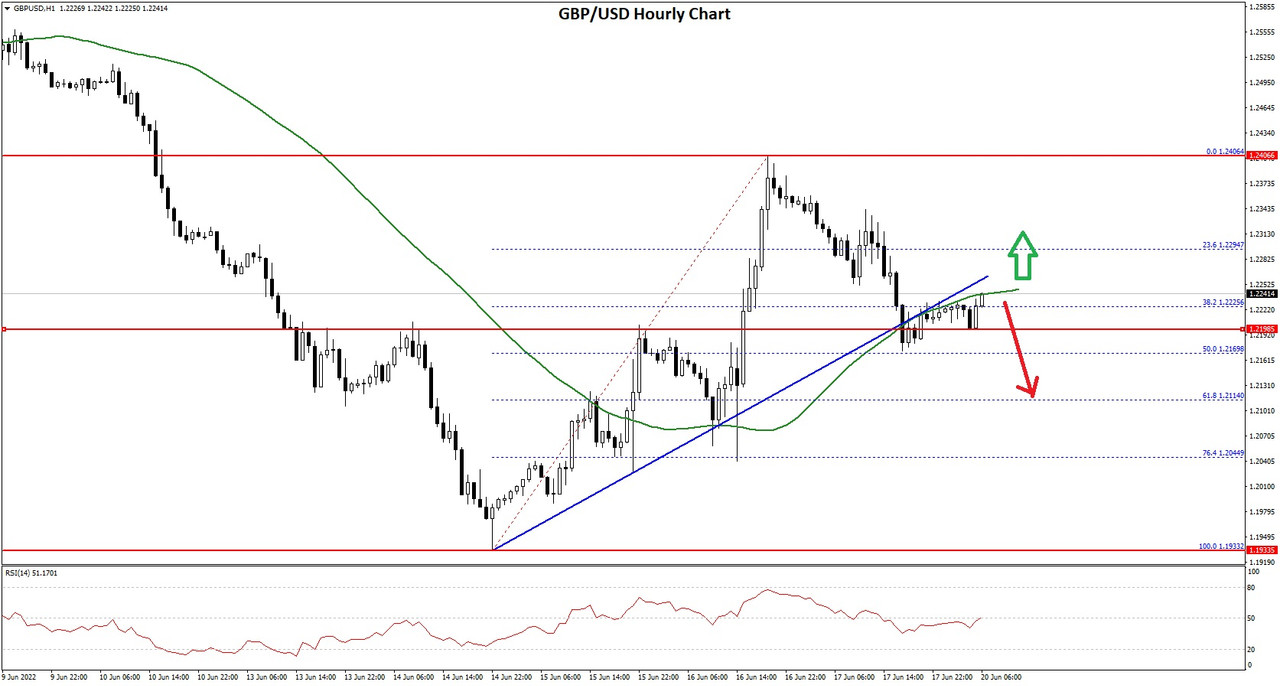

GBP/USD Hourly Chart

There was a break below a key bullish trend line with support near 1.2220 on the hourly chart of GBP/USD. The pair traded below the 38.2% Fib retracement level of the upward move from the 1.1933 swing low to 1.2406 high (formed on FXOpen).

The pair tested the 50% Fib retracement level of the upward move from the 1.1933 swing low to 1.2406 high. It is now rising and trading above the 1.2240 level.

On the upside, an initial resistance is near the 1.2280 level. The next main resistance is near the 1.2320 zone. A clear upside break above the 1.2320 and 1.2330 resistance levels could open the doors for a steady increase in the near term. The next major resistance sits near the 1.2400 level.

If not, the pair might start a fresh decline below 1.2180. The next major support is near the 1.2150 level. Any more losses could lead the pair towards the 1.2050 support zone or even 1.2020.

Read Full on FXOpen Company Blog...

GBP/USD started a fresh increase above the 1.2150 resistance. EUR/GBP is showing positive signs above the 0.8550 resistance zone.

Important Takeaways for GBP/USD and EUR/GBP

- The British Pound started a decent increase above 1.2150 against the US Dollar.

- There was a break below a key bullish trend line with support near 1.2220 on the hourly chart of GBP/USD.

- EUR/GBP is holding the 0.8580 support but struggling above 0.8600.

- There is a major bullish trend line forming with support near 0.8570 on the hourly chart.

GBP/USD Technical Analysis

The British Pound remained well bid above the 1.1920 zone against the US Dollar. The GBP/USD pair started a decent increase after it broke the 1.2000 resistance.

There was a clear move above the 1.2100 level and the 50 hourly simple moving average. The bulls were even able to clear the 1.2150 resistance. However, the pair struggled near the 1.2400 resistance and started a downside correction.

GBP/USD Hourly Chart

There was a break below a key bullish trend line with support near 1.2220 on the hourly chart of GBP/USD. The pair traded below the 38.2% Fib retracement level of the upward move from the 1.1933 swing low to 1.2406 high (formed on FXOpen).

The pair tested the 50% Fib retracement level of the upward move from the 1.1933 swing low to 1.2406 high. It is now rising and trading above the 1.2240 level.

On the upside, an initial resistance is near the 1.2280 level. The next main resistance is near the 1.2320 zone. A clear upside break above the 1.2320 and 1.2330 resistance levels could open the doors for a steady increase in the near term. The next major resistance sits near the 1.2400 level.

If not, the pair might start a fresh decline below 1.2180. The next major support is near the 1.2150 level. Any more losses could lead the pair towards the 1.2050 support zone or even 1.2020.

Read Full on FXOpen Company Blog...