Vlad RF

Well-Known Member

How To Trade the Abandoned Baby Pattern

Author : Victor Gryazin

Dear Clients and Partners,

In this review, we will get acquainted with the candlestick analysis strong reversal pattern "Abandoned Baby". Let's look at the features of its formation, and the trading techniques for this pattern.

How the “Abandoned Baby” pattern is formed

The Abandoned Baby candlestick pattern is a rare, strong reversal pattern that forms on the local highs and lows of the price chart. It consists of three candlesticks. The first one has a normal body, and the second one is a doji candle (it has practically no body, the open and close prices being almost the same). The third one closes in the opposite direction to the first candlestick. The second candlestick should have gaps (price gaps) on both sides.

As noted by the guru of candlestick analysis Steve Nison, the appearance of a doji after a strong white candlestick indicates the current overbought state of the financial instrument. And vice versa: the appearance of a doji after a black candlestick indicates an oversold condition of the asset. In the "Abandoned Baby" pattern, a doji opens with a gap from the first candlestick, followed by a gap in the opposite direction, with the third candlestick closing thereafter to confirm the reversal.

"Abandoned Baby" is very similar to "Morning Star" and "Evening Star" in its formation principle, but differs in the appearance of a doji candlestick with a gap on both sides. "Morning Star" and "Evening Star" do not require the average candlestick to be a doji or have gaps on both sides, so they are much more common on price charts.

“Bullish” pattern “Abandoned baby”

This is formed during a downtrend, at the lows of the price chart. The first black candlestick appears first. Against the backdrop of negative market sentiment, the next trading session opens with a gap down, but the "bears" do not succeed, and a doji appears on the chart. Seeing the weakness of the sellers, the bulls seize the initiative: the third candlestick opens with a gap up and closes with a confident white body.

A bullish "Abandoned Baby" reversal pattern forms on the chart as a result. Buyers have managed to seize the initiative, and are ready to keep pushing the price up. If the "bears" fail to close the gaps and drop the quotations below the doji low, the "bulls" are likely to go on the offensive and initiate an upward correction or even a trend reversal.

How to buy on the bullish “Abandoned Baby” pattern

How to sell on the bearish “Abandoned Baby” pattern

Sincerely,

RoboForex team

Author : Victor Gryazin

Dear Clients and Partners,

In this review, we will get acquainted with the candlestick analysis strong reversal pattern "Abandoned Baby". Let's look at the features of its formation, and the trading techniques for this pattern.

How the “Abandoned Baby” pattern is formed

The Abandoned Baby candlestick pattern is a rare, strong reversal pattern that forms on the local highs and lows of the price chart. It consists of three candlesticks. The first one has a normal body, and the second one is a doji candle (it has practically no body, the open and close prices being almost the same). The third one closes in the opposite direction to the first candlestick. The second candlestick should have gaps (price gaps) on both sides.

As noted by the guru of candlestick analysis Steve Nison, the appearance of a doji after a strong white candlestick indicates the current overbought state of the financial instrument. And vice versa: the appearance of a doji after a black candlestick indicates an oversold condition of the asset. In the "Abandoned Baby" pattern, a doji opens with a gap from the first candlestick, followed by a gap in the opposite direction, with the third candlestick closing thereafter to confirm the reversal.

"Abandoned Baby" is very similar to "Morning Star" and "Evening Star" in its formation principle, but differs in the appearance of a doji candlestick with a gap on both sides. "Morning Star" and "Evening Star" do not require the average candlestick to be a doji or have gaps on both sides, so they are much more common on price charts.

