FXOpen Trader

Active Member

Gold Breaks Above $1,900 On Inflation Fears

Gold has long played an important role in financial markets. It is the only form of money that survived for millenniums, and investment managers value it as a hedge against inflation.

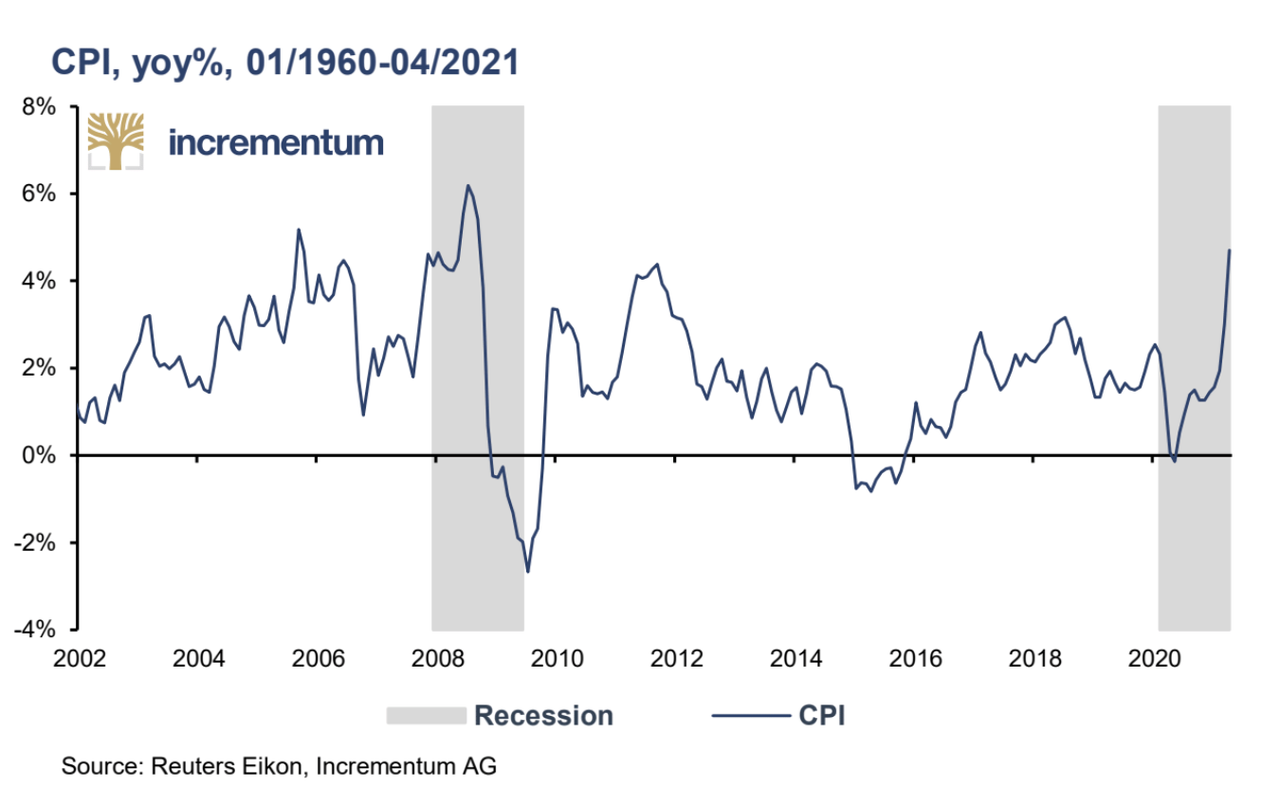

Inflation is on everyone´s lips nowadays. In April, the Consumer Price Index (CPI) in the United States has grown at the fastest pace since 1981. Both the core and the headline CPI are poised to rise further in the summer, as the US government and the Fed keep the accommodative measures.

Last week, the Personal Core Expenditure (PCE) in the United States rose by 0.7% on expectations of 0.6% and following 0.4% in the previous month. The upbeat data is important because the PCE measures the change in the price of goods and services purchased by consumers, without counting for energy and food prices, considered too volatile. Also, the PCE is the Fed´s favored way of measuring inflation, and the rise fuels expectations of higher inflation in the months ahead.

