Unitedpips

Member

Understanding EUR/USD Daily Market Dynamics

Introduction to EURUSD

The EUR-USD currency pair, commonly known as "Fiber," represents the exchange rate between the Euro and the US Dollar. It's one of the most liquid and widely traded currency pairs globally, highly favored by forex traders due to its volatility and substantial trading volume. Understanding EUR/USD movements provides essential insights into economic health and monetary policy differences between the Eurozone and the United States.

EUR-USD Market Overview

EURUSD is experiencing mixed signals influenced by recent economic data from both Europe and the United States. Currently, the pair is affected by hawkish expectations from upcoming US Federal Reserve member speeches, notably from Mary Daly and Jerome Powell, indicating potential tightening in monetary policy. US Producer Price Index (PPI) and Retail Sales data are key drivers this week, potentially supporting the USD if the actual figures outperform forecasts. On the Euro side, economic indicators such as the Wholesale Price Index (WPI), Consumer Price Index (CPI), and Industrial Output provide a cautious yet stable outlook. Traders should closely watch these indicators, as better-than-expected results from the US could strengthen the Dollar, pressing the EUR/USD lower in the short term.

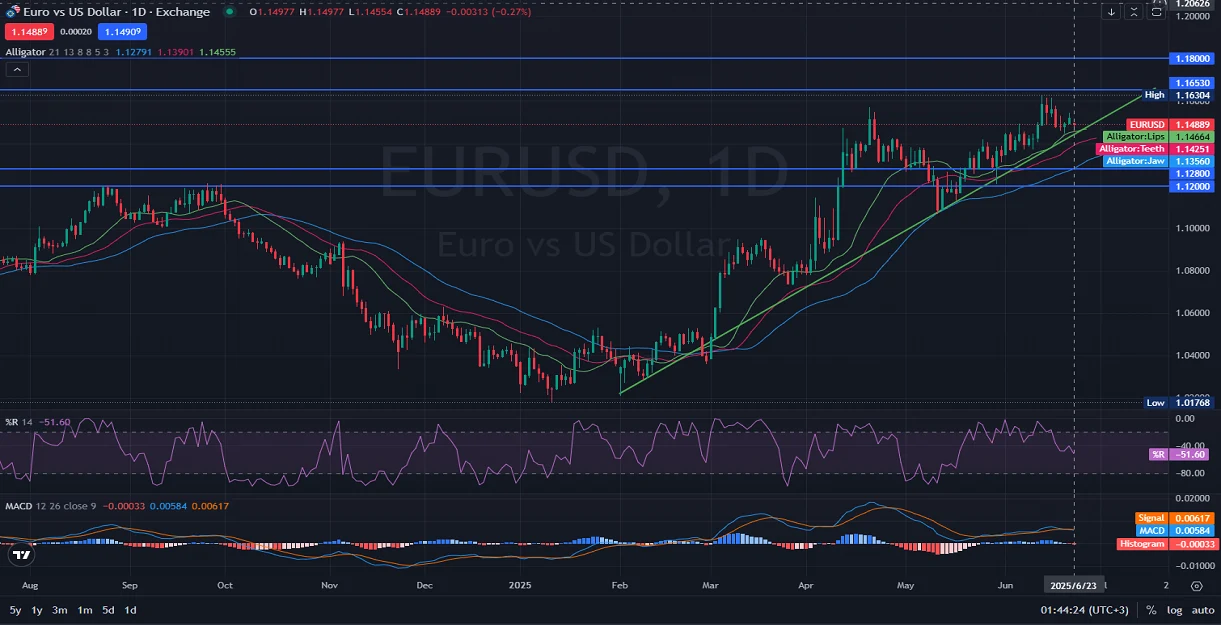

EUR/USD Technical Analysis

On the daily chart, EURUSD recently embarked on an upward trend but encountered strong resistance around the 1.11735 level, failing to stabilize above it and subsequently falling back below this critical resistance zone. The pair has completed a corrective move, finding support precisely at the Fibonacci retracement level of 0.382, suggesting a potential rebound. The 9-day EMA indicates cautious optimism, but the Parabolic SAR shows bearish sentiment persists for now. Fisher Transform oscillates in negative territory, highlighting the ongoing bearish momentum, while the MACD histogram remains below zero, affirming the short-term downward bias. Traders should watch for a sustained breakout above 1.11735 as confirmation of bullish revival.

Final Words about EUR vs USD

Considering the current technical and fundamental backdrop, EUR-USD appears to be at a critical juncture with potential bullish opportunities contingent upon breaking above the key resistance of 1.11735. However, strong upcoming USD-related economic events and Fed speeches could intensify market volatility, potentially maintaining downward pressure on the pair. Forex traders should carefully monitor these developments, managing risks prudently and staying adaptive to rapid market shifts. Clear trading signals from both technical indicators and economic data will be crucial for accurate market positioning in the coming sessions.

05.15.2025

Introduction to EURUSD

The EUR-USD currency pair, commonly known as "Fiber," represents the exchange rate between the Euro and the US Dollar. It's one of the most liquid and widely traded currency pairs globally, highly favored by forex traders due to its volatility and substantial trading volume. Understanding EUR/USD movements provides essential insights into economic health and monetary policy differences between the Eurozone and the United States.

EUR-USD Market Overview

EURUSD is experiencing mixed signals influenced by recent economic data from both Europe and the United States. Currently, the pair is affected by hawkish expectations from upcoming US Federal Reserve member speeches, notably from Mary Daly and Jerome Powell, indicating potential tightening in monetary policy. US Producer Price Index (PPI) and Retail Sales data are key drivers this week, potentially supporting the USD if the actual figures outperform forecasts. On the Euro side, economic indicators such as the Wholesale Price Index (WPI), Consumer Price Index (CPI), and Industrial Output provide a cautious yet stable outlook. Traders should closely watch these indicators, as better-than-expected results from the US could strengthen the Dollar, pressing the EUR/USD lower in the short term.

EUR/USD Technical Analysis

On the daily chart, EURUSD recently embarked on an upward trend but encountered strong resistance around the 1.11735 level, failing to stabilize above it and subsequently falling back below this critical resistance zone. The pair has completed a corrective move, finding support precisely at the Fibonacci retracement level of 0.382, suggesting a potential rebound. The 9-day EMA indicates cautious optimism, but the Parabolic SAR shows bearish sentiment persists for now. Fisher Transform oscillates in negative territory, highlighting the ongoing bearish momentum, while the MACD histogram remains below zero, affirming the short-term downward bias. Traders should watch for a sustained breakout above 1.11735 as confirmation of bullish revival.

Final Words about EUR vs USD

Considering the current technical and fundamental backdrop, EUR-USD appears to be at a critical juncture with potential bullish opportunities contingent upon breaking above the key resistance of 1.11735. However, strong upcoming USD-related economic events and Fed speeches could intensify market volatility, potentially maintaining downward pressure on the pair. Forex traders should carefully monitor these developments, managing risks prudently and staying adaptive to rapid market shifts. Clear trading signals from both technical indicators and economic data will be crucial for accurate market positioning in the coming sessions.

05.15.2025