“Bullish” pattern “Abandoned baby”

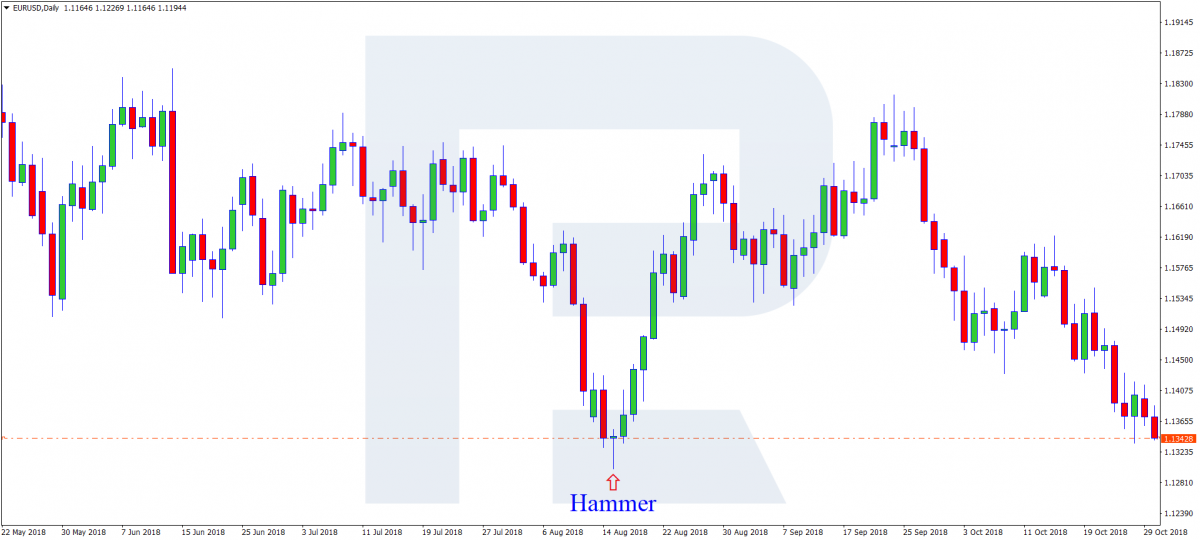

This is formed during a downtrend, at the lows of the price chart. The first black candlestick appears first. Against the backdrop of negative market sentiment, the next trading session opens with a gap down, but the "bears" do not succeed, and a doji appears on the chart. Seeing the weakness of the sellers, the bulls seize the initiative: the third candlestick opens with a gap up and closes with a confident white body.

A bullish "Abandoned Baby" reversal pattern forms on the chart as a result. Buyers have managed to seize the initiative, and are ready to keep pushing the price up. If the "bears" fail to close the gaps and drop the quotations below the doji low, the "bulls" are likely to go on the offensive and initiate an upward correction or even a trend reversal.