Two Different Recessions

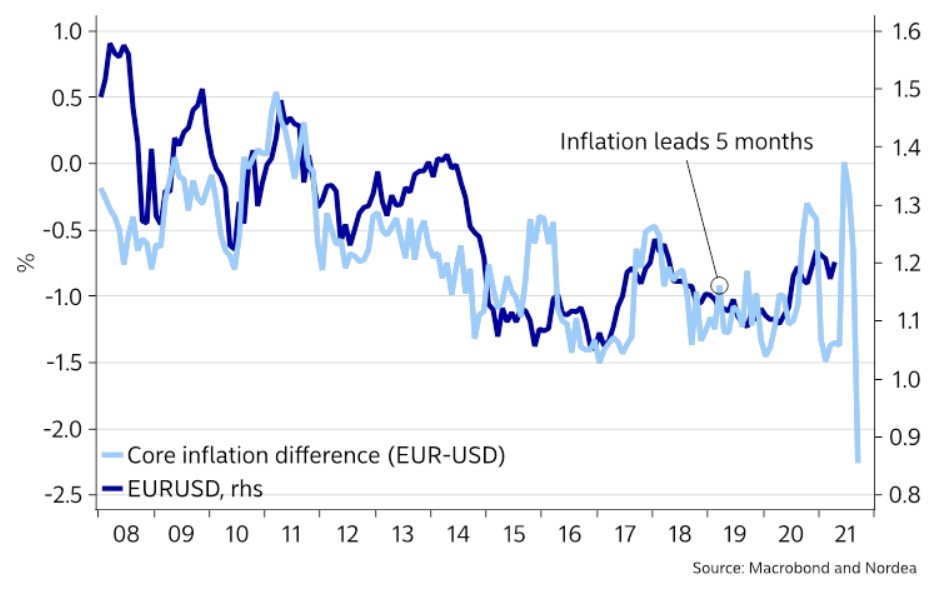

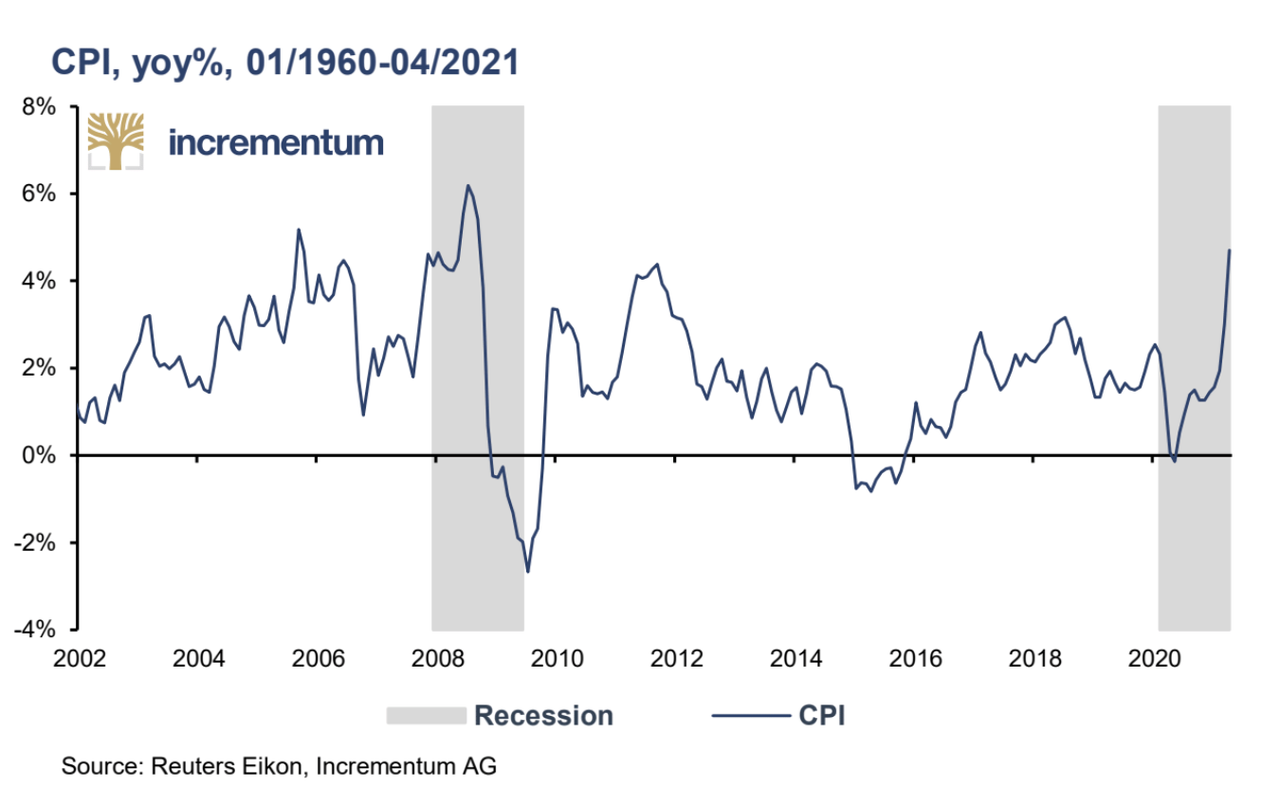

A quick comparison of the two last recessions reveals that the CPI had a different path. For example, in the aftermath of the 2008-2009 Great Financial Crisis, inflation fell below zero. In other words, deflation gripped the world´s developed economies, or at least it threatened to do so.

However, it is not the case during the current recession. Instead of falling, inflation is poised to rise further. The Fed in the United States has anticipated higher inflation already since August last year. During the Jackson Hole symposium in 2020, the Fed changed its mandate from targeting 2% to averaging 2% over a certain period.

Higher inflation typically triggers higher gold prices. Only that the price of gold tumbled since last summer, falling from a record high above $2,000 to below $1,700. At the same time, the US dollar continued to weaken, losing ground against its G10 peers.

But the price of gold recovered from its recent lows and now threatens to break to a new all-time high. If the trend in inflation seen in April is set to continue, the bullish trend in the price of gold is likely to continue as well.

Now that the cryptocurrency market lost more than half of its value, as seen by the price of Bitcoin falling by 50% in a couple of weeks, investors seem to favor gold again as a hedge against inflation. If that is the case, the recent rise in the price of gold is just the start of an attempt at a new all-time high. The higher the CPI rises, the bigger the share investors will allocate to gold.

FXOpen Blog

Gold has long played an important role in financial markets. It is the only form of money that survived for millenniums, and investment managers value it as a hedge against inflation.

Inflation is on everyone´s lips nowadays. In April, the Consumer Price Index (CPI) in the United States has grown at the fastest pace since 1981. Both the core and the headline CPI are poised to rise further in the summer, as the US government and the Fed keep the accommodative measures.

