Gold Price Struggles, Oil Price Consolidates Well above $50

Gold price made an attempt to surpass the $1,860 resistance, but there was a major rejection. Crude oil price seems to be consolidating gains above $51.50 and $51.20.

Important Takeaways for Gold and Oil

- Gold price is still trading below the main $1,860 and $1,880 resistance levels against the US Dollar.

- There is a major bearish trend line forming with resistance near $1,855 on the hourly chart of gold.

- Crude oil price seems to be facing a strong resistance near the $53.50 and $54.00 levels.

- There is likely an expanding triangle forming with support near $52.00 on the hourly chart of XTI/USD.

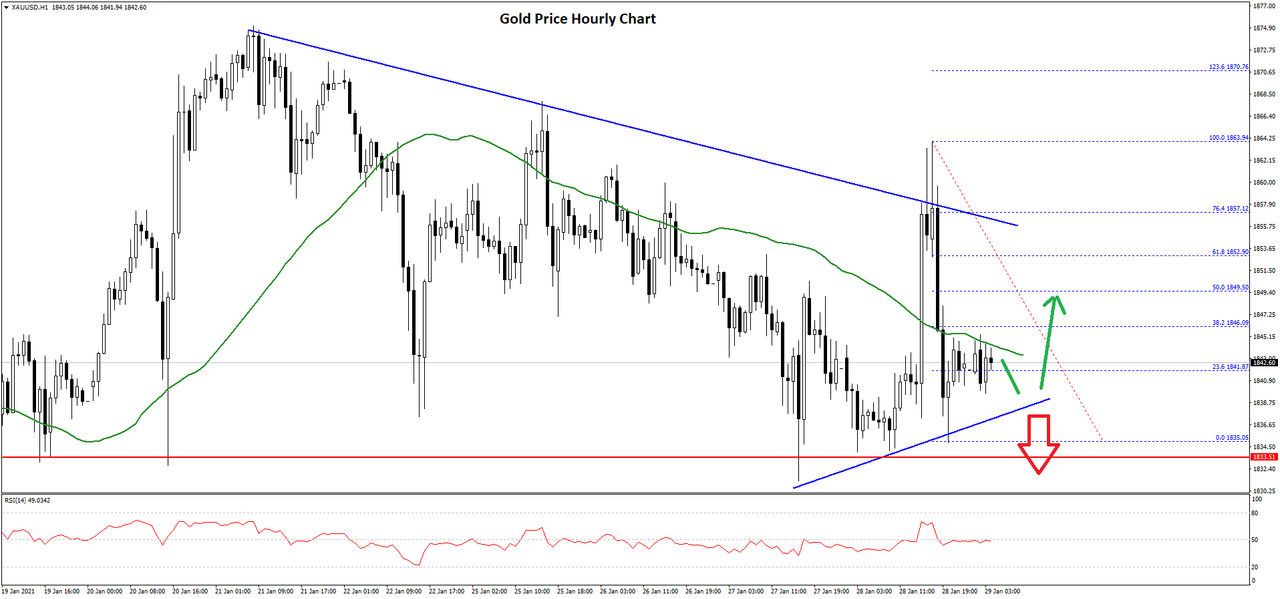

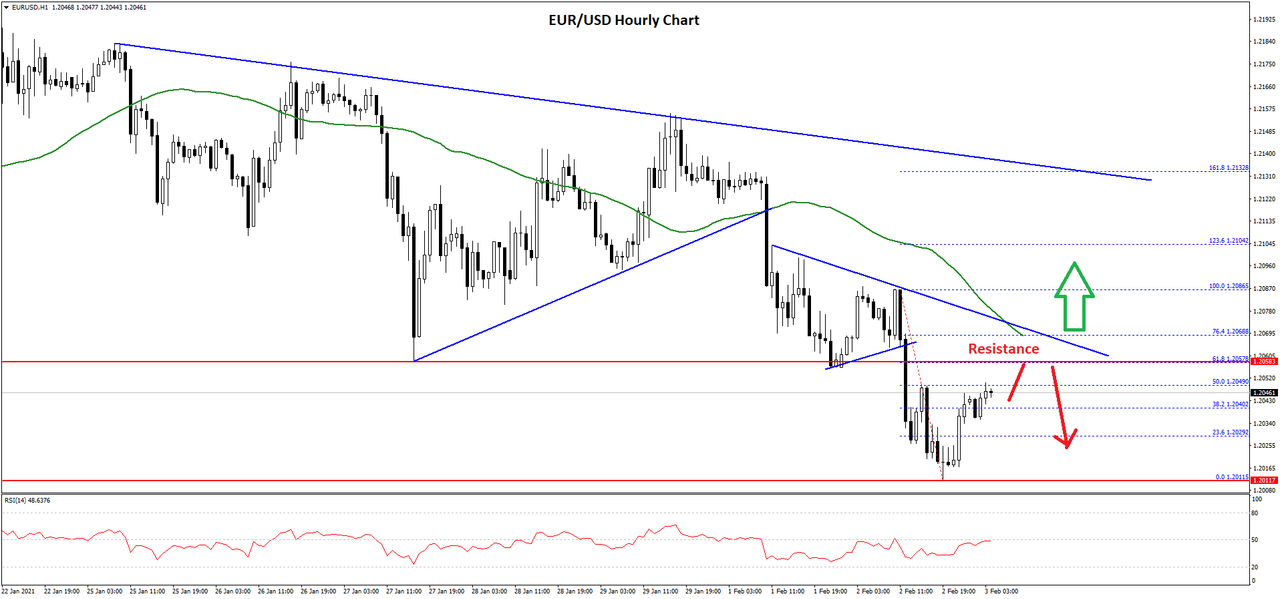

Gold Price Technical Analysis

Gold price settled below the main $1,900 pivot level to move into a bearish zone against the US Dollar. The price even settled below the $1,880 level and the 50 hourly simple moving average.