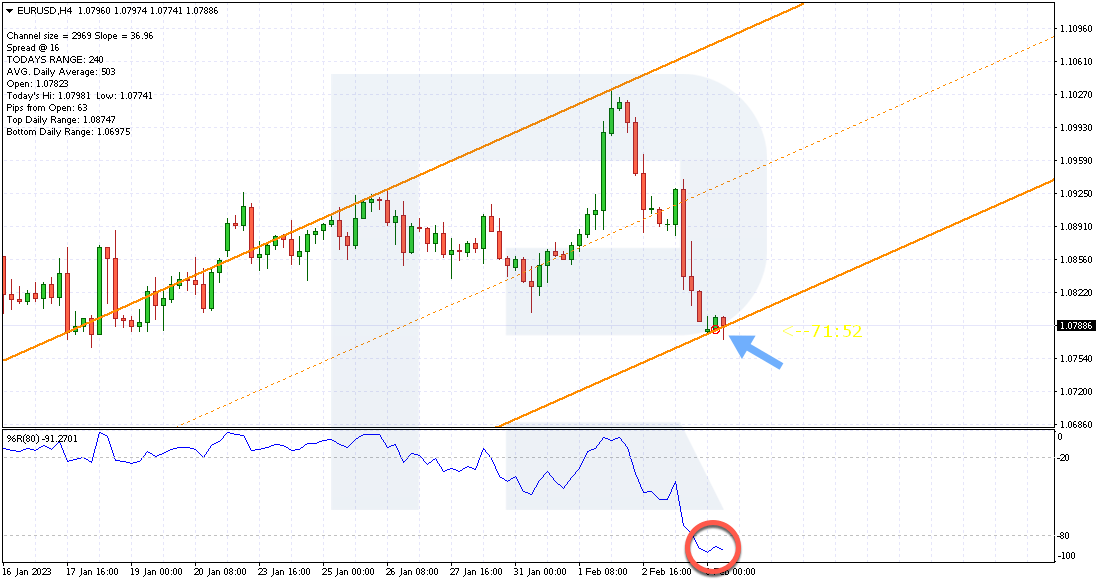

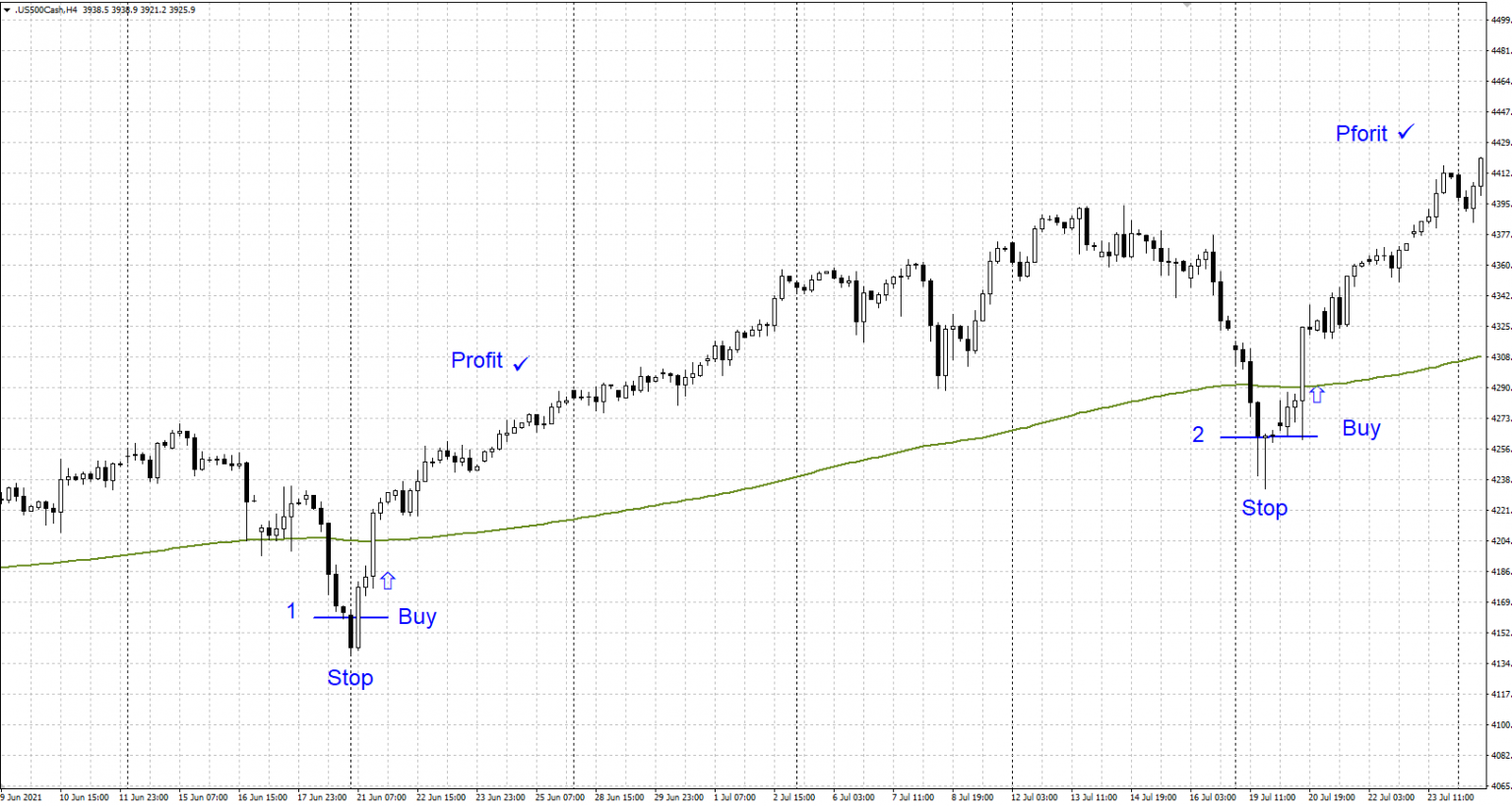

How to buy on the bullish “Abandoned Baby” pattern

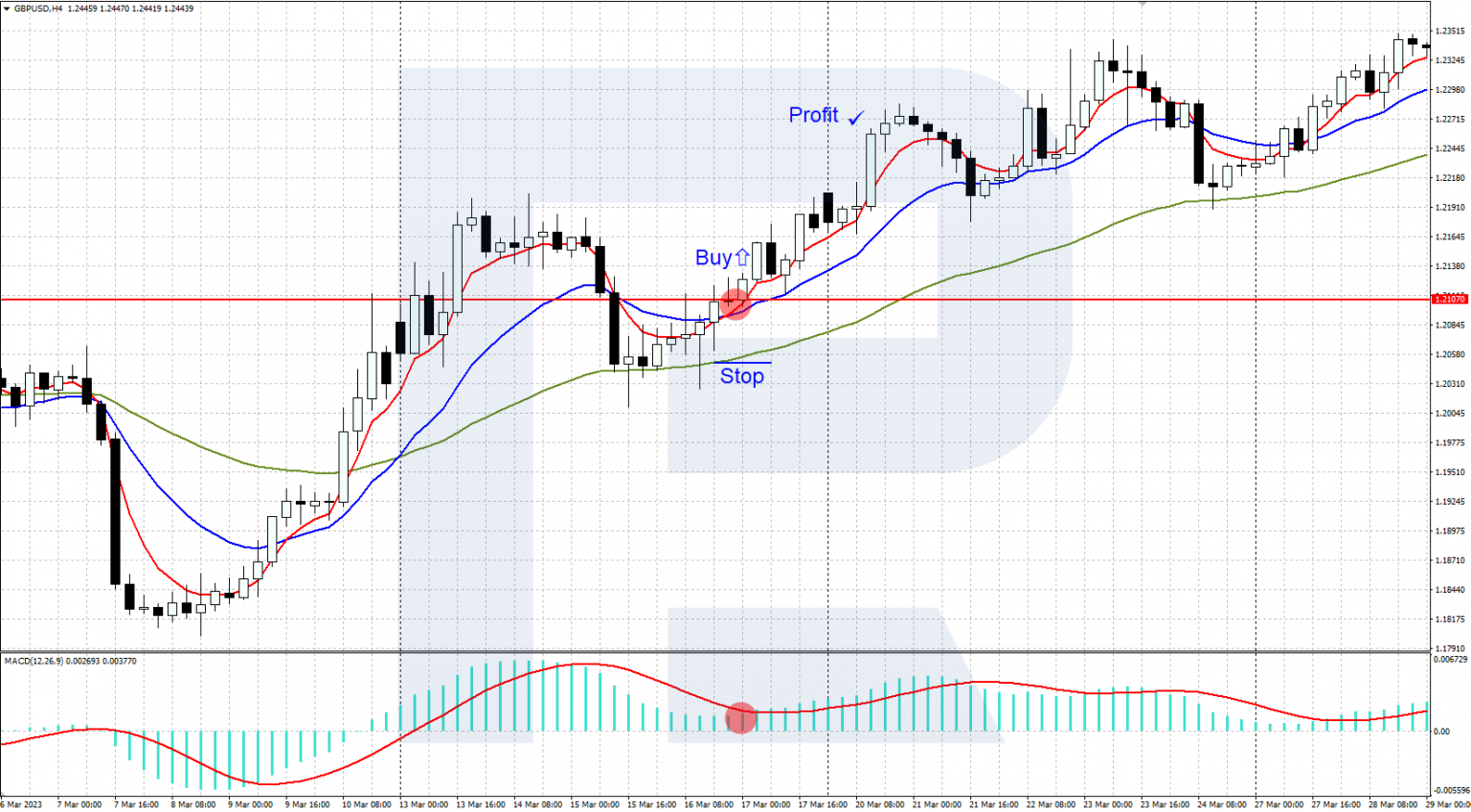

- During a downtrend, a bullish "Abandoned Baby" pattern appears on the local lows of the price chart

- It is advisable to open a buy position when the price rises above the maximum of the third white candlestick in the pattern. Stop Loss is set at the doji low

- To set Take Profit, you can be guided by Fibonacci retracement levels from the previous downtrend, significant support, and resistance levels