Last week, the Personal Core Expenditure (PCE) in the United States rose by 0.7% on expectations of 0.6% and following 0.4% in the previous month. The upbeat data is important because the PCE measures the change in the price of goods and services purchased by consumers, without counting for energy and food prices, considered too volatile. Also, the PCE is the Fed´s favored way of measuring inflation, and the rise fuels expectations of higher inflation in the months ahead.

Two Different Recessions

A quick comparison of the two last recessions reveals that the CPI had a different path. For example, in the aftermath of the 2008-2009 Great Financial Crisis, inflation fell below zero. In other words, deflation gripped the world´s developed economies, or at least it threatened to do so.

However, it is not the case during the current recession. Instead of falling, inflation is poised to rise further. The Fed in the United States has anticipated higher inflation already since August last year. During the Jackson Hole symposium in 2020, the Fed changed its mandate from targeting 2% to averaging 2% over a certain period.

Higher inflation typically triggers higher gold prices. Only that the price of gold tumbled since last summer, falling from a record high above $2,000 to below $1,700. At the same time, the US dollar continued to weaken, losing ground against its G10 peers.

But the price of gold recovered from its recent lows and now threatens to break to a new all-time high. If the trend in inflation seen in April is set to continue, the bullish trend in the price of gold is likely to continue as well.

Now that the cryptocurrency market lost more than half of its value, as seen by the price of Bitcoin falling by 50% in a couple of weeks, investors seem to favor gold again as a hedge against inflation. If that is the case, the recent rise in the price of gold is just the start of an attempt at a new all-time high. The higher the CPI rises, the bigger the share investors will allocate to gold.

FXOpen Blog