FXOpen Trader

Active Member

ETHUSD and LTCUSD Technical Analysis – 29th SEP, 2022

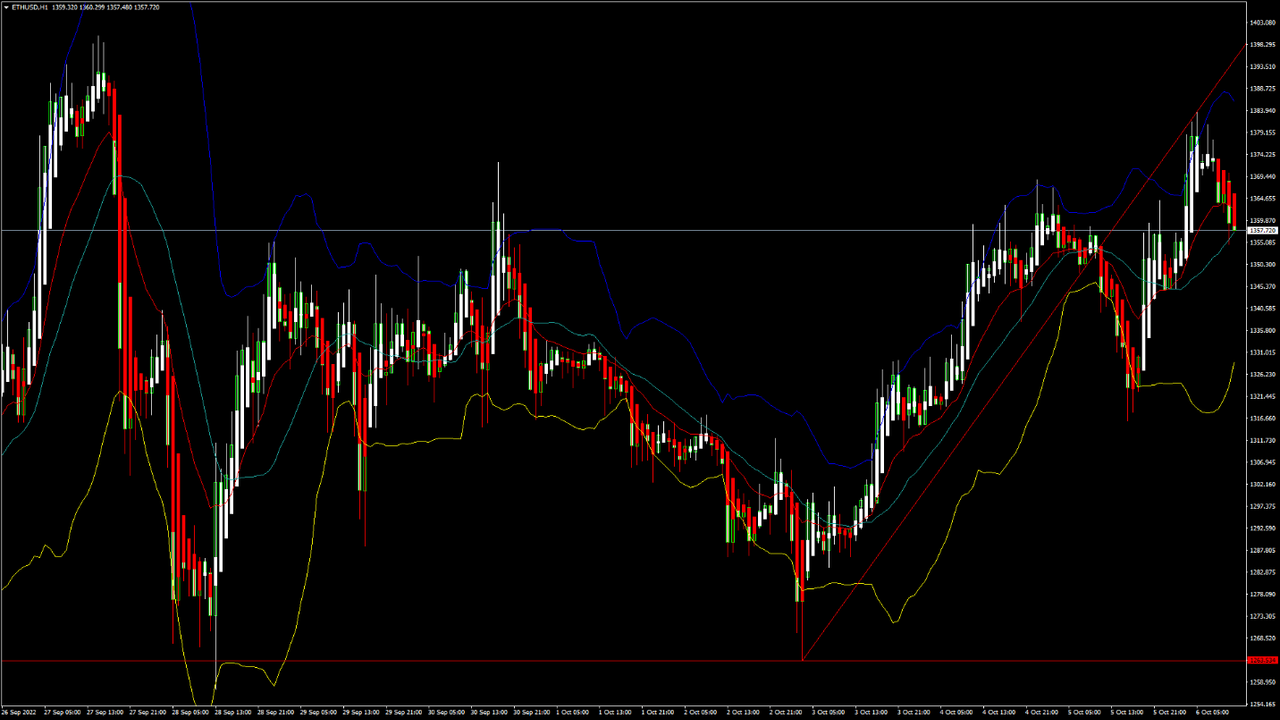

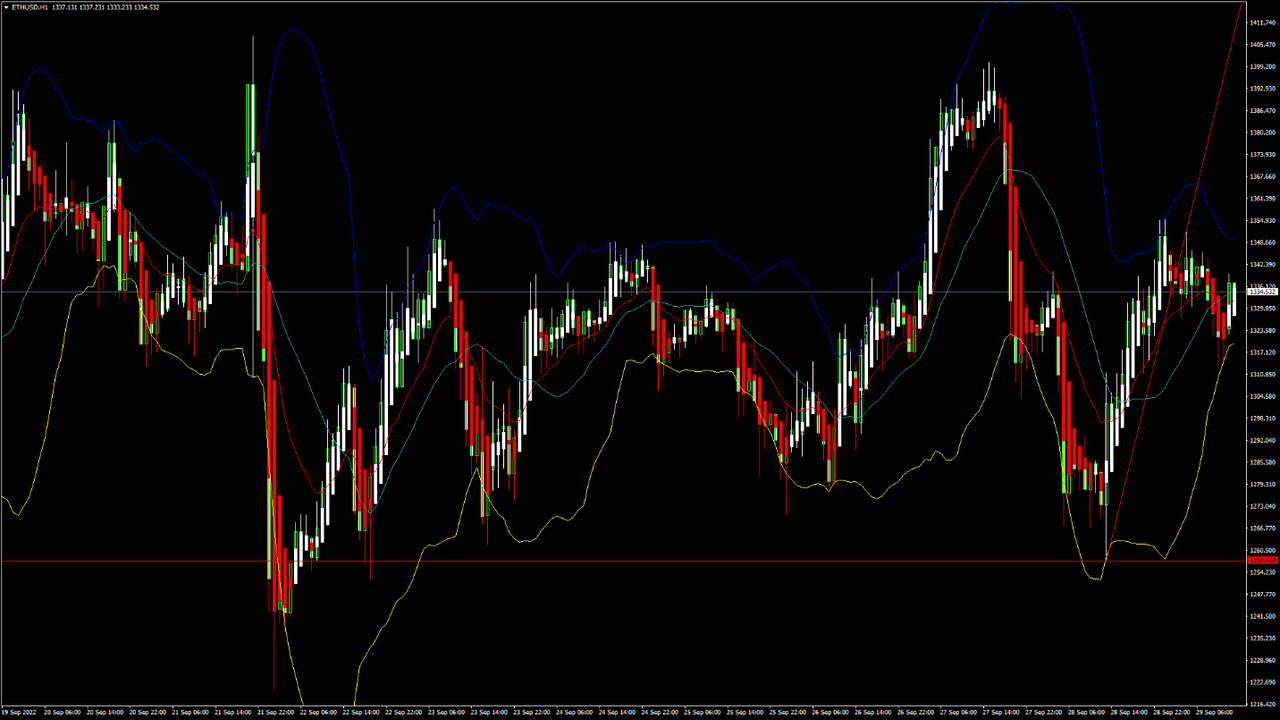

ETHUSD: Bullish Engulfing Pattern Above $1257

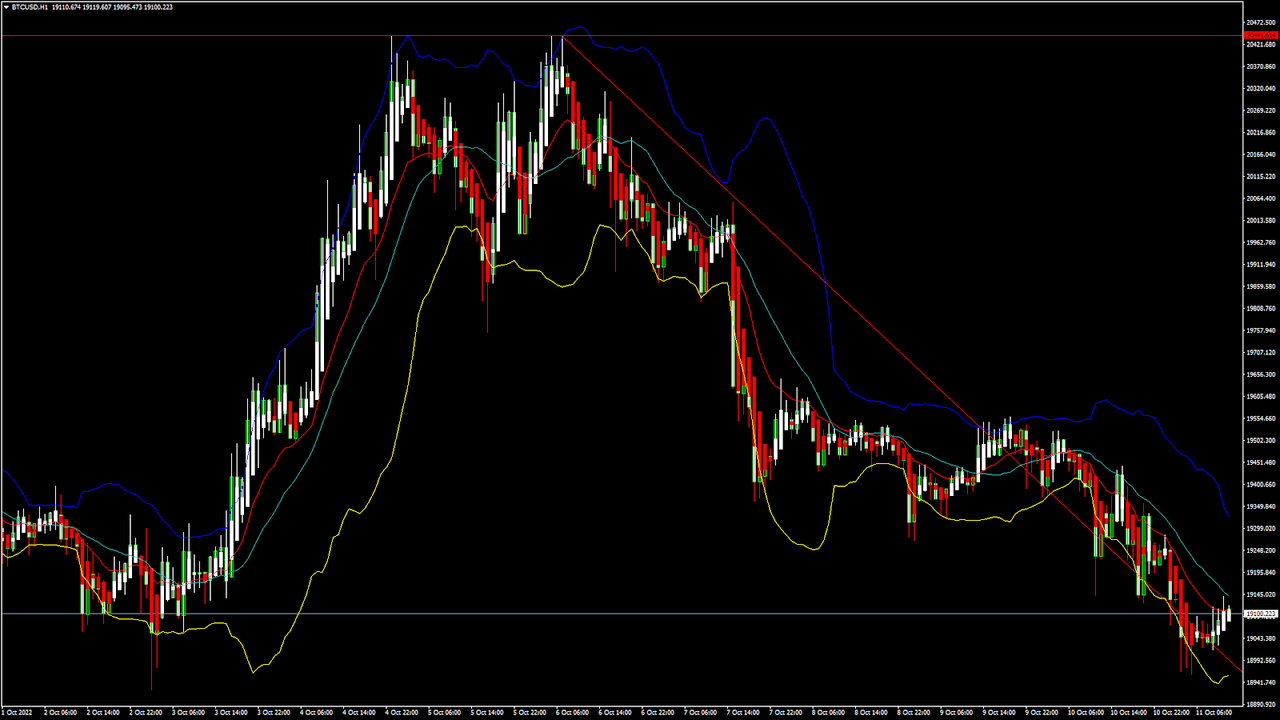

Ethereum was unable to sustain its bullish momentum and after touching a high of 1400 on 27th Sep the price started to decline against the US dollar. The price of Ethereum touched a low of 1266 on 28th Sep after which we can see a bounce upwards.

We can see a continued buying pressure today and the formation of a bullish engulfing line in the 2-hour time frame.