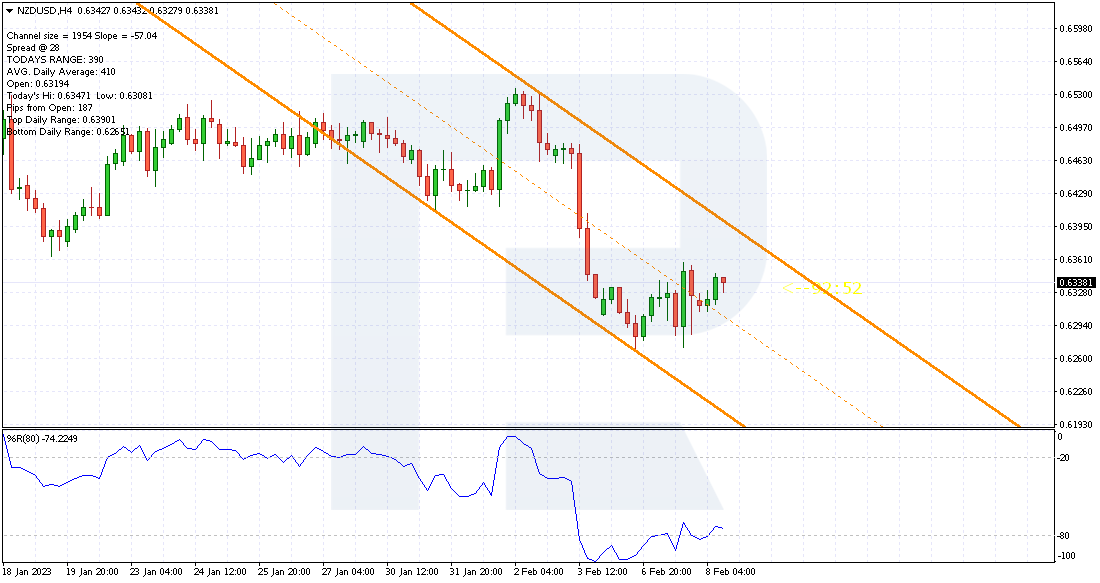

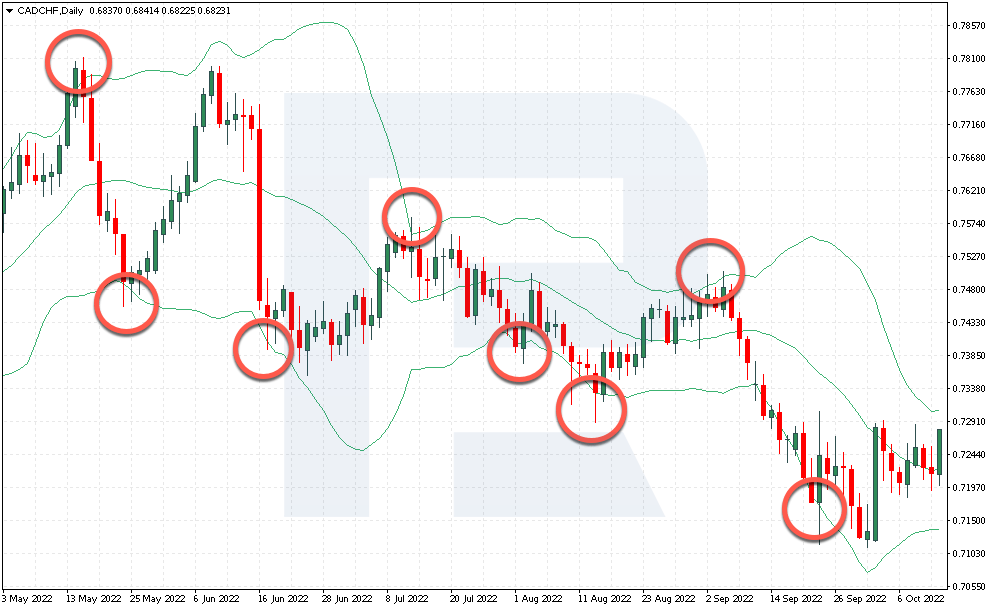

How to sell on the bearish “Abandoned Baby” pattern

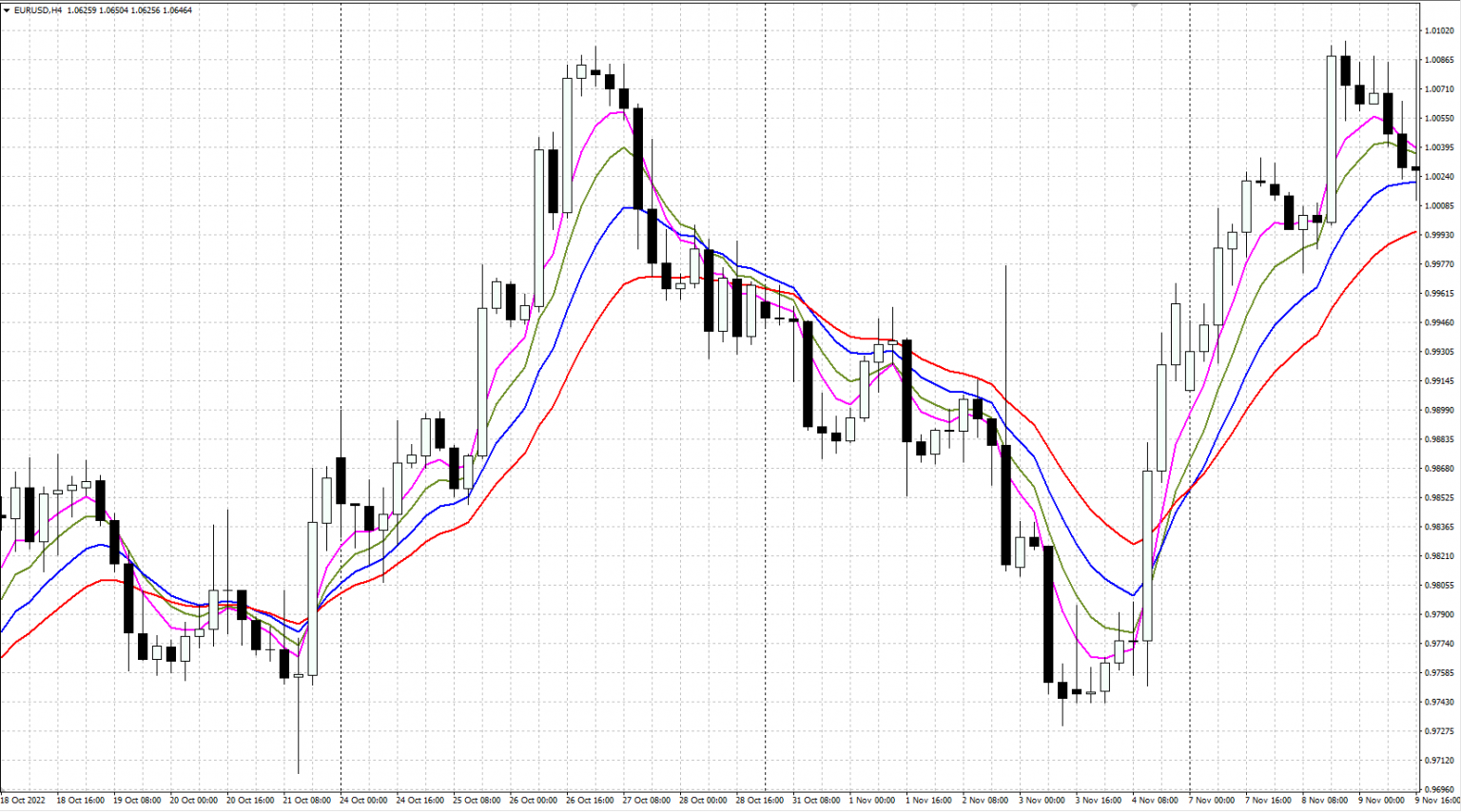