On the downside, the price is finding strong bids above the $1,830 and $1,835 levels. Recently, there was a sharp recovery above the $1,850 level and the 50 hourly simple moving average. However, the price failed to clear the $1,860 resistance level.

A high was formed near $1,863 on FXOpen before there was a fresh decline. A low is formed near $1,835 and the price is currently consolidating losses.

There was a break above the 23.6% Fib retracement level of the downward move from the $1,863 swing high to $1,838 low. It is now facing resistance near the $1,845 level and the 50 hourly simple moving average.

The next major resistance is near the $1,850 level. The 50% Fib retracement level of the downward move from the $1,863 swing high to $1,838 low is at $1,850. There is also a major bearish trend line forming with resistance near $1,855 on the hourly chart of gold.

On the downside, there is a connecting bullish trend line forming with support near $1,838. The first key support is near the $1,830 level. The next major support is at $1,820, below which the price might test the $1,800 support level.

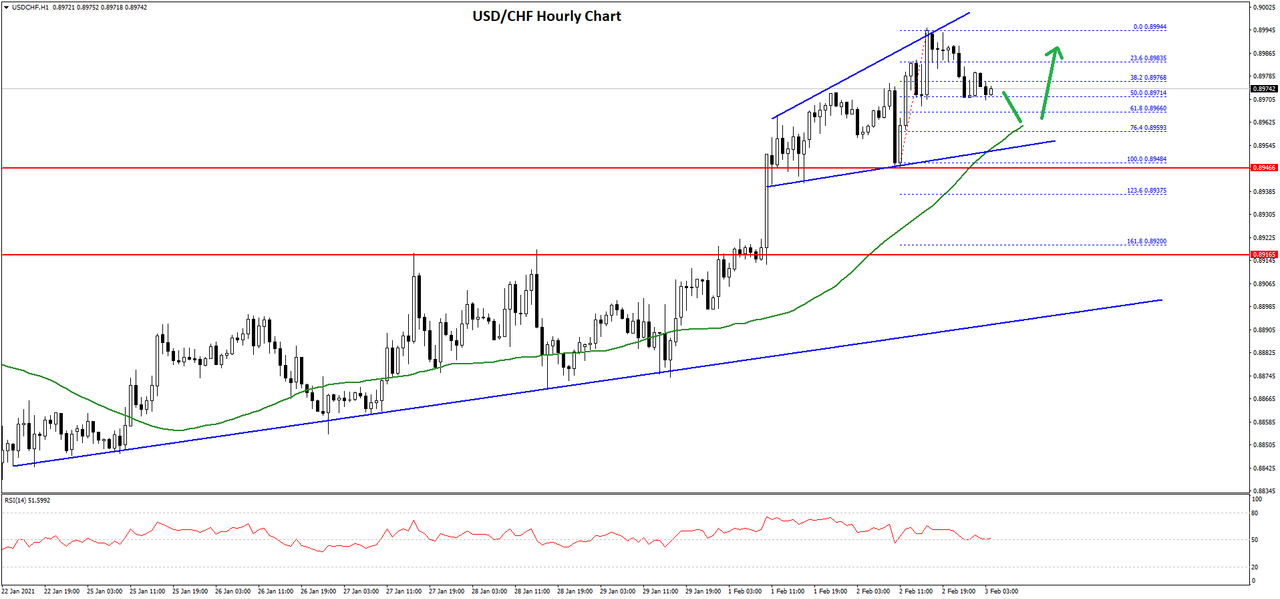

Oil Price Technical Analysis

Crude oil price remained in a strong uptrend well above the $50.00 resistance zone against the US Dollar. The price settled nicely above $52.00 and it even made a few attempts to gain strength above the $54.00 level.

The recent high was formed near $53.47 before the price trimmed most gains. It broke the $53.00 support and tested the $52.00 level.

A low is formed near $51.98 and the price is currently consolidating. It tested the 23.6% Fib retracement level of the recent decline from the $53.47 high to $51.98 low. The first major resistance is near the $52.55 level and the 50 hourly simple moving average.

The next key resistance is near the $52.75 level or the 50% Fib retracement level of the recent decline from the $53.47 high to $51.98 low.

Moreover, it seems like there is likely an expanding triangle forming with support near $52.00 on the hourly chart of XTI/USD. If there are more downsides below the triangle support, the price could test the $51.50 support.

The next key support is near the $51.20 level. On the upside, the $53.50 and $54.00 levels are major hurdles. A clear break above $54.00 may possibly lead the price towards the $55.00 level.