We can clearly see a bullish engulfing pattern above the $1257 handle which is a bullish pattern and signifies the end of a bearish phase and the start of a bullish phase in the markets.

ETH is now trading just above its pivot level of 1321 and moving into a strong bullish channel. The price of ETHUSD is now testing its сlassic resistance level of 1327 and Fibonacci resistance level of 1331 after which the path towards 1400 will get cleared.

The relative strength index is at 53 indicating a NEUTRAL demand for Ether and a shift towards the consolidation phase in the markets.

We can see that the adaptive moving average AMA20, AMA50, and AMA100 are giving a bullish trend reversal signal in the markets.

The STOCHRSI and Williams percent range is indicating a NEUTRAL market, which means that the prices are expected to remain in a consolidation phase in the short-term range.

Some of the technical indicators are giving a STRONG BUY market signal.

Most of the moving averages are giving a BUY signal and we are now looking at the levels of $1400 to $1550 in the short-term range.

ETH is now trading above both its 100 & 200 hourly simple and exponential moving averages.

Ether: Bullish Reversal Seen Above $1257

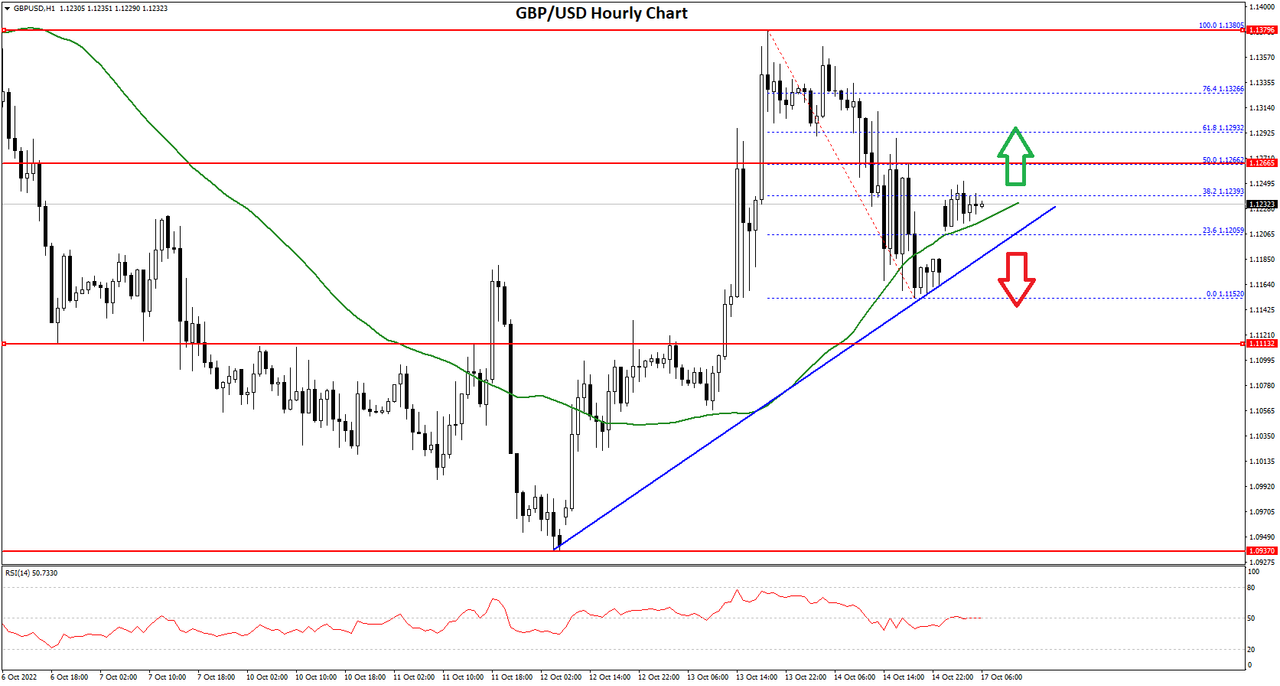

ETHUSD is moving in a mildly bullish channel with the price trading above the $1300 handle in the European trading session today.

ETH touched an intraday high of 1351 in the Asian trading session and an intraday low of 1313 in the European trading session today.

We have seen that the ichimoku price is over the cloud in the 1-hour time frame indicating a bullish scenario.

The Bullish harami pattern is observed in the weekly timeframe and MACD indicator is giving a bullish divergence signal in the 4-hour time frame.

The parabolic SAR indicator is giving a bullish reversal signal in the 30-minute time frame and now we are looking at the levels of 1450 to 1500 in the medium-term range.

The daily RSI is printing at 40 indicating a neutral demand in the long-term range.

The key support levels to watch are $1245 and $1285 and the prices of ETHUSD need to remain above these levels for the continuation of the bullish reversal in the markets.

ETH has increased by 4.27% with a price change of 54.65$ in the past 24hrs and has a trading volume of 16.127 billion USD.