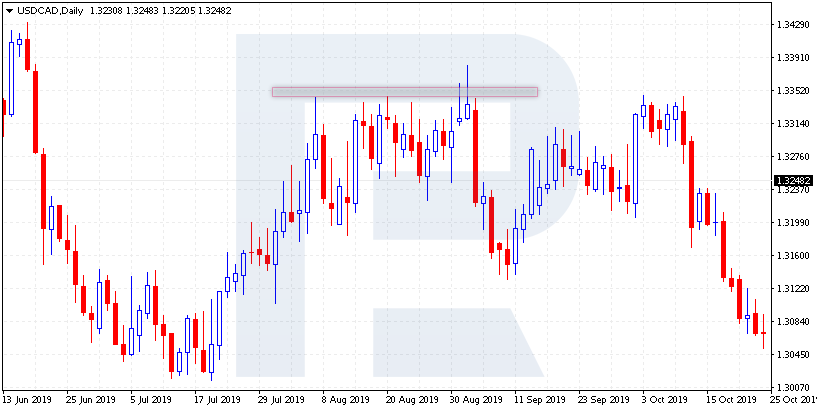

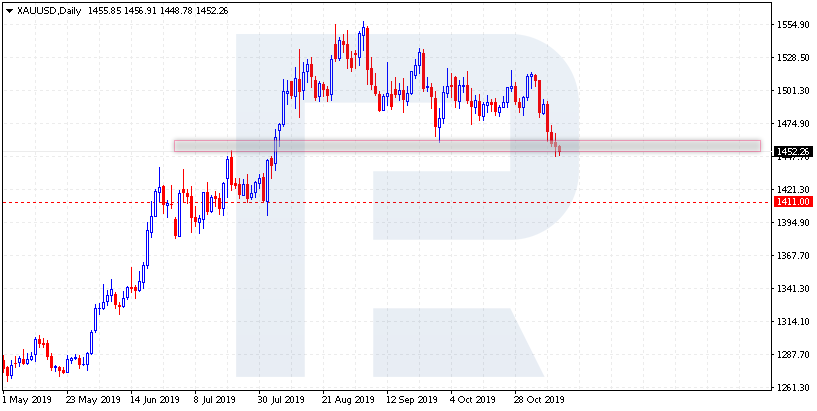

- During the upward trend, a bearish "Abandoned Baby" pattern is formed at the local highs on the price chart.

- A sell position can be opened after the price decreases below the third black candlestick in the pattern. Stop Loss is set at the doji's maximum.

Sincerely,

RoboForex team