We can see a decrease of 13.25% in the total trading volume in the last 24 hrs which is due to the shift towards a consolidation phase in the markets.

The Week Ahead

The price of Ethereum declined due the ongoing strength of the United States dollar and the increase in the market liquidity. We can see that now we are moving into a consolidation zone and the prices tend to move in a narrow range.

We are now looking for a fresh upside wave of correction towards the $1500 and $1600 levels.

We can see the formation of a bullish trendline in place from $1257 towards $1491 level.

The immediate short-term outlook for Ether has turned mildly BULLISH, the medium-term outlook has turned BULLISH, and the long-term outlook for Ether is NEUTRAL in present market conditions.

The prices of ETHUSD will need to remain above the important support level of $1250 this week.

The weekly outlook is projected at $1550 with a consolidation zone of $1500.

Technical Indicators:

The average directional change (14): is at 25.71 indicating a BUY

The rate of price change: is at 0.156 indicating a BUY

The bull/bear power (13): is at 1.606 indicating a BUY

The ultimate oscillator: is at 56.76 indicating a BUY

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.

ETHUSD: Bullish Engulfing Pattern Above $1257

Ethereum was unable to sustain its bullish momentum and after touching a high of 1400 on 27th Sep the price started to decline against the US dollar. The price of Ethereum touched a low of 1266 on 28th Sep after which we can see a bounce upwards.

We can see a continued buying pressure today and the formation of a bullish engulfing line in the 2-hour time frame.

We can clearly see a bullish engulfing pattern above the $1257 handle which is a bullish pattern and signifies the end of a bearish phase and the start of a bullish phase in the markets.

ETH is now trading just above its pivot level of 1321 and moving into a strong bullish channel. The price of ETHUSD is now testing its сlassic resistance level of 1327 and Fibonacci resistance level of 1331 after which the path towards 1400 will get cleared.

The relative strength index is at 53 indicating a NEUTRAL demand for Ether and a shift towards the consolidation phase in the markets.

We can see that the adaptive moving average AMA20, AMA50, and AMA100 are giving a bullish trend reversal signal in the markets.

The STOCHRSI and Williams percent range is indicating a NEUTRAL market, which means that the prices are expected to remain in a consolidation phase in the short-term range.

Some of the technical indicators are giving a STRONG BUY market signal.

Most of the moving averages are giving a BUY signal and we are now looking at the levels of $1400 to $1550 in the short-term range.

ETH is now trading above both its 100 & 200 hourly simple and exponential moving averages.

- Ether: bullish reversal seen above the $1257 mark

- The short-term range appears to be mildly BULLISH

- ETH continues to remain above the $1300 level

- The average true range is indicating LESS market volatility

Ether: Bullish Reversal Seen Above $1257

ETHUSD is moving in a mildly bullish channel with the price trading above the $1300 handle in the European trading session today.

ETH touched an intraday high of 1351 in the Asian trading session and an intraday low of 1313 in the European trading session today.

We have seen that the ichimoku price is over the cloud in the 1-hour time frame indicating a bullish scenario.

The Bullish harami pattern is observed in the weekly timeframe and MACD indicator is giving a bullish divergence signal in the 4-hour time frame.

The parabolic SAR indicator is giving a bullish reversal signal in the 30-minute time frame and now we are looking at the levels of 1450 to 1500 in the medium-term range.

The daily RSI is printing at 40 indicating a neutral demand in the long-term range.

The key support levels to watch are $1245 and $1285 and the prices of ETHUSD need to remain above these levels for the continuation of the bullish reversal in the markets.

ETH has increased by 4.27% with a price change of 54.65$ in the past 24hrs and has a trading volume of 16.127 billion USD.

We can see a decrease of 13.25% in the total trading volume in the last 24 hrs which is due to the shift towards a consolidation phase in the markets.

The Week Ahead

The price of Ethereum declined due the ongoing strength of the United States dollar and the increase in the market liquidity. We can see that now we are moving into a consolidation zone and the prices tend to move in a narrow range.

We are now looking for a fresh upside wave of correction towards the $1500 and $1600 levels.

We can see the formation of a bullish trendline in place from $1257 towards $1491 level.

The immediate short-term outlook for Ether has turned mildly BULLISH, the medium-term outlook has turned BULLISH, and the long-term outlook for Ether is NEUTRAL in present market conditions.

The prices of ETHUSD will need to remain above the important support level of $1250 this week.

The weekly outlook is projected at $1550 with a consolidation zone of $1500.

Technical Indicators:

The average directional change (14): is at 25.71 indicating a BUY

The rate of price change: is at 0.156 indicating a BUY

The bull/bear power (13): is at 1.606 indicating a BUY

The ultimate oscillator: is at 56.76 indicating a BUY